Question: Please write the working using pen if possible QUESTION 3: Carsome Tire & Air-Con Services is considering a lease financing facility or a bank loan

Please write the working using pen if possible

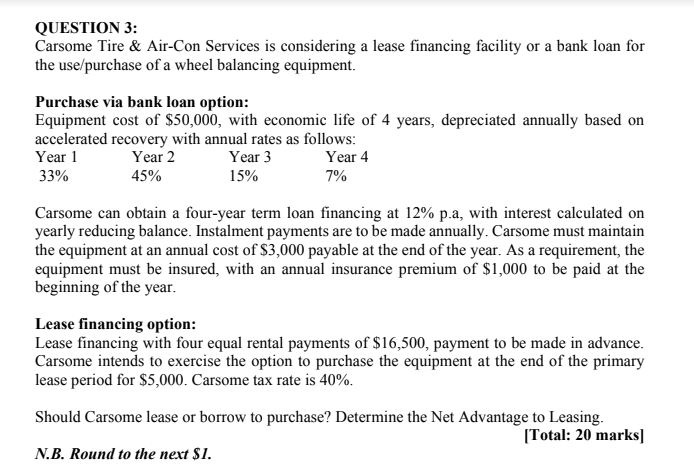

QUESTION 3: Carsome Tire & Air-Con Services is considering a lease financing facility or a bank loan for the use/purchase of a wheel balancing equipment. Purchase via bank loan option: Equipment cost of $50,000, with economic life of 4 years, depreciated annually based on accelerated recovery with annual rates as follows: Year 1 Year 2 Year 3 Year 4 33% 45% 15% 7% Carsome can obtain a four-year term loan financing at 12% p.a, with interest calculated on yearly reducing balance. Instalment payments are to be made annually. Carsome must maintain the equipment at an annual cost of $3,000 payable at the end of the year. As a requirement, the equipment must be insured, with an annual insurance premium of $1,000 to be paid at the beginning of the year. Lease financing option: Lease financing with four equal rental payments of $16,500, payment to be made in advance. Carsome intends to exercise the option to purchase the equipment at the end of the primary lease period for $5,000. Carsome tax rate is 40%. Should Carsome lease or borrow to purchase? Determine the Net Advantage to Leasing. [Total: 20 marks] N.B. Round to the next $1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts