Question: Please write the solution steps The 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed long-term debt of $2.7 million, and the 2021 balance sheet

Please write the solution steps

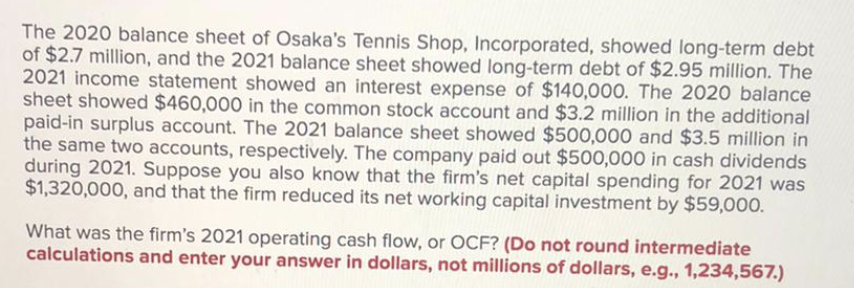

The 2020 balance sheet of Osaka's Tennis Shop, Incorporated, showed long-term debt of $2.7 million, and the 2021 balance sheet showed long-term debt of $2.95 million. The 2021 income statement showed an interest expense of $140,000. The 2020 balance sheet showed $460,000 in the common stock account and $3.2 million in the additional paid-in surplus account. The 2021 balance sheet showed $500,000 and $3.5 million in the same two accounts, respectively. The company paid out $500,000 in cash dividends during 2021. Suppose you also know that the firm's net capital spending for 2021 was $1,320,000, and that the firm reduced its net working capital investment by $59,000. What was the firm's 2021 operating cash flow, or OCF? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, e.g., 1,234,567.) Operating cash flow $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts