Question: please your answer as asked in the question Q2) Below are extracts from the financial statements of Maria Ltd: Below are extracts from the financial

please your answer as asked in the question

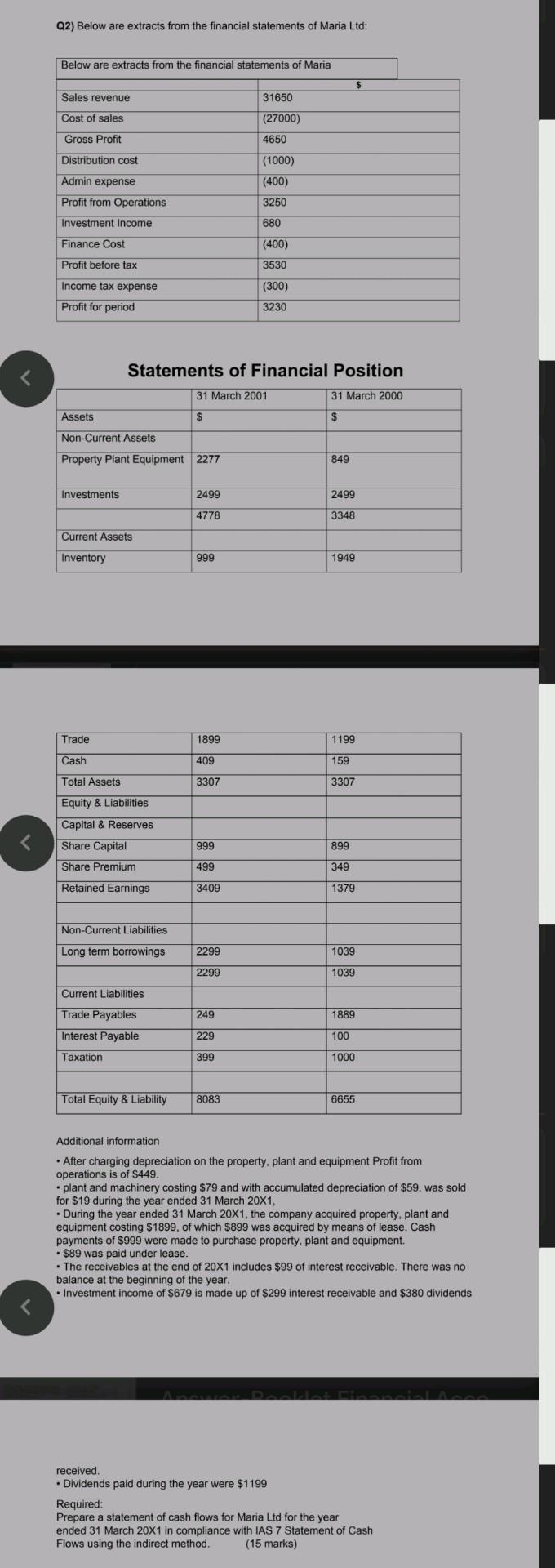

Q2) Below are extracts from the financial statements of Maria Ltd: Below are extracts from the financial statements of Maria Sales revenue 31650 Cost of sales (27000) Gross Profit 4650 Distribution cost (1000) (400) Admin expense 3250 Profit from Operations Investment Income 680 Finance Cost (400) 3530 Profit before tax Income tax expense Profit for period (300) 3230 Statements of Financial Position 31 March 2001 31 March 2000 Assets $ $ Non-Current Assets Property Plant Equipment 2277 849 Investments 2499 2499 4778 3348 Current Assets Inventory 999 1949 Trade 1899 1199 Cash 409 159 Total Assets 3307 3307 Equity & Liabilities Capital & Reserves Share Capital Share Premium 999 899 499 349 Retained Earnings 3409 1379 Non-Current Liabilities Long term borrowings 2299 1039 2299 1039 Current Liabilities Trade Payables Interest Payable 249 1889 229 100 Taxation 399 1000 Total Equity & Liability 8083 6655 Additional information After charging depreciation on the property, plant and equipment Profit from operations is of $449 plant and machinery costing $79 and with accumulated depreciation of $59, was sold for $19 during the year ended 31 March 20x1. . During the year ended 31 March 20X1, the company acquired property, plant and equipment costing S1899, of which $899 was acquired by means of lease. Cash payments of $999 were made to purchase property, plant and equipment $89 was paid under lease. The receivables at the end of 20x1 includes $99 of interest receivable. There was no balance at the beginning of the year. Investment income of $679 is made up of $299 interest receivable and $380 dividends . received Dividends paid during the year were $1199 Required: Prepare a statement of cash flows for Maria Ltd for the year ended 31 March 20X1 in compliance with IAS 7 Statement of Cash Flows using the indirect method. (15 marks) Q2) Below are extracts from the financial statements of Maria Ltd: Below are extracts from the financial statements of Maria Sales revenue 31650 Cost of sales (27000) Gross Profit 4650 Distribution cost (1000) (400) Admin expense 3250 Profit from Operations Investment Income 680 Finance Cost (400) 3530 Profit before tax Income tax expense Profit for period (300) 3230 Statements of Financial Position 31 March 2001 31 March 2000 Assets $ $ Non-Current Assets Property Plant Equipment 2277 849 Investments 2499 2499 4778 3348 Current Assets Inventory 999 1949 Trade 1899 1199 Cash 409 159 Total Assets 3307 3307 Equity & Liabilities Capital & Reserves Share Capital Share Premium 999 899 499 349 Retained Earnings 3409 1379 Non-Current Liabilities Long term borrowings 2299 1039 2299 1039 Current Liabilities Trade Payables Interest Payable 249 1889 229 100 Taxation 399 1000 Total Equity & Liability 8083 6655 Additional information After charging depreciation on the property, plant and equipment Profit from operations is of $449 plant and machinery costing $79 and with accumulated depreciation of $59, was sold for $19 during the year ended 31 March 20x1. . During the year ended 31 March 20X1, the company acquired property, plant and equipment costing S1899, of which $899 was acquired by means of lease. Cash payments of $999 were made to purchase property, plant and equipment $89 was paid under lease. The receivables at the end of 20x1 includes $99 of interest receivable. There was no balance at the beginning of the year. Investment income of $679 is made up of $299 interest receivable and $380 dividends . received Dividends paid during the year were $1199 Required: Prepare a statement of cash flows for Maria Ltd for the year ended 31 March 20X1 in compliance with IAS 7 Statement of Cash Flows using the indirect method. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts