Question: PLEASE WRITING MUST BE CLEAR TO READ!! Assigning a Long-Term Debt Rating Using Financial Ratios Refer to the information below from Nordstrom Inc.'s 2016 financial

PLEASE WRITING MUST BE CLEAR TO READ!!

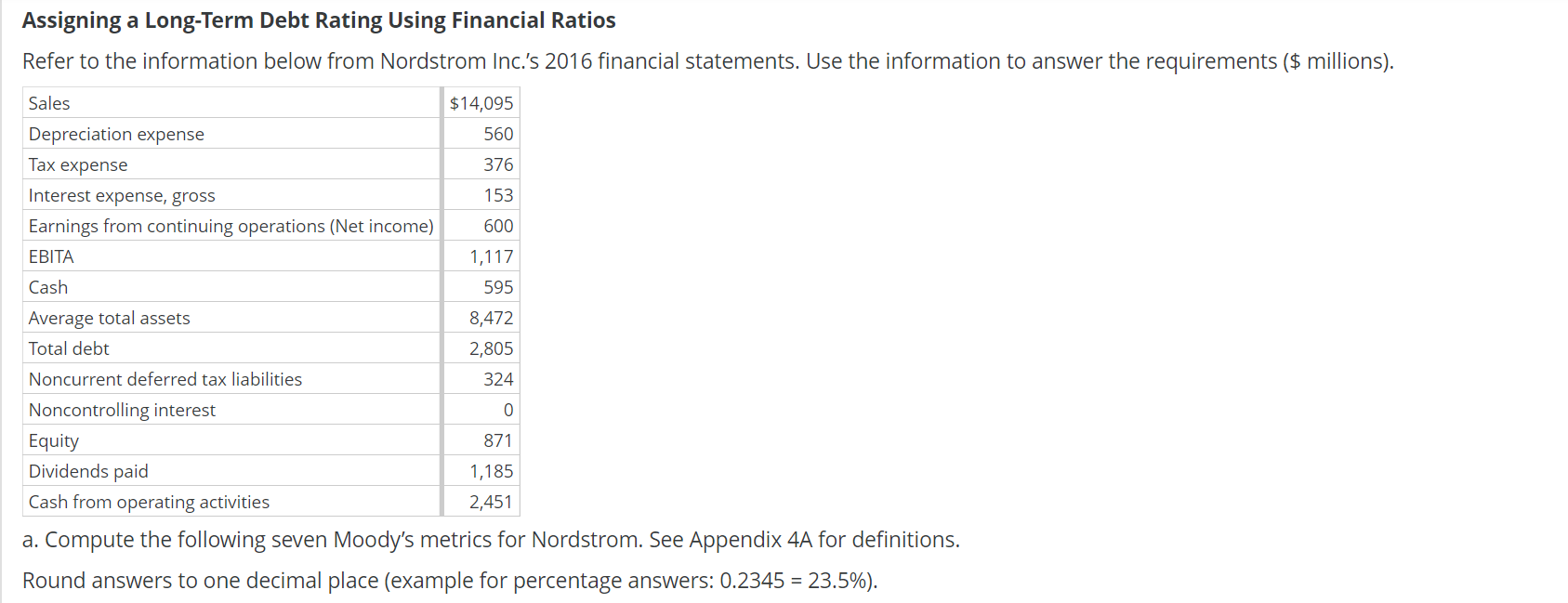

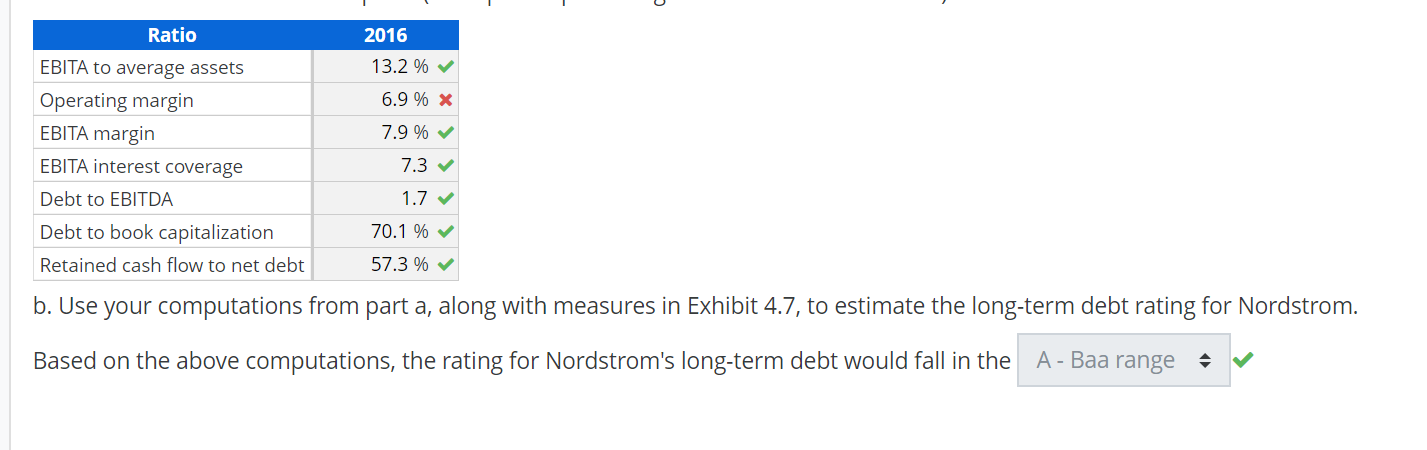

Assigning a Long-Term Debt Rating Using Financial Ratios Refer to the information below from Nordstrom Inc.'s 2016 financial statements. Use the information to answer the requirements ($ millions). $14,095 560 376 153 600 Sales Depreciation expense Tax expense Interest expense, gross Earnings from continuing operations (Net income) Cash Average total assets Total debt Noncurrent deferred tax liabilities Noncontrolling interest Equity Dividends paid Cash from operating activities 1,117 595 8,472 2,805 324 0 871 1,185 2,451 a. Compute the following seven Moody's metrics for Nordstrom. See Appendix 4A for definitions. Round answers to one decimal place (example for percentage answers: 0.2345 = 23.5%). Ratio 2016 EBITA to average assets 13.2 % Operating margin 6.9 % x EBITA margin 7.9 % EBITA interest coverage 7.3 Debt to EBITDA 1.7 Debt to book capitalization 70.1 % Retained cash flow to net debt 57.3 % b. Use your computations from part a, along with measures in Exhibit 4.7, to estimate the long-term debt rating for Nordstrom. Based on the above computations, the rating for Nordstrom's long-term debt would fall in the A - Baa range av

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts