Question: Please write your answer clearly,especially the last question. Consider two bonds, each pays semi-annual coupons and 5 years left until maturity. One has a coupon

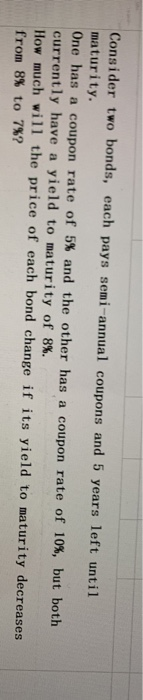

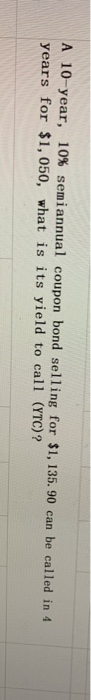

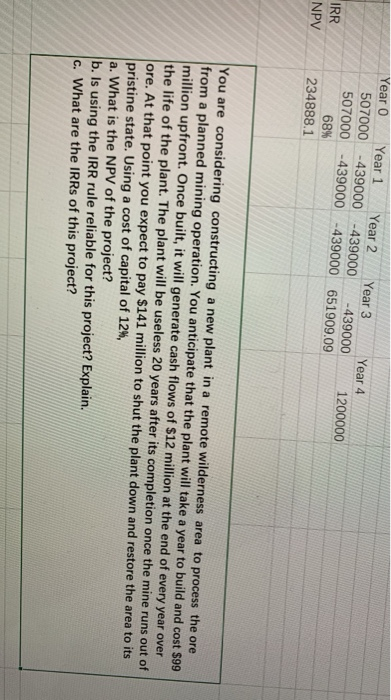

Consider two bonds, each pays semi-annual coupons and 5 years left until maturity. One has a coupon rate of 5% and the other has a coupon rate of 10%, but both currently have a yield to maturity of 8%. How much will the price of each bond change if its yield to maturity decreases from 8% to 7%? A 10-year, 10% semiannual coupon bond selling for $1, 135.90 can be called in 4 years for $1,050, what is its yield to call (YTC)? Year 0 Year 1 Year 2 Year 3 d Year 4 507000 -439000 -439000 -439000 1200000 507000 -439000-439000 651909.09 IRR NPV 68% 234888.1 You are considering constructing a new plant in a remote wilderness area to process the ore from a planned mining operation. You anticipate that the plant will take a year to build and cost $99 million upfront. Once built, it will generate cash flows of $12 million at the end of every year over the life of the plant. The plant will be useless 20 years after its completion once the mine runs out of ore. At that point you expect to pay $141 million to shut the plant down and restore the area to its pristine state. Using a cost of capital of 12%, a. What is the NPV of the project? b. Is using the IRR rule reliable for this project? Explain. c. What are the IRRs of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts