Question: please write the steps and do not use excel thanks Atoll bridge across the Mississippi River is being considered as a replacement for the current

please write the steps and do not use excel

please write the steps and do not use excel

thanks

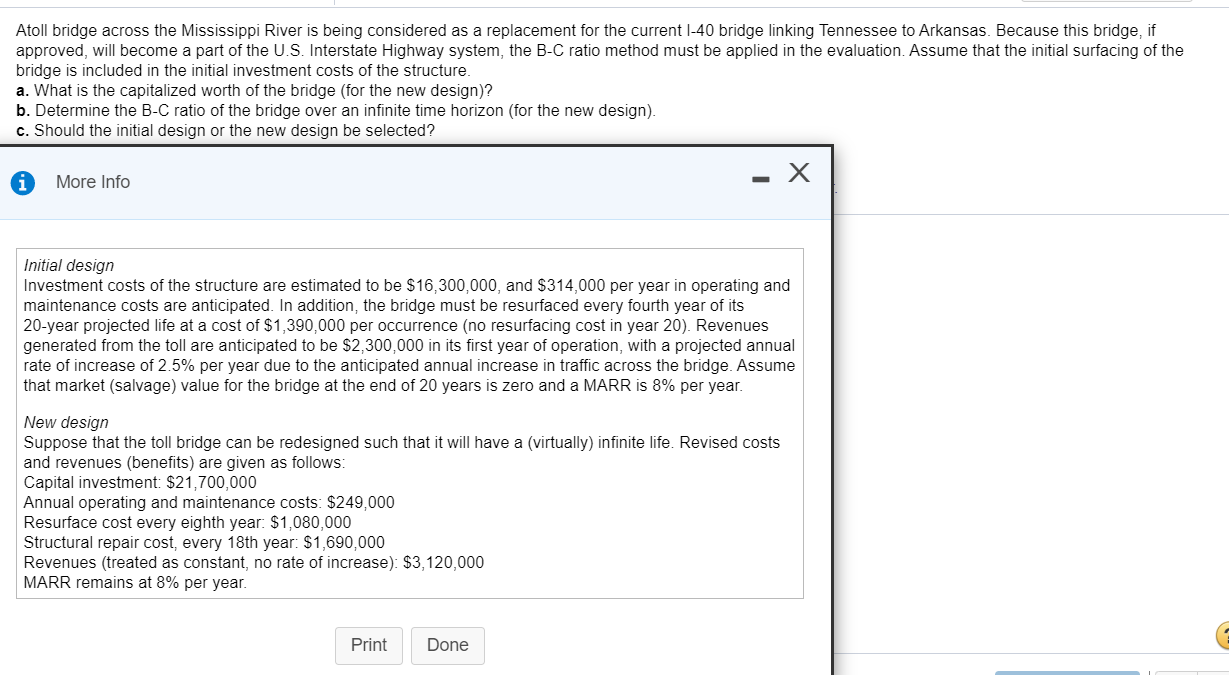

Atoll bridge across the Mississippi River is being considered as a replacement for the current 1-40 bridge linking Tennessee to Arkansas. Because this bridge, if approved, will become a part of the U.S. Interstate Highway system, the B-C ratio method must be applied in the evaluation. Assume that the initial surfacing of the bridge is included in the initial investment costs of the structure. a. What is the capitalized worth of the bridge (for the new design)? b. Determine the B-C ratio of the bridge over an infinite time horizon (for the new design). c. Should the initial design or the new design be selected? More Info Initial design Investment costs of the structure are estimated to be $16,300,000, and $314,000 per year in operating and maintenance costs are anticipated. In addition, the bridge must be resurfaced every fourth year of its 20-year projected life at a cost of $1,390,000 per occurrence (no resurfacing cost in year 20). Revenues generated from the toll are anticipated to be $2,300,000 in its first year of operation, with a projected annual rate of increase of 2.5% per year due to the anticipated annual increase in traffic across the bridge. Assume that market (salvage) value for the bridge at the end of 20 years is zero and a MARR is 8% per year. New design Suppose that the toll bridge can be redesigned such that it will have a virtually) infinite life. Revised costs and revenues (benefits) are given as follows: Capital investment: $21,700,000 Annual operating and maintenance costs: $249,000 Resurface cost every eighth year: $1,080,000 Structural repair cost, every 18th year: $1,690,000 Revenues (treated as constant, no rate of increase): $3,120,000 MARR remains at 8% per year. Print Done Atoll bridge across the Mississippi River is being considered as a replacement for the current 1-40 bridge linking Tennessee to Arkansas. Because this bridge, if approved, will become a part of the U.S. Interstate Highway system, the B-C ratio method must be applied in the evaluation. Assume that the initial surfacing of the bridge is included in the initial investment costs of the structure. a. What is the capitalized worth of the bridge (for the new design)? b. Determine the B-C ratio of the bridge over an infinite time horizon (for the new design). c. Should the initial design or the new design be selected? More Info Initial design Investment costs of the structure are estimated to be $16,300,000, and $314,000 per year in operating and maintenance costs are anticipated. In addition, the bridge must be resurfaced every fourth year of its 20-year projected life at a cost of $1,390,000 per occurrence (no resurfacing cost in year 20). Revenues generated from the toll are anticipated to be $2,300,000 in its first year of operation, with a projected annual rate of increase of 2.5% per year due to the anticipated annual increase in traffic across the bridge. Assume that market (salvage) value for the bridge at the end of 20 years is zero and a MARR is 8% per year. New design Suppose that the toll bridge can be redesigned such that it will have a virtually) infinite life. Revised costs and revenues (benefits) are given as follows: Capital investment: $21,700,000 Annual operating and maintenance costs: $249,000 Resurface cost every eighth year: $1,080,000 Structural repair cost, every 18th year: $1,690,000 Revenues (treated as constant, no rate of increase): $3,120,000 MARR remains at 8% per year. Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts