Question: PLEASEEE help!!! will thumbs up! 1. Perry, Inc. has $45,508 of finished goods inventory as of December 31 . If finished goods inventory at January

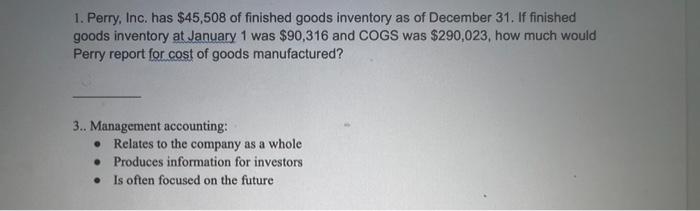

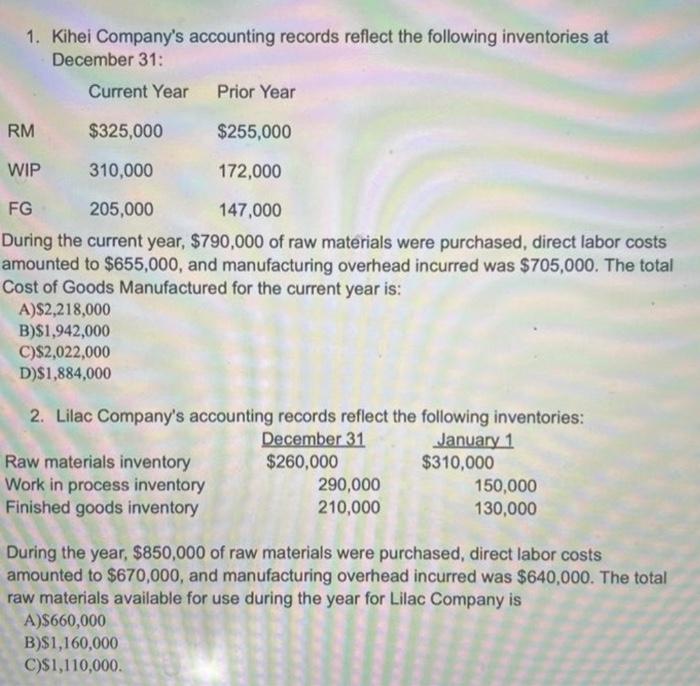

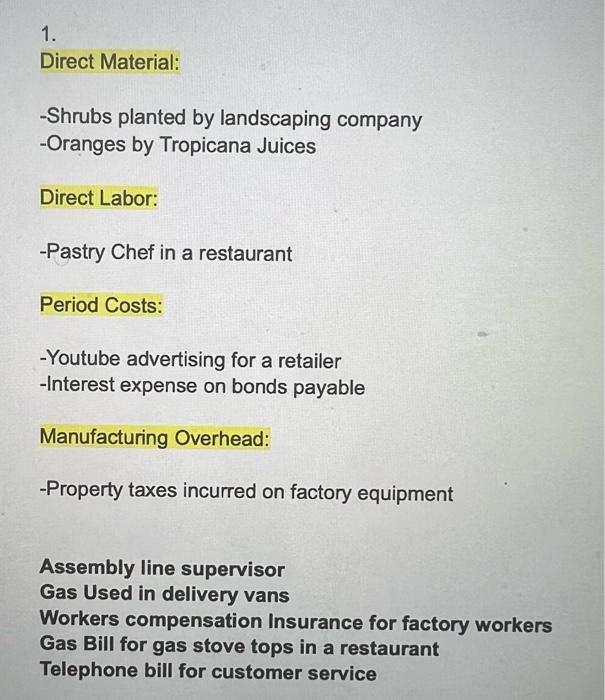

1. Perry, Inc. has $45,508 of finished goods inventory as of December 31 . If finished goods inventory at January 1 was $90,316 and COGS was $290,023, how much would Perry report for cost of goods manufactured? 3.. Management accounting: - Relates to the company as a whole - Produces information for investors - Is often focused on the future 1. Kihei Company's accounting records reflect the following inventories at December 31: During the current year, $790,000 of raw materials were purchased, direct labor costs amounted to $655,000, and manufacturing overhead incurred was $705,000. The total Cost of Goods Manufactured for the current year is: A) 2,218,000 B) $1,942,000 C) $2,022,000 D) $1,884,000 2. Lilac Company's accounting records reflect the following inventories: During the year, $850,000 of raw materials were purchased, direct labor costs amounted to $670,000, and manufacturing overhead incurred was $640,000. The total raw materials available for use during the year for Lilac Company is A) $660,000 B) $1,160,000 C) $1,110,000. 1. Direct Material: -Shrubs planted by landscaping company -Oranges by Tropicana Juices Direct Labor: -Pastry Chef in a restaurant Period Costs: -Youtube advertising for a retailer -Interest expense on bonds payable Manufacturing Overhead: -Property taxes incurred on factory equipment Assembly line supervisor Gas Used in delivery vans Workers compensation Insurance for factory workers Gas Bill for gas stove tops in a restaurant Telephone bill for customer service

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts