Question: PLEASE WRITING SHOULD BE CLEAR TO READ! Estimating the Cost of Equity Capital Kellogg Company manufactures cereal and other convenience food under its many well-known

PLEASE WRITING SHOULD BE CLEAR TO READ!

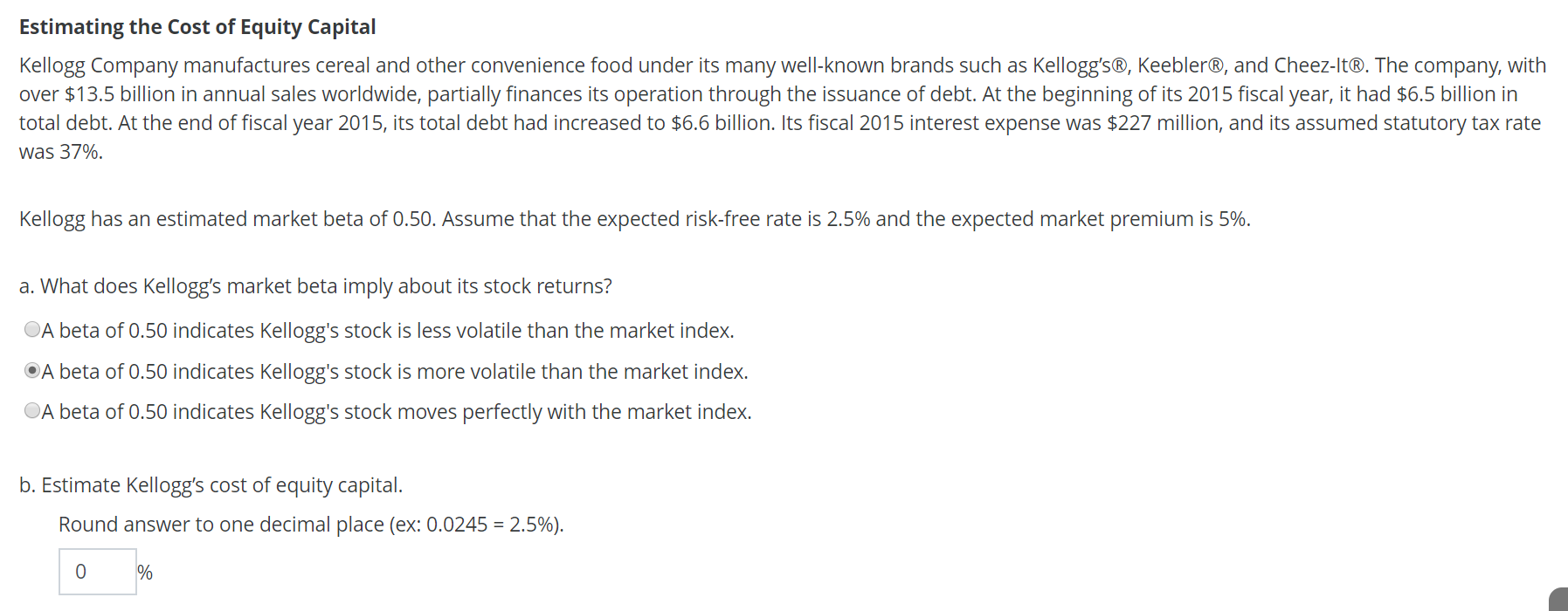

Estimating the Cost of Equity Capital Kellogg Company manufactures cereal and other convenience food under its many well-known brands such as Kellogg's, Keebler, and Cheez-It. The company, with over $13.5 billion in annual sales worldwide, partially finances its operation through the issuance of debt. At the beginning of its 2015 fiscal year, it had $6.5 billion in total debt. At the end of fiscal year 2015, its total debt had increased to $6.6 billion. Its fiscal 2015 interest expense was $227 million, and its assumed statutory tax rate was 37%. Kellogg has an estimated market beta of 0.50. Assume that the expected risk-free rate is 2.5% and the expected market premium is 5%. a. What does Kellogg's market beta imply about its stock returns? A beta of 0.50 indicates Kellogg's stock is less volatile than the market index. A beta of 0.50 indicates Kellogg's stock is more volatile than the market index. A beta of 0.50 indicates Kellogg's stock moves perfectly with the market index. b. Estimate Kellogg's cost of equity capital. Round answer to one decimal place (ex: 0.0245 = 2.5%). 0 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts