Question: pleasee do the requirements Instructions . Read the setup Prepare the appropriate documents. Use the chart of accounts to help you identify the right account.

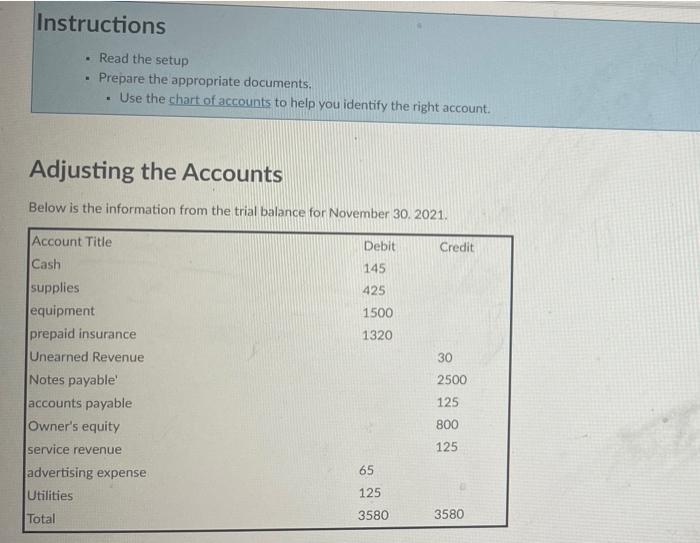

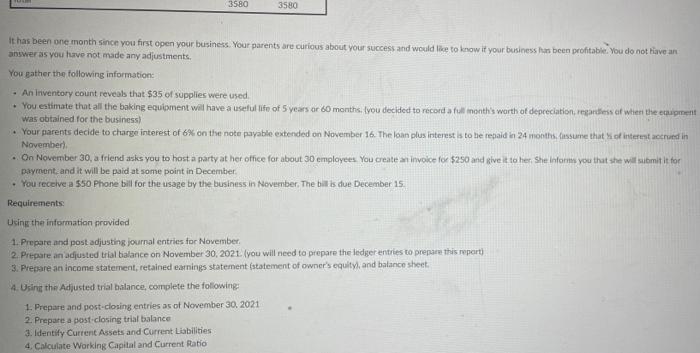

Instructions . Read the setup Prepare the appropriate documents. Use the chart of accounts to help you identify the right account. Adjusting the Accounts Below is the information from the trial balance for November 30, 2021. Account Title Cash supplies equipment prepaid insurance Unearned Revenue Notes payable' accounts payable Owner's equity service revenue advertising expense Utilities Total Debit 145 425 1500 1320 65 125 3580 Credit 30 2500 125 800 125 3580 3580 3580 It has been one month since you first open your business. Your parents are curious about your success and would like to know if your business has been profitable. You do not have an answer as you have not made any adjustments. You gather the following information: . An inventory count reveals that $35 of supplies were used. You estimate that all the baking equipment will have a useful life of 5 years or 60 months. (you decided to record a full month's worth of depreciation, regardless of when the equipment was obtained for the business) Your parents decide to charge interest of 6% on the note payable extended on November 16. The loan plus interest is to be repaid in 24 months. (assume that % of interest accrued in November). . On November 30, a friend asks you to host a party at her office for about 30 employees. You create an invoice for $250 and give it to her. She informs you that she will submit it for payment, and it will be paid at some point in December. You receive a $50 Phone bill for the usage by the business in November. The bill is due December 15 Requirements: Using the information provided i 1. Prepare and post adjusting journal entries for November. 2. Prepare an adjusted trial balance on November 30, 2021. (you will need to prepare the ledger entries to prepare this report) 3. Prepare an income statement, retained earnings statement (statement of owner's equity), and balance sheet. 4. Using the Adjusted trial balance, complete the following: 1. Prepare and post-closing entries as of November 30, 2021 2. Prepare a post-closing trial balance 3. Identify Current Assets and Current Liabilities. 4. Calculate Working Capital and Current Ratio Instructions . Read the setup Prepare the appropriate documents. Use the chart of accounts to help you identify the right account. Adjusting the Accounts Below is the information from the trial balance for November 30, 2021. Account Title Cash supplies equipment prepaid insurance Unearned Revenue Notes payable' accounts payable Owner's equity service revenue advertising expense Utilities Total Debit 145 425 1500 1320 65 125 3580 Credit 30 2500 125 800 125 3580 3580 3580 It has been one month since you first open your business. Your parents are curious about your success and would like to know if your business has been profitable. You do not have an answer as you have not made any adjustments. You gather the following information: . An inventory count reveals that $35 of supplies were used. You estimate that all the baking equipment will have a useful life of 5 years or 60 months. (you decided to record a full month's worth of depreciation, regardless of when the equipment was obtained for the business) Your parents decide to charge interest of 6% on the note payable extended on November 16. The loan plus interest is to be repaid in 24 months. (assume that % of interest accrued in November). . On November 30, a friend asks you to host a party at her office for about 30 employees. You create an invoice for $250 and give it to her. She informs you that she will submit it for payment, and it will be paid at some point in December. You receive a $50 Phone bill for the usage by the business in November. The bill is due December 15 Requirements: Using the information provided i 1. Prepare and post adjusting journal entries for November. 2. Prepare an adjusted trial balance on November 30, 2021. (you will need to prepare the ledger entries to prepare this report) 3. Prepare an income statement, retained earnings statement (statement of owner's equity), and balance sheet. 4. Using the Adjusted trial balance, complete the following: 1. Prepare and post-closing entries as of November 30, 2021 2. Prepare a post-closing trial balance 3. Identify Current Assets and Current Liabilities. 4. Calculate Working Capital and Current Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts