Question: PLEASE WRITE YOUR ANSWERS IN BOLD it 1 question Saved Help Save & Exit Submit Use the following information to answer this question: Windswept, Incorporated

PLEASE WRITE YOUR ANSWERS IN BOLD it 1 question

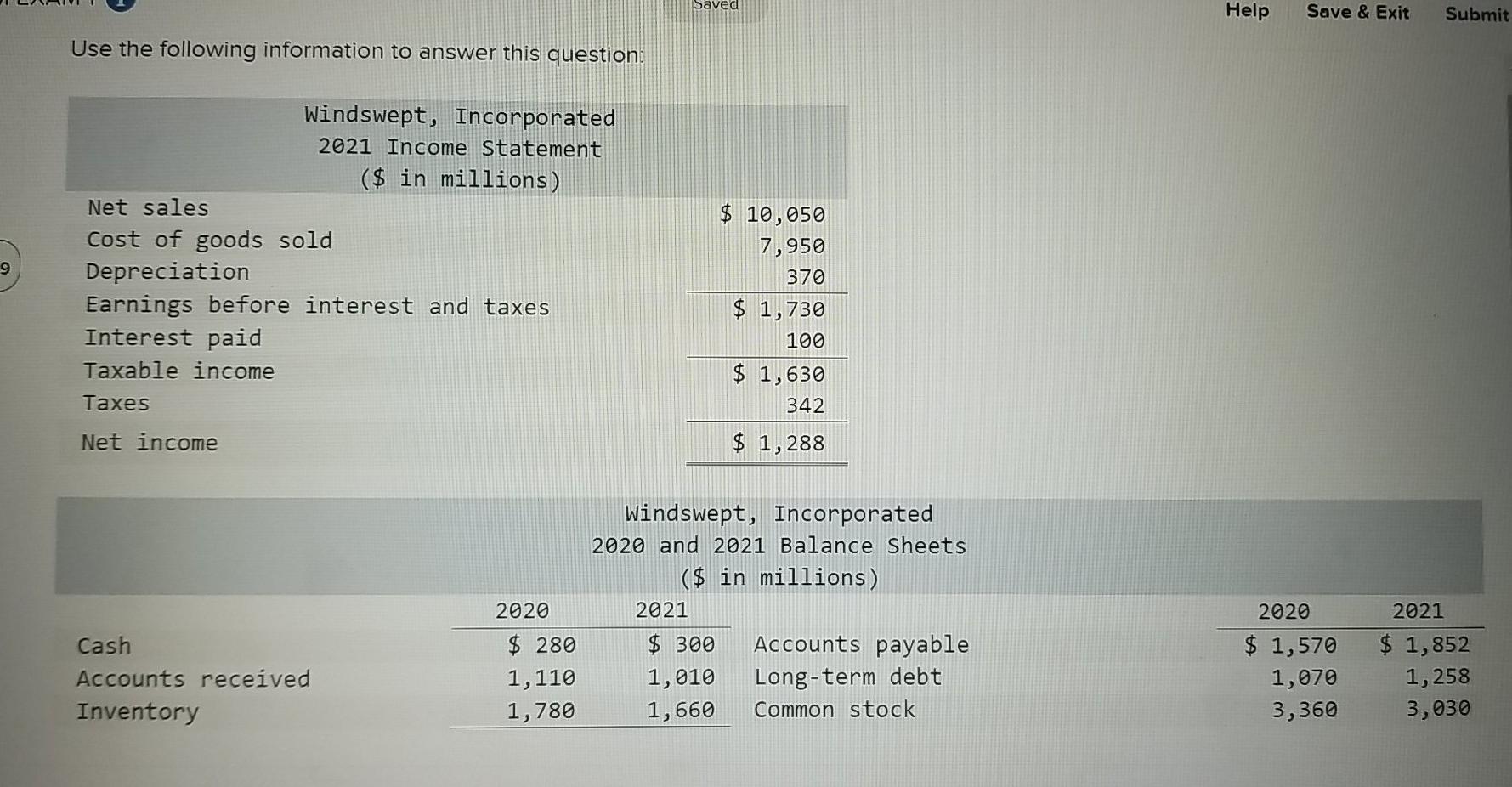

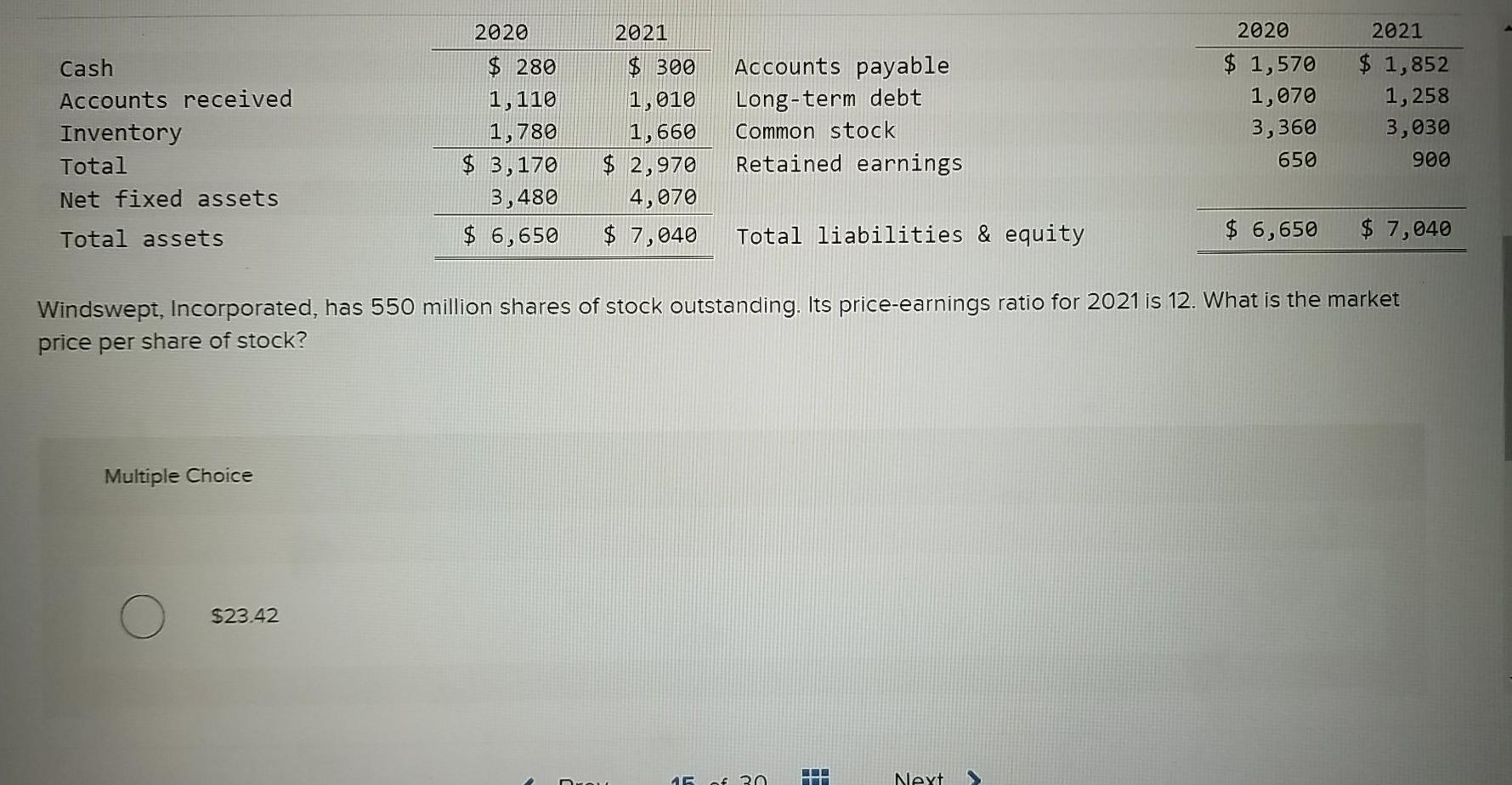

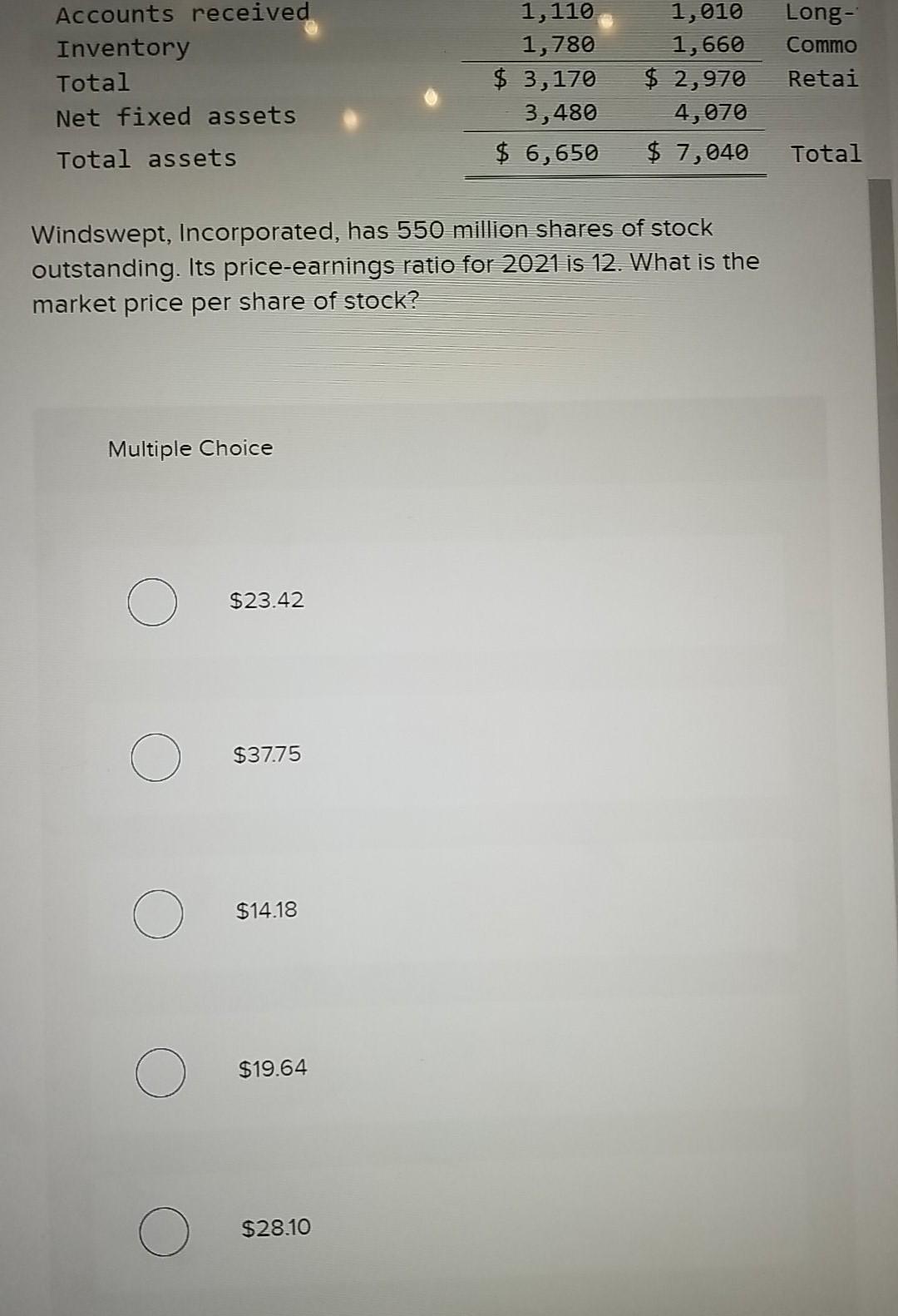

Saved Help Save & Exit Submit Use the following information to answer this question: Windswept, Incorporated 2021 Income Statement ($ in millions) Net sales $ 10,050 7,950 9 370 Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income $ 1,730 100 $ 1,630 342 Taxes Net income $ 1,288 2020 Windswept, Incorporated 2020 and 2021 Balance Sheets ($ in millions) 2021 $ 300 Accounts payable 1,010 Long-term debt 1,660 Common stock 2020 2021 Cash $ 280 Accounts received 1,110 $ 1,570 1,070 3,360 $ 1,852 1,258 3,030 Inventory 1,780 2020 2021 2020 2021 Cash Accounts received $ 280 1,110 1,780 $ 3,170 3,480 $ 300 1,010 1,660 $ 2,970 4,070 Accounts payable Long-term debt Common stock $ 1,570 1,070 3,360 Inventory Total $ 1,852 1,258 3,030 Retained earnings 650 900 Net fixed assets Total assets $ 6,650 $ 7,040 Total liabilities & equity $ 6,650 $ 7,040 Windswept, Incorporated, has 550 million shares of stock outstanding. Its price-earnings ratio for 2021 is 12. What is the market price per share of stock? Multiple Choice $23.42 HU 15 f 30 Next Accounts received Long- Commo Inventory Total 1,110 1,780 $ 3,170 3,480 1,010 1,660 $ 2,970 4,070 Retai Net fixed assets Total assets $ 6,650 $ 7,040 Total Windswept, Incorporated, has 550 million shares of stock outstanding. Its price-earnings ratio for 2021 is 12. What is the market price per share of stock? Multiple Choice $23.42 $37.75 0 $14.18 $19.64 ( ) $28.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts