Question: please WRITE THE FORMULA NEXT TO the answers, dont answer my question without the formula ( I did some of this so just do the

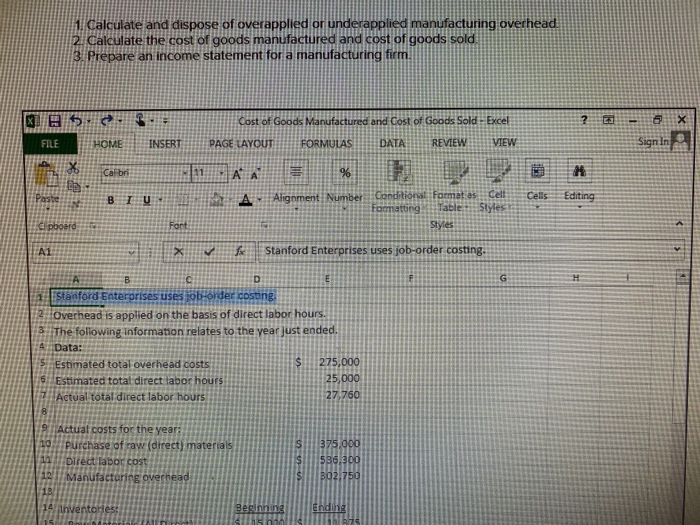

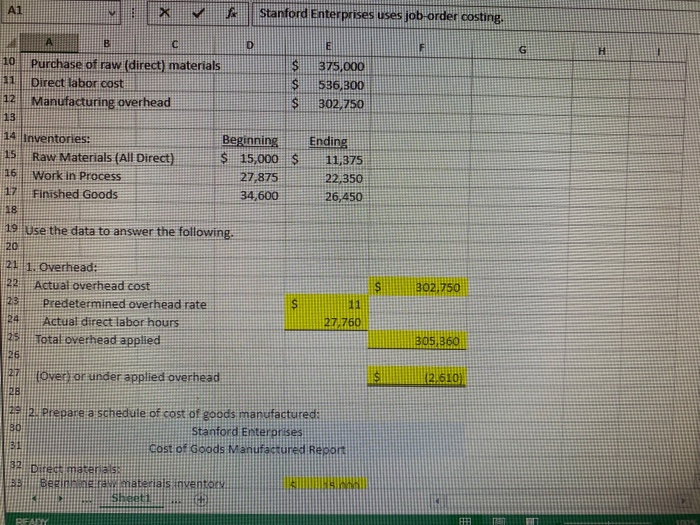

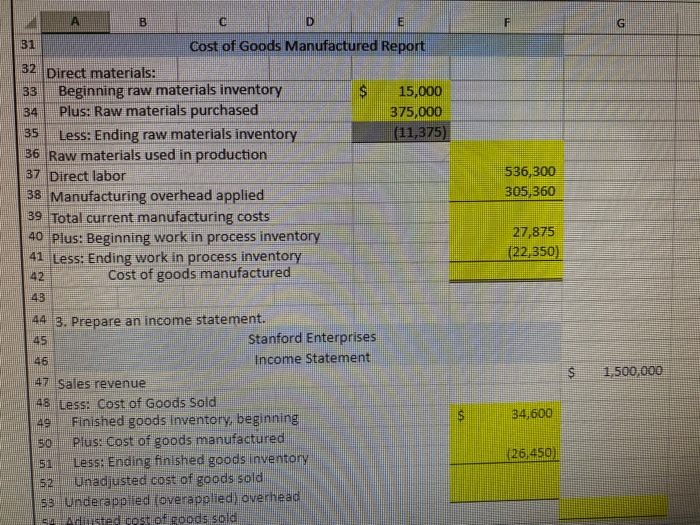

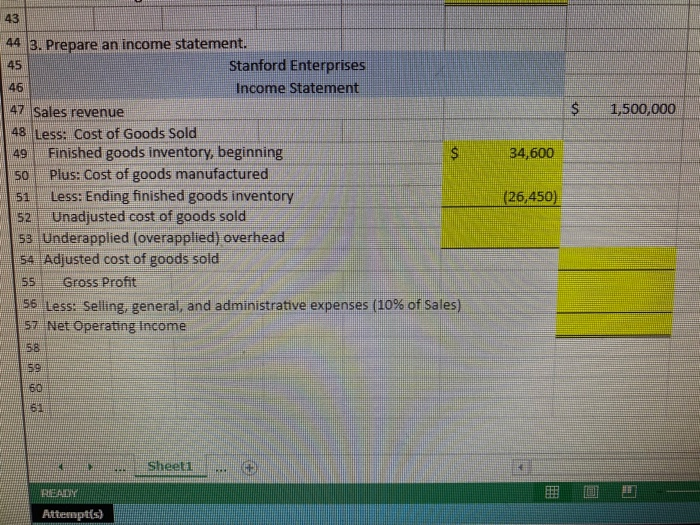

1. Calculate and dispose of overapplied or underapplied manufacturing overhead. 2. calculate the cost of goods manufactured and cost of goods sold, 3. Prepare an income statement for a manufacturing firm, Cost of Goods Manufactured and Cost of Goods Sold - Excel TAYOUT MULASI DATA REVIEW VIEW HOME INSERT Sign In Alignment Number Conditional Formatos Cell matting Sivec Cells Editing El pboard Stvies f Stanford Enterprises uses job-order costing. TH 1. Stanford Enterprises uses job order costing. 2 Overhead is applied on the basis of direct labor hours. 3. The following information relates to the year just ended. A Data: Estimated total overhead costs 75,000 Estimated total direct labor hours 25,000 Actual total direct labor hours 89 Actual costs for the year: 10. Purchase of raw (direct) mater Direct labor cost Manufactoring overne Stanford Enterprises uses job order costing. 10. Purchase of raw (direct 11 Direct labor cost Manufacturing overhead 375,000 536,300 302,750 $ 14 Inventories: Raw Materials (All Direct) Work in Process Finished Goods Beginning $ 15,000 27.875 34,600 Ending 11,375 22,350 26,450 19 Use the data to answer the following. 302.750 1. Overhead: Actual overhead cost Predetermined overhead rate Actual direct labor hours Total overhead applied 27 760 360 Lover) or under applied overhead 2.610) 2. Prepare a schedule of cost of goods manufactured: Stanford Enterprises Cost of Goods Manufac ure ne raw materials inventory cost of Goods Manufactured Report Direct materials: 33 Beginning raw materials inventory $ 15,000 Plus: Raw materials purchased 375,000 Less: Ending raw materials inventory 11,375) 36 Raw materials used in production 37 Direct labor 38 Manufacturing overhead applied 39 Total current manufacturing costs 40 Plus: Beginning work in process inventory 41 Less: Ending work in process inventory Cost of goods manufactured 536,300 305,360 27,875 (22,350) 2 $ 1.500.000 3. Prepare an income statement. Stanford Enterprises Income Statement 47 sales revenue 48 Less: Cost of Goods Sold 49 Finished goods Inventory, beginning 50Plus: Cost of goods manufactured 51 Less: Ending finished goods inventory 52 Unadjusted cost of goods sold 53 Underapp led overapplied) overhead sted cost of goods sold 34,600 (26.450) 43 1,500,000 34,600 44 3. Prepare an income statement. Stanford Enterprises 46 Income Statement 47 Sales revenue 48 Less: Cost of Goods Sold 49 Finished goods inventory, beginning 50 Plus: Cost of goods manufactured 51 Less: Ending finished goods inventory 52 Unadjusted cost of goods sold 53 Underapplied (overapplied) overhead 54 Adjusted cost of goods sold 55 Gross Profit 55 Less: Selling, general, and administrative expenses (10% of Sales) 57. Net Operating Income (26,450) Sheet1 ... PLAY Attemptis)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts