Question: please write with all the details 2. (40 points) Stock M has a beta of 0.4 and expected return of 8%. Stock N has a

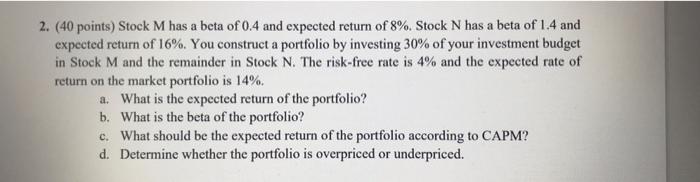

2. (40 points) Stock M has a beta of 0.4 and expected return of 8%. Stock N has a beta of 1.4 and expected return of 16%. You construct a portfolio by investing 30% of your investment budget in Stock M and the remainder in Stock N. The risk-free rate is 4% and the expected rate of return on the market portfolio is 14%. a. What is the expected return of the portfolio? b. What is the beta of the portfolio? c. What should be the expected return of the portfolio according to CAPM? d. Determine whether the portfolio is overpriced or underpriced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts