Question: Please writes down all the formulas and steps. Appreciate all help. isme / study /busines s/ finance/ finance questions and answers /a former employee of

Please writes down all the formulas and steps.

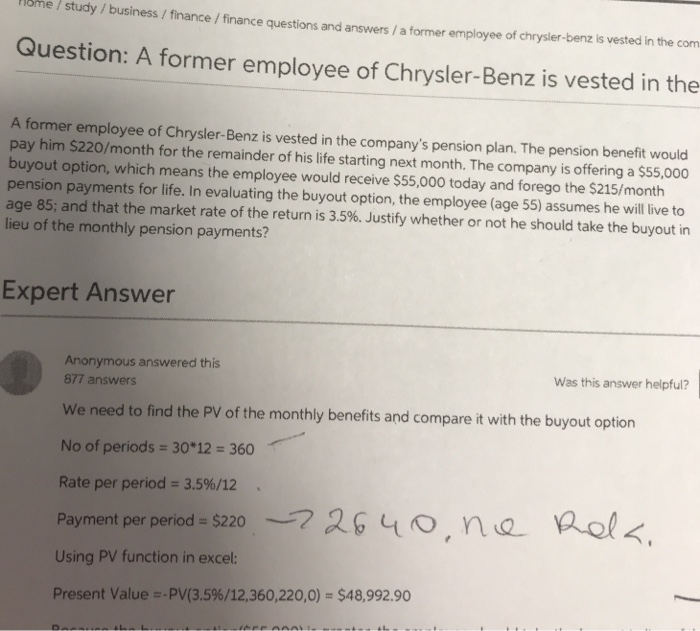

Please writes down all the formulas and steps. isme / study /busines s/ finance/ finance questions and answers /a former employee of chrysler-benz is vested in the com Question: A former employee of Chrysler-Benz is vested in the A former employee of Chrysler-Benz is vested in the company's pension plan. The pension benefit would pay him $220/month for the remainder of his life starting next month. The company is offering a $55,000 buyout option, which means the employee would receive $55,000 today and forego the $215/month pension payments for life. In evaluating the buyout option, the employee (age 55) assumes he will live to age 85; and that the market rate of the return is 3.5%. Justify whether or not he should take the buyout in lieu of the monthly pension payments? Expert Answer Anonymous answered this Was this answer helpful? 877 answers We need to find the PV of the monthly benefits and compare it with the buyout option No of periods 30*12 360 Rate per period-3.5%/12 Payment per period-$320 26,na pols Using PV function in excel: $48,992.90 Present Values-PV(3.5%/12,360,220,0)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts