Question: Please write the answer to the third question in detail according to the question in the link and the data given in the pictur (Some

Please write the answer to the third question in detail according to the question in the link and the data given in the pictur (Some unspecified data can be assumed):

https://www.chegg.com/homework-help/questions-and-answers/sydney-harbour-fuel-pty-ltd-assistance-breaking-scenario-would-helpful-many-years-sydney-h-q84498158

3. Conduct sensitivity analysis for the following: demand of diesel, margin on sales of fuel, and salvage value for the new vessels.

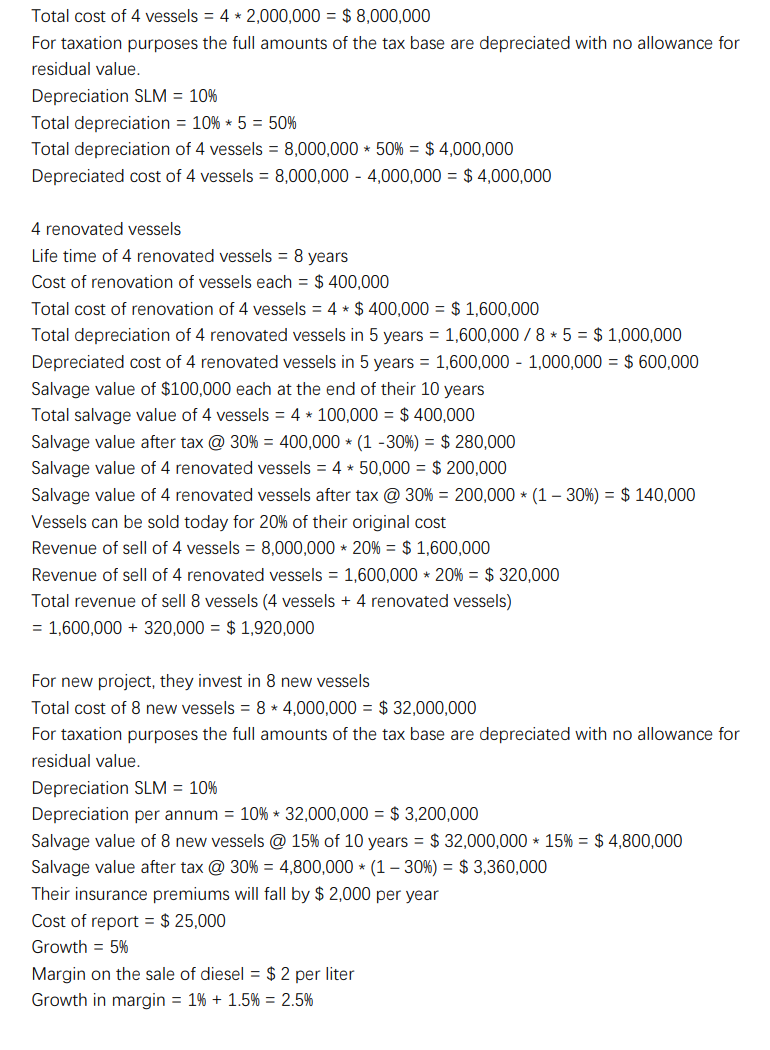

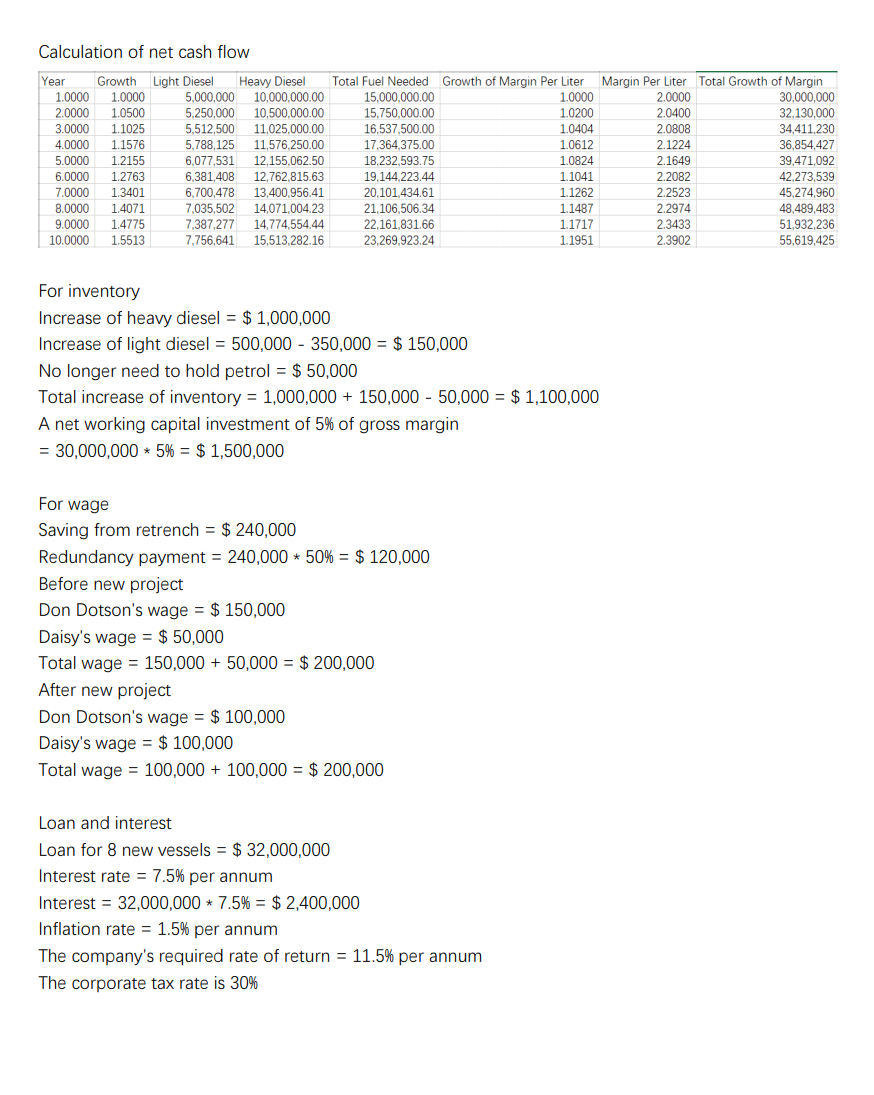

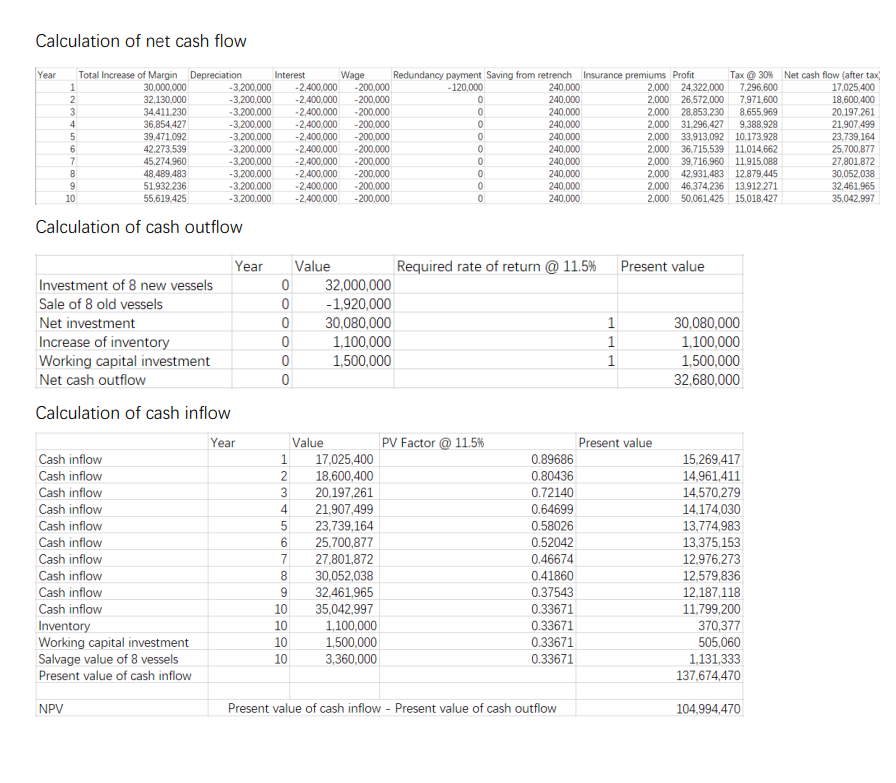

Total cost of 4 vessels = 4 * 2,000,000 = $ 8,000,000 For taxation purposes the full amounts of the tax base are depreciated with no allowance for residual value. Depreciation SLM = 10% Total depreciation = 10% + 5 = 50% Total depreciation of 4 vessels = 8,000,000 * 50% = $ 4,000,000 Depreciated cost of 4 vessels = 8,000,000 - 4,000,000 = $ 4,000,000 4 renovated vessels Life time of 4 renovated vessels = 8 years Cost of renovation of vessels each = $ 400,000 Total cost of renovation of 4 vessels = 4 * $ 400,000 = $ 1,600,000 Total depreciation of 4 renovated vessels in 5 years = 1,600,000 / 8 * 5 = $ 1,000,000 Depreciated cost of 4 renovated vessels in 5 years = 1,600,000 - 1,000,000 = $ 600,000 Salvage value of $100,000 each at the end of their 10 years Total salvage value of 4 vessels = 4 * 100,000 = $ 400,000 Salvage value after tax @ 30% = 400,000 + (1 -30%) = $ 280,000 Salvage value of 4 renovated vessels = 4 * 50,000 = $ 200,000 Salvage value of 4 renovated vessels after tax @ 30% = 200,000 + (1 - 30%) = $ 140,000 Vessels can be sold today for 20% of their original cost Revenue of sell of 4 vessels = 8,000,000 * 20% = $ 1,600,000 Revenue of sell of 4 renovated vessels = 1,600,000 + 20% = $ 320,000 Total revenue of sell 8 vessels (4 vessels + 4 renovated vessels) = 1,600,000 + 320,000 = $ 1,920,000 For new project, they invest in 8 new vessels Total cost of 8 new vessels = 8 + 4,000,000 = $ 32,000,000 For taxation purposes the full amounts of the tax base are depreciated with no allowance for residual value. Depreciation SLM = 10% Depreciation per annum = 10% * 32,000,000 = $3,200,000 Salvage value of 8 new vessels @ 15% of 10 years = $ 32,000,000 * 15% = $ 4,800,000 Salvage value after tax @ 30% = 4,800,000 + (1 - 30%) = $ 3,360,000 Their insurance premiums will fall by $ 2,000 per year Cost of report = $ 25,000 Growth = 5% Margin on the sale of diesel = $ 2 per liter Growth in margin = 1% + 1.5% = 2.5% Year Calculation of net cash flow Growth Light Diesel Heavy Diesel 1.0000 1.0000 5.000.000 10,000,000.00 2.0000 1.0500 5,250,000 10,500,000.00 3.0000 1.1025 5,512,500 11,025,000.00 4.0000 5,788,125 11,576,250.00 50000 5.0000 1 2155 1.2155 6,077,531 12,155,062.50 60000 6.0000 1.2763 6.381.408 1.2763 6,381,408 12,762.815.63 7.0000 1.3401 6,700,478 13,400,956.41 8.0000 1.4071 7,035,502 14,071,004.23 9.0000 7,387,277 14,774,554.44 10.0000 1.5513 7.756,641 15,513,282.16 1.1576 Total Fuel Needed Growth of Margin Per Liter Margin Per Liter Total Growth of Margin 15,000,000.00 1.0000 2.0000 30,000,000 15,750,000.00 1.0200 2.0400 32,130,000 16,537,500.00 1.0404 2.0808 34,411.230 17,364,375.00 1.0612 1.0612 2.1224 36,854,427 18,232,593.79 18.232.593.75 1.0824 1 0824 21649 2.1649 39.471.092 39,471,092 19,144.223.44 1.1041 1.1041 2.2002 2.2082 42.273539 42,273,539 20,101,434.61 1.1262 2.2523 45,274,960 21.106,506.34 1.1487 2.2974 48,489,483 22,161,831.66 1.1717 2.3433 51.932.236 23,269,923.24 1.1951 55,619,425 1.4775 2.3902 For inventory Increase of heavy diesel = $ 1,000,000 Increase of light diesel = 500,000 - 350,000 = $ 150,000 No longer need to hold petrol = $ 50,000 Total increase of inventory = 1,000,000 + 150,000 - 50,000 = $ 1,100,000 A net working capital investment of 5% of gross margin = 30,000,000 + 5% = $ 1,500,000 For wage Saving from retrench = $ 240,000 Redundancy payment = 240,000 + 50% = $ 120,000 Before new project Don Dotson's wage = $ 150,000 Daisy's wage = $ 50,000 Total wage = 150,000 + 50,000 = $ 200,000 After new project Don Dotson's wage = $ 100,000 Daisy's wage = $ 100,000 Total wage = 100,000 + 100,000 = $ 200,000 Loan and interest Loan for 8 new vessels = $ 32,000,000 Interest rate = 7.5% per annum Interest = 32,000,000 * 7.5% = $ 2,400,000 Inflation rate = 1.5% per annum The company's required rate of return = 11.5% per annum The corporate tax rate is 30% Calculation of net cash flow Year Total Increase of Margin Depreciation Interest Wage Redundancy payment Saving from retrench Insurance premiums Profit Tax @ 30% Net cash flow (after tax 1 30,000,000 -3.200.000 -2,400,000 -200,000 - 120,000 240,000 2,000 24,322,000 7.296,600 17.025,400 2 32,130,000 -3,200,000 -2,400,000 -200,000 240,000 2,000 26,572,000 7.971,600 18,600,400 3 34,411.230 -3.200.000 -2,400.000 - 200.000 240,000 2.000 28.853,230 8.655,969 20,197.261 4 36,854.427 -3,200,000 -2.400.000 -200,000 240,000 2.000 31.296,427 9,388,928 21,907,499 5 39,471,092 -3.200.000 -2,400.000 -200,000 240,000 2,000 33.913,092 10,173,928 23,739,164 6 42,273,539 -3.200.000 -2,400,000 - 200.000 240,000 2.000 36.715,539 11.014.662 25,700,877 7 45,274.960 -3.200.000 -2,400,000 - 200.000 240,000 2.000 39.716,960 11.915,088 27.801,872 8 48,489.483 -3,200,000 -2,400,000 -200,000 240,000 2,000 42.931,483 12.879,445 30.052,038 9 51.932.236 -3.200.000 -2.400.000 -200.000 240,000 2,000 46,374.236 13.912,271 32.461.965 10 55,619.425 -3.200.000 -2,400,000 - 200.000 240,000 2,000 50,061,425 15.018,427 35,042,997 OOOOOOOOO Calculation of cash outflow Present value O i Year Investment of 8 new vessels Sale of 8 old vessels Net investment Increase of inventory Working capital investment Net cash outflow Calculation of cash inflow Value Required rate of return @ 11.5% 0 32,000,000 0 -1.920,000 0 30,080,000 0 1,100,000 0 1,500,000 0 1 1 1 30,080,000 1,100,000 1,500,000 32,680,000 Year Present value O AWNA Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Inventory Working capital investment Salvage value of 8 vessels Present value of cash inflow Value PV Factor @ 11.5% 1 17.025,400 2 18,600,400 3 20,197,261 4 21,907,499 5 23,739,164 25,700,877 7 27,801,872 8 30.052,038 9 32,461,965 10 35,042,997 10 1,100,000 10 1,500,000 10 3,360,000 0.89686 0.80436 0.72140 0.64699 0.58026 0.52042 0.46674 0.41860 0.37543 0.33671 0.33671 0.33671 0.33671 15,269,417 14,961,411 14,570,279 14,174,030 13,774,983 13,375,153 12,976,273 12,579,836 12,187,118 11,799,200 370,377 505,060 1,131,333 137,674.470 NPV Present value of cash inflow - Present value of cash outflow 104,994,470 Total cost of 4 vessels = 4 * 2,000,000 = $ 8,000,000 For taxation purposes the full amounts of the tax base are depreciated with no allowance for residual value. Depreciation SLM = 10% Total depreciation = 10% + 5 = 50% Total depreciation of 4 vessels = 8,000,000 * 50% = $ 4,000,000 Depreciated cost of 4 vessels = 8,000,000 - 4,000,000 = $ 4,000,000 4 renovated vessels Life time of 4 renovated vessels = 8 years Cost of renovation of vessels each = $ 400,000 Total cost of renovation of 4 vessels = 4 * $ 400,000 = $ 1,600,000 Total depreciation of 4 renovated vessels in 5 years = 1,600,000 / 8 * 5 = $ 1,000,000 Depreciated cost of 4 renovated vessels in 5 years = 1,600,000 - 1,000,000 = $ 600,000 Salvage value of $100,000 each at the end of their 10 years Total salvage value of 4 vessels = 4 * 100,000 = $ 400,000 Salvage value after tax @ 30% = 400,000 + (1 -30%) = $ 280,000 Salvage value of 4 renovated vessels = 4 * 50,000 = $ 200,000 Salvage value of 4 renovated vessels after tax @ 30% = 200,000 + (1 - 30%) = $ 140,000 Vessels can be sold today for 20% of their original cost Revenue of sell of 4 vessels = 8,000,000 * 20% = $ 1,600,000 Revenue of sell of 4 renovated vessels = 1,600,000 + 20% = $ 320,000 Total revenue of sell 8 vessels (4 vessels + 4 renovated vessels) = 1,600,000 + 320,000 = $ 1,920,000 For new project, they invest in 8 new vessels Total cost of 8 new vessels = 8 + 4,000,000 = $ 32,000,000 For taxation purposes the full amounts of the tax base are depreciated with no allowance for residual value. Depreciation SLM = 10% Depreciation per annum = 10% * 32,000,000 = $3,200,000 Salvage value of 8 new vessels @ 15% of 10 years = $ 32,000,000 * 15% = $ 4,800,000 Salvage value after tax @ 30% = 4,800,000 + (1 - 30%) = $ 3,360,000 Their insurance premiums will fall by $ 2,000 per year Cost of report = $ 25,000 Growth = 5% Margin on the sale of diesel = $ 2 per liter Growth in margin = 1% + 1.5% = 2.5% Year Calculation of net cash flow Growth Light Diesel Heavy Diesel 1.0000 1.0000 5.000.000 10,000,000.00 2.0000 1.0500 5,250,000 10,500,000.00 3.0000 1.1025 5,512,500 11,025,000.00 4.0000 5,788,125 11,576,250.00 50000 5.0000 1 2155 1.2155 6,077,531 12,155,062.50 60000 6.0000 1.2763 6.381.408 1.2763 6,381,408 12,762.815.63 7.0000 1.3401 6,700,478 13,400,956.41 8.0000 1.4071 7,035,502 14,071,004.23 9.0000 7,387,277 14,774,554.44 10.0000 1.5513 7.756,641 15,513,282.16 1.1576 Total Fuel Needed Growth of Margin Per Liter Margin Per Liter Total Growth of Margin 15,000,000.00 1.0000 2.0000 30,000,000 15,750,000.00 1.0200 2.0400 32,130,000 16,537,500.00 1.0404 2.0808 34,411.230 17,364,375.00 1.0612 1.0612 2.1224 36,854,427 18,232,593.79 18.232.593.75 1.0824 1 0824 21649 2.1649 39.471.092 39,471,092 19,144.223.44 1.1041 1.1041 2.2002 2.2082 42.273539 42,273,539 20,101,434.61 1.1262 2.2523 45,274,960 21.106,506.34 1.1487 2.2974 48,489,483 22,161,831.66 1.1717 2.3433 51.932.236 23,269,923.24 1.1951 55,619,425 1.4775 2.3902 For inventory Increase of heavy diesel = $ 1,000,000 Increase of light diesel = 500,000 - 350,000 = $ 150,000 No longer need to hold petrol = $ 50,000 Total increase of inventory = 1,000,000 + 150,000 - 50,000 = $ 1,100,000 A net working capital investment of 5% of gross margin = 30,000,000 + 5% = $ 1,500,000 For wage Saving from retrench = $ 240,000 Redundancy payment = 240,000 + 50% = $ 120,000 Before new project Don Dotson's wage = $ 150,000 Daisy's wage = $ 50,000 Total wage = 150,000 + 50,000 = $ 200,000 After new project Don Dotson's wage = $ 100,000 Daisy's wage = $ 100,000 Total wage = 100,000 + 100,000 = $ 200,000 Loan and interest Loan for 8 new vessels = $ 32,000,000 Interest rate = 7.5% per annum Interest = 32,000,000 * 7.5% = $ 2,400,000 Inflation rate = 1.5% per annum The company's required rate of return = 11.5% per annum The corporate tax rate is 30% Calculation of net cash flow Year Total Increase of Margin Depreciation Interest Wage Redundancy payment Saving from retrench Insurance premiums Profit Tax @ 30% Net cash flow (after tax 1 30,000,000 -3.200.000 -2,400,000 -200,000 - 120,000 240,000 2,000 24,322,000 7.296,600 17.025,400 2 32,130,000 -3,200,000 -2,400,000 -200,000 240,000 2,000 26,572,000 7.971,600 18,600,400 3 34,411.230 -3.200.000 -2,400.000 - 200.000 240,000 2.000 28.853,230 8.655,969 20,197.261 4 36,854.427 -3,200,000 -2.400.000 -200,000 240,000 2.000 31.296,427 9,388,928 21,907,499 5 39,471,092 -3.200.000 -2,400.000 -200,000 240,000 2,000 33.913,092 10,173,928 23,739,164 6 42,273,539 -3.200.000 -2,400,000 - 200.000 240,000 2.000 36.715,539 11.014.662 25,700,877 7 45,274.960 -3.200.000 -2,400,000 - 200.000 240,000 2.000 39.716,960 11.915,088 27.801,872 8 48,489.483 -3,200,000 -2,400,000 -200,000 240,000 2,000 42.931,483 12.879,445 30.052,038 9 51.932.236 -3.200.000 -2.400.000 -200.000 240,000 2,000 46,374.236 13.912,271 32.461.965 10 55,619.425 -3.200.000 -2,400,000 - 200.000 240,000 2,000 50,061,425 15.018,427 35,042,997 OOOOOOOOO Calculation of cash outflow Present value O i Year Investment of 8 new vessels Sale of 8 old vessels Net investment Increase of inventory Working capital investment Net cash outflow Calculation of cash inflow Value Required rate of return @ 11.5% 0 32,000,000 0 -1.920,000 0 30,080,000 0 1,100,000 0 1,500,000 0 1 1 1 30,080,000 1,100,000 1,500,000 32,680,000 Year Present value O AWNA Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Cash inflow Inventory Working capital investment Salvage value of 8 vessels Present value of cash inflow Value PV Factor @ 11.5% 1 17.025,400 2 18,600,400 3 20,197,261 4 21,907,499 5 23,739,164 25,700,877 7 27,801,872 8 30.052,038 9 32,461,965 10 35,042,997 10 1,100,000 10 1,500,000 10 3,360,000 0.89686 0.80436 0.72140 0.64699 0.58026 0.52042 0.46674 0.41860 0.37543 0.33671 0.33671 0.33671 0.33671 15,269,417 14,961,411 14,570,279 14,174,030 13,774,983 13,375,153 12,976,273 12,579,836 12,187,118 11,799,200 370,377 505,060 1,131,333 137,674.470 NPV Present value of cash inflow - Present value of cash outflow 104,994,470

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts