Question: please write the full solutions :( strategic cost final exam samples: 1) product A: company sells it profit -9000 sales - 50000 fixed cost -

please write the full solutions :(

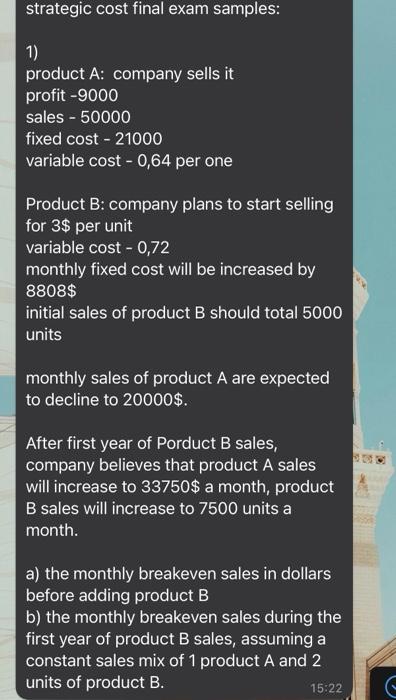

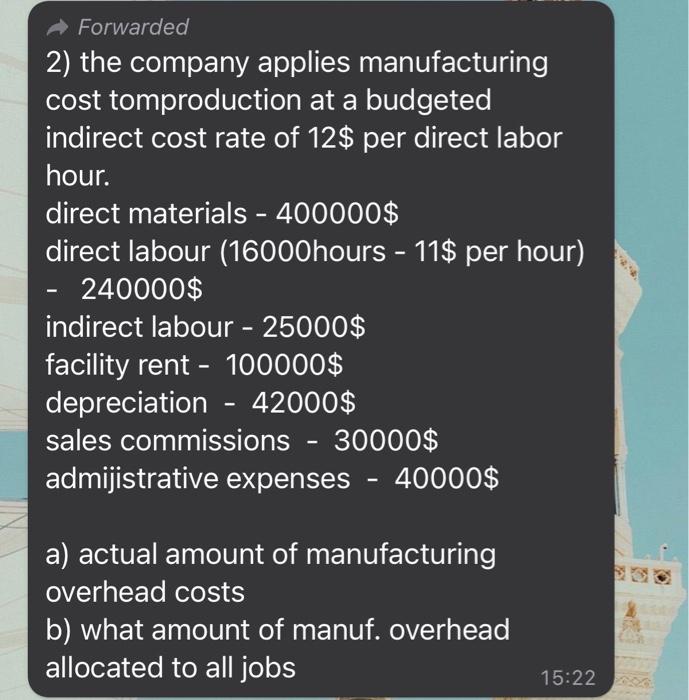

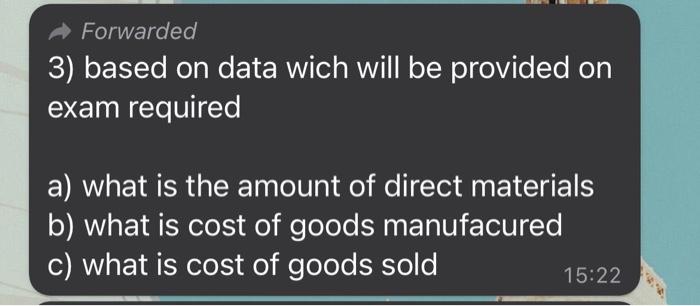

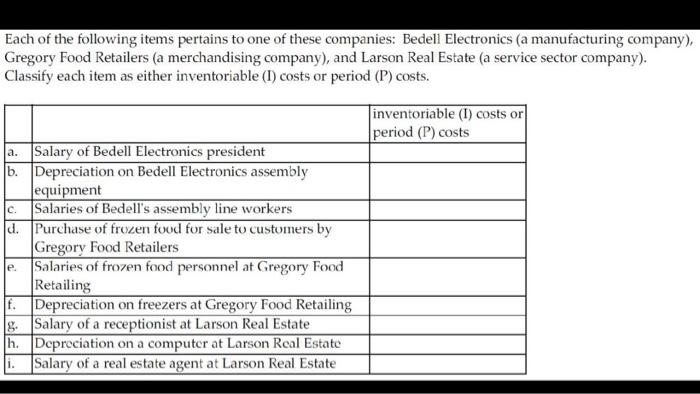

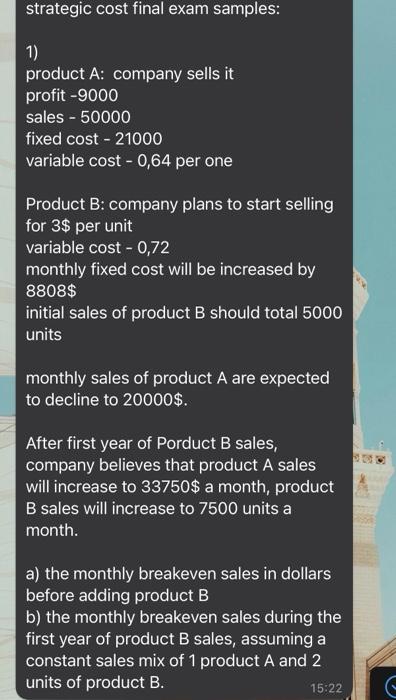

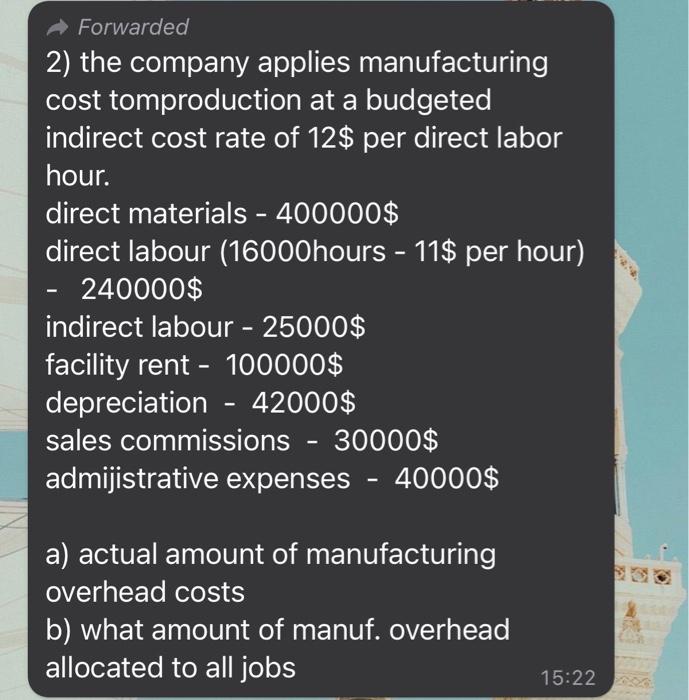

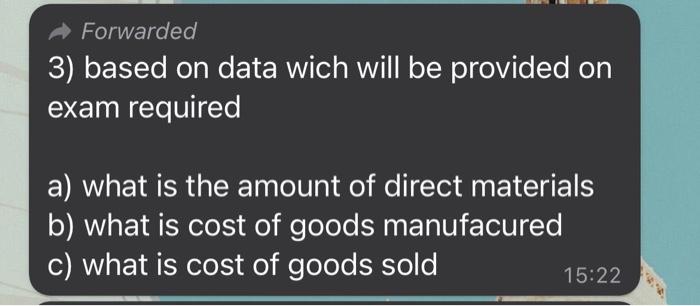

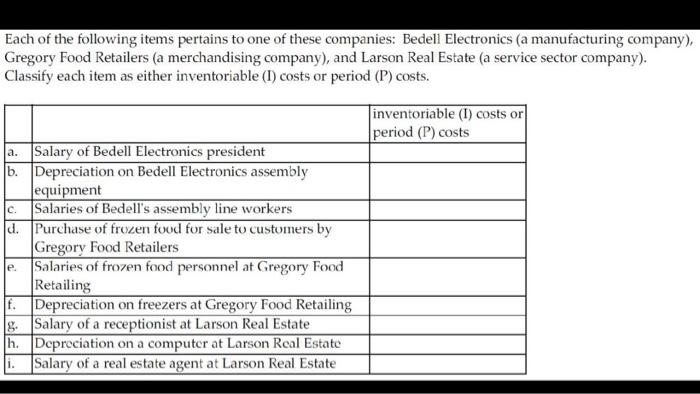

strategic cost final exam samples: 1) product A: company sells it profit -9000 sales - 50000 fixed cost - 21000 variable cost - 0,64 per one Product B: company plans to start selling for 3$ per unit variable cost - 0,72 monthly fixed cost will be increased by 8808$ initial sales of product B should total 5000 units monthly sales of product A are expected to decline to 20000$. After first year of Porduct B sales, company believes that product A sales will increase to 33750$ a month, product B sales will increase to 7500 units a month. a) the monthly breakeven sales in dollars before adding product B b) the monthly breakeven sales during the first year of product B sales, assuming a constant sales mix of 1 product A and 2 units of product B. 15:22 - - Forwarded 2) the company applies manufacturing cost tomproduction at a budgeted indirect cost rate of 12$ per direct labor hour. direct materials - 400000$ direct labour (16000hours - 11$ per hour) 240000$ indirect labour - 25000$ facility rent - 100000$ depreciation - 42000$ sales commissions - 30000$ admijistrative expenses - 40000$ a) actual amount of manufacturing overhead costs b) what amount of manuf. overhead allocated to all jobs 15:22 Forwarded 3) based on data wich will be provided on exam required a) what is the amount of direct materials b) what is cost of goods manufacured c) what is cost of goods sold 15:22 Each of the following items pertains to one of these companies: Bedell Electronics (a manufacturing company), Gregory Food Retailers (a merchandising company), and Larson Real Estate (a service sector company). Classify each item as either inventoriable (1) costs or period (P) costs. inventoriable (I) costs or period (P) costs c. a. Salary of Bedell Electronics president b. Depreciation on Bedell Electronics assembly equipment Salaries of Bedell's assembly line workers d. Purchase of frozen food for sale to customers by Gregory Food Retailers Salaries of frozen food personnel at Gregory Food Retailing f. Depreciation on freezers at Gregory Food Retailing g. Salary of a receptionist at Larson Real Estate h. Depreciation on a computer at Larson Real Estate i. Salary of a real estate agent at Larson Real Estate e. strategic cost final exam samples: 1) product A: company sells it profit -9000 sales - 50000 fixed cost - 21000 variable cost - 0,64 per one Product B: company plans to start selling for 3$ per unit variable cost - 0,72 monthly fixed cost will be increased by 8808$ initial sales of product B should total 5000 units monthly sales of product A are expected to decline to 20000$. After first year of Porduct B sales, company believes that product A sales will increase to 33750$ a month, product B sales will increase to 7500 units a month. a) the monthly breakeven sales in dollars before adding product B b) the monthly breakeven sales during the first year of product B sales, assuming a constant sales mix of 1 product A and 2 units of product B. 15:22 - - Forwarded 2) the company applies manufacturing cost tomproduction at a budgeted indirect cost rate of 12$ per direct labor hour. direct materials - 400000$ direct labour (16000hours - 11$ per hour) 240000$ indirect labour - 25000$ facility rent - 100000$ depreciation - 42000$ sales commissions - 30000$ admijistrative expenses - 40000$ a) actual amount of manufacturing overhead costs b) what amount of manuf. overhead allocated to all jobs 15:22 Forwarded 3) based on data wich will be provided on exam required a) what is the amount of direct materials b) what is cost of goods manufacured c) what is cost of goods sold 15:22 Each of the following items pertains to one of these companies: Bedell Electronics (a manufacturing company), Gregory Food Retailers (a merchandising company), and Larson Real Estate (a service sector company). Classify each item as either inventoriable (1) costs or period (P) costs. inventoriable (I) costs or period (P) costs c. a. Salary of Bedell Electronics president b. Depreciation on Bedell Electronics assembly equipment Salaries of Bedell's assembly line workers d. Purchase of frozen food for sale to customers by Gregory Food Retailers Salaries of frozen food personnel at Gregory Food Retailing f. Depreciation on freezers at Gregory Food Retailing g. Salary of a receptionist at Larson Real Estate h. Depreciation on a computer at Larson Real Estate i. Salary of a real estate agent at Larson Real Estate e

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock