Question: Please write the steps for c and d thank you Yerba Industries is an all-equity firm whose stock has a beta of 1.10 and an

Please write the steps for c and d thank you

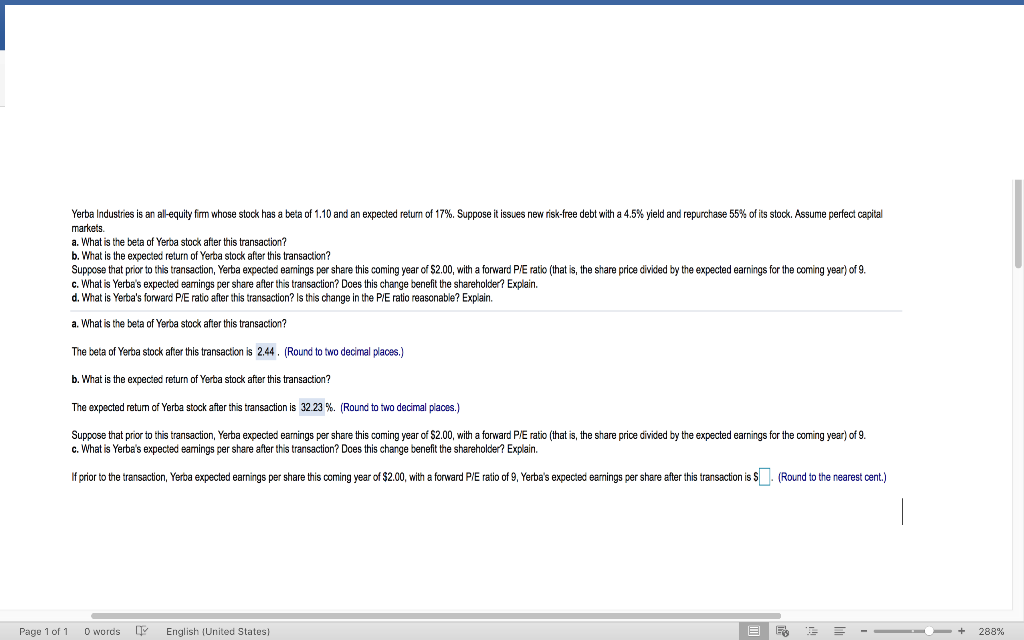

Yerba Industries is an all-equity firm whose stock has a beta of 1.10 and an expected return of 17%. Suppose it issues new risk-free debt with a 4.5% yield and repurchase 55% of its stock. Assume perfect capital markets. a. What is the beta of Yerba stock after this transaction? b. What is the expected return of Yerba stock after this transaction? Suppose that prior to this transaction, Yerba expected earnings per share this coming year of $2.00, with a forward P/E ratio (that is, the share price divided by the expected earnings for the coming year) of 9. c. What is Yerba's expected eamings per share after this transaction? Does this change benefit the shareholder? Explain. d. What is Yerba's forward P/E ratio after this transaction? Is this change in the P/E ratio reasonable? Explain. a. What is the beta of Yerba stock after this transaction? The beta of Yerba stock after this transaction is 2.44. (Round to two decimal places.) b. What is the expected return of Yerba stock after this transaction? The expected return of Yerba stock after this transaction is 32.23 %. (Round to two decimal places.) Suppose that prior to this transaction, Yerba expected earnings per share this coming year of $2.00, with a forward P/E ratio (that is, the share price divided by the expected earnings for the coming year) of 9. c. What is Yerba's expected earings per share after this transaction? Does this change benefit the shareholder? Explain. If prior to the transaction, Yerba expected earnings per share this coming year of $2.00, with a forward P/E ratio of 9, Yerba's expected earnings per share after this transaction is $ (Round to the nearest cent.) Page 1 of 1 O words English (United States) E E = - + 288%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts