Question: Sungsam Corporation, a US-based conglomerate, is considering expanding its operations in India. As the group's chief financial officer, you are asked to estimate the

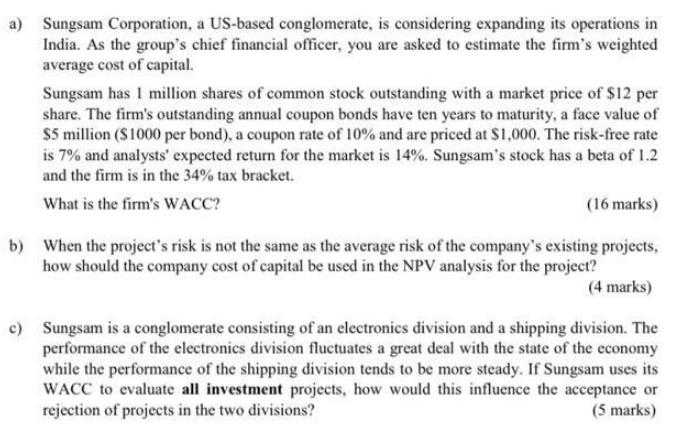

Sungsam Corporation, a US-based conglomerate, is considering expanding its operations in India. As the group's chief financial officer, you are asked to estimate the firm's weighted average cost of capital. Sungsam has I million shares of common stock outstanding with a market price of $12 per share. The firm's outstanding annual coupon bonds have ten years to maturity, a face value of S5 million ($1000 per bond), a coupon rate of 10% and are priced at S1,000. The risk-free rate is 7% and analysts' expected return for the market is 14%. Sungsam's stock has a beta of 1.2 and the firm is in the 34% tax bracket. What is the firm's WACC? (16 marks) b) When the project's risk is not the same as the average risk of the company's existing projects, how should the company cost of capital be used in the NPV analysis for the project? (4 marks) c) Sungsam is a conglomerate consisting of an electronics division and a shipping division. The performance of the electronics division fluctuates a great deal with the state of the economy while the performance of the shipping division tends to be more steady. If Sungsam uses its WACC to evaluate all investment projects, how would this influence the acceptance or rejection of projects in the two divisions? (5 marks)

Step by Step Solution

There are 3 Steps involved in it

a Market Value of Shares 1 million shares x 12 per share 12 Million or 12000000 Face Value Of Bonds 5 Million Face Value Per Bond 1000 therefore No Of ... View full answer

Get step-by-step solutions from verified subject matter experts