Question: pleaseee help 1 exercise. accounting 1 more clear pictures please help The Accounts Receivable balance or Highland Company at December 12, 20 During 2004 Highland

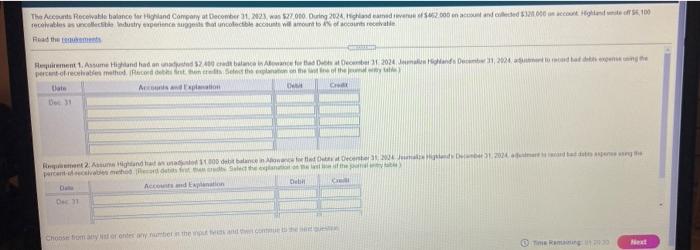

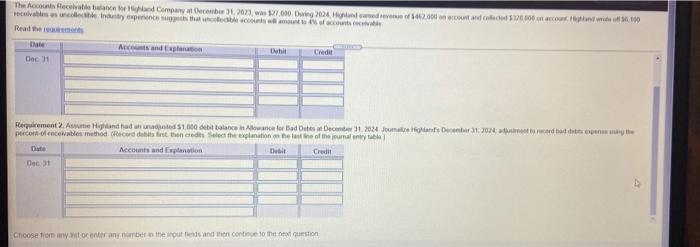

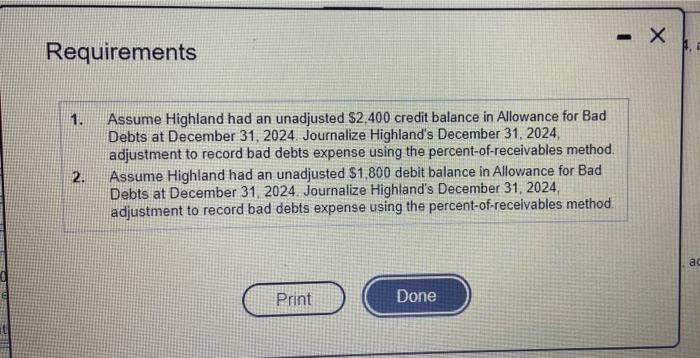

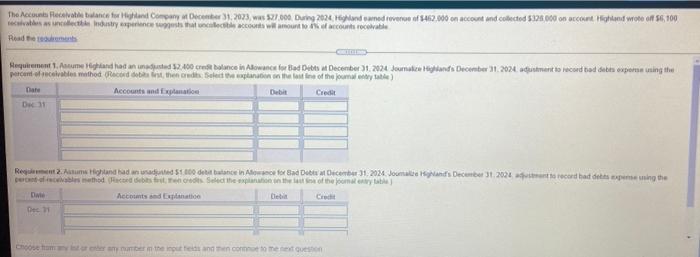

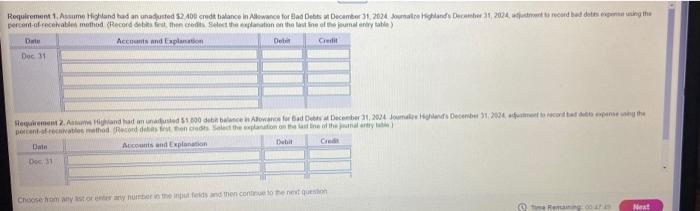

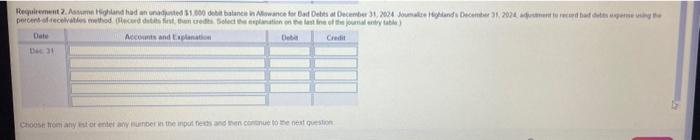

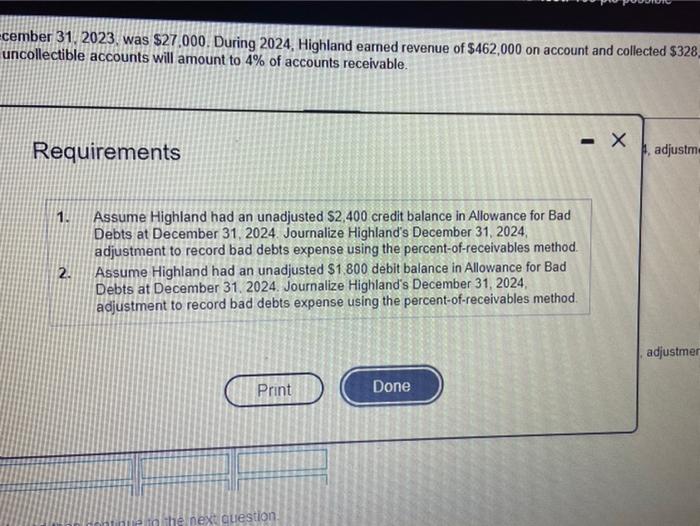

The Accounts Receivable balance or Highland Company at December 12, 20 During 2004 Highland medicale $120.000 cc Holand.100 reces as well as experience that incolectible con il mount of contracte Hepiment 1. Assume Highland had and be in 2024 pertrechtfermo content Date Apa 33 2 Antand 100 dobitbanden oder Profi Accord En be De Choose and the RE The Acceleration behind Company at December 2017 wing 2024. 562.000 on count and cod 000 account. Illud e f 34.180 vos colectie Industry experience the mounts of Date And Expo Crede Oor 1 Requirement 2.Awe Hand had an add 1000 bitcoin wance for Bed Dec. 2024 Jomas Decorada percom fecewable method Record de fritthence Salect the planin e line of the many Date Accounts and Explanation Duit Cred Dec 31 Choose from any warrany number in the routes and contie 10 euro - X Requirements 1. Assume Highland had an unadjusted $2,400 credit balance in Allowance for Bad Debts at December 31, 2024. Journalize Highland's December 31, 2024 adjustment to record bad debts expense using the percent-of-receivables method. Assume Highland had an unadjusted $1,800 debit balance in Allowance for Bad Debts at December 31, 2024. Journalize Highland's December 31, 2024 adjustment to record bad debts expense using the percent-of-receivables method 2. Print Done The Accountance for and Company December 31, 2023, was 32.000 During 2020. ghand owned over 5462.000 on account and collected 5328.000 on account Highend wote 56,100 receives Industry experiences that occur wit moto counts receivable Read the Hequirement toome stand has an industd 32.400 credit balance in Allowance for Bied Ditto December 31, 2024 Somalee Highlands December 1, 2024 utment to record tod debts esporte using the percent of receptes method Records, the credits Separation of one of the promocy table) Accounts and Exam Debit Credit De Date Resume Highland sad in die 51.100 de balance in face for Bed December 31, 2012. Jouand's December 31, 2024. record has despese in the De todos os e Sachen of the many De Accounts and plant Dec 13 Choose they are in the outcome que Requirement 1. Asume Highland had an unausted 82 Acredit balance in Alwance for Bad Dates December 31, 2024. Suatre Highlands Dec 31, 2024. tocad bad doties un ing the percent of receivable method Records then select the explanation on the line of many table> Account and Explanation Det Greit Doc 31 Requirement and has anne 1800 di balowanced December 31, 2004 December 2006 seconds and the pohod Records it then the one that in the area Accounts and Explanation Debat G D31 Choose a story number ones and then come to the ques RES Neat Requirement. Amihand had an add 100 de balance wance Bad Debits at December 1, 2004 Jan December 31, 2024 hod percent ofreceive the cards in the Senate of the Datu Accs and plant De Di Choose a story in the input the continue to be neatest Ecember 31, 2023 was $27,000. During 2024, Highland earned revenue of $462,000 on account and collected $328. uncollectible accounts will amount to 4% of accounts receivable. - X Requirements adjustm. 1. Assume Highland had an unadjusted $2,400 credit balance in Allowance for Bad Debts at December 31, 2024. Journalize Highland's December 31, 2024 adjustment to record bad debts expense using the percent-of-receivables method. Assume Highland had an unadjusted $1.800 debit balance in Allowance for Bad Debts at December 31, 2024. Journalize Highland's December 31, 2024 adjustment to record bad debts expense using the percent-of-receivables method. 2. adjustmer Print Done next question The Accounts Receivable balance or Highland Company at December 12, 20 During 2004 Highland medicale $120.000 cc Holand.100 reces as well as experience that incolectible con il mount of contracte Hepiment 1. Assume Highland had and be in 2024 pertrechtfermo content Date Apa 33 2 Antand 100 dobitbanden oder Profi Accord En be De Choose and the RE The Acceleration behind Company at December 2017 wing 2024. 562.000 on count and cod 000 account. Illud e f 34.180 vos colectie Industry experience the mounts of Date And Expo Crede Oor 1 Requirement 2.Awe Hand had an add 1000 bitcoin wance for Bed Dec. 2024 Jomas Decorada percom fecewable method Record de fritthence Salect the planin e line of the many Date Accounts and Explanation Duit Cred Dec 31 Choose from any warrany number in the routes and contie 10 euro - X Requirements 1. Assume Highland had an unadjusted $2,400 credit balance in Allowance for Bad Debts at December 31, 2024. Journalize Highland's December 31, 2024 adjustment to record bad debts expense using the percent-of-receivables method. Assume Highland had an unadjusted $1,800 debit balance in Allowance for Bad Debts at December 31, 2024. Journalize Highland's December 31, 2024 adjustment to record bad debts expense using the percent-of-receivables method 2. Print Done The Accountance for and Company December 31, 2023, was 32.000 During 2020. ghand owned over 5462.000 on account and collected 5328.000 on account Highend wote 56,100 receives Industry experiences that occur wit moto counts receivable Read the Hequirement toome stand has an industd 32.400 credit balance in Allowance for Bied Ditto December 31, 2024 Somalee Highlands December 1, 2024 utment to record tod debts esporte using the percent of receptes method Records, the credits Separation of one of the promocy table) Accounts and Exam Debit Credit De Date Resume Highland sad in die 51.100 de balance in face for Bed December 31, 2012. Jouand's December 31, 2024. record has despese in the De todos os e Sachen of the many De Accounts and plant Dec 13 Choose they are in the outcome que Requirement 1. Asume Highland had an unausted 82 Acredit balance in Alwance for Bad Dates December 31, 2024. Suatre Highlands Dec 31, 2024. tocad bad doties un ing the percent of receivable method Records then select the explanation on the line of many table> Account and Explanation Det Greit Doc 31 Requirement and has anne 1800 di balowanced December 31, 2004 December 2006 seconds and the pohod Records it then the one that in the area Accounts and Explanation Debat G D31 Choose a story number ones and then come to the ques RES Neat Requirement. Amihand had an add 100 de balance wance Bad Debits at December 1, 2004 Jan December 31, 2024 hod percent ofreceive the cards in the Senate of the Datu Accs and plant De Di Choose a story in the input the continue to be neatest Ecember 31, 2023 was $27,000. During 2024, Highland earned revenue of $462,000 on account and collected $328. uncollectible accounts will amount to 4% of accounts receivable. - X Requirements adjustm. 1. Assume Highland had an unadjusted $2,400 credit balance in Allowance for Bad Debts at December 31, 2024. Journalize Highland's December 31, 2024 adjustment to record bad debts expense using the percent-of-receivables method. Assume Highland had an unadjusted $1.800 debit balance in Allowance for Bad Debts at December 31, 2024. Journalize Highland's December 31, 2024 adjustment to record bad debts expense using the percent-of-receivables method. 2. adjustmer Print Done next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts