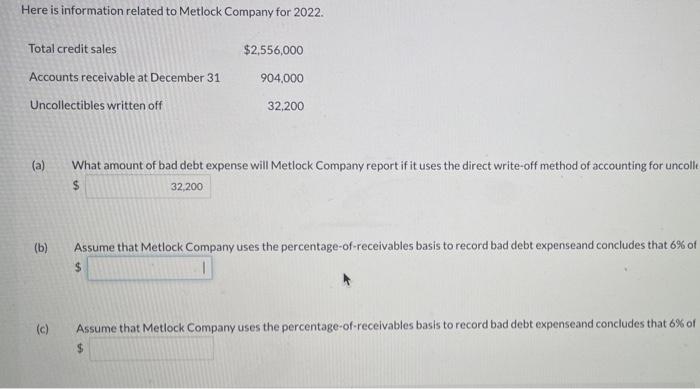

Question: pleasebhelp me woth a b and c i don't understand how Here is information related to Metlock Company for 2022. Total credit sales $2,556,000 Accounts

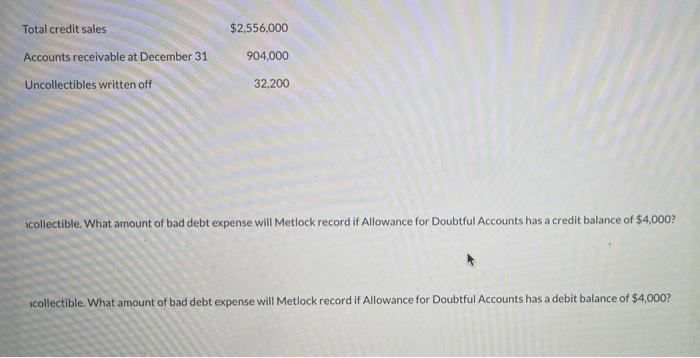

Here is information related to Metlock Company for 2022. Total credit sales $2,556,000 Accounts receivable at December 31 904,000 Uncollectibles written off 32,200 (a) What amount of bad debt expense will Metlock Company reportif it uses the direct write-off method of accounting for uncolle $ 32,200 (b) Assume that Metlock Company uses the percentage-of-receivables basis to record bad debt expenseand concludes that 6% of $ (c) Assume that Metlock Company uses the percentage-of-receivables basis to record bad debt expenseand concludes that 6% of $2,556,000 Total credit sales Accounts receivable at December 31 Uncollectibles written off 904,000 32.200 collectible. What amount of bad debt expense will Metlock record if Allowance for Doubtful Accounts has a credit balance of $4,000? collectible. What amount of bad debt expense will Metlock record if Allowance for Doubtful Accounts has a debit balance of $4,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts