Question: PLEASEEEE!!!!! A hedge fund sets its fee at 2% and a 20% carry with an 8% benchmark. What is the Net IRR to the investors

PLEASEEEE!!!!!

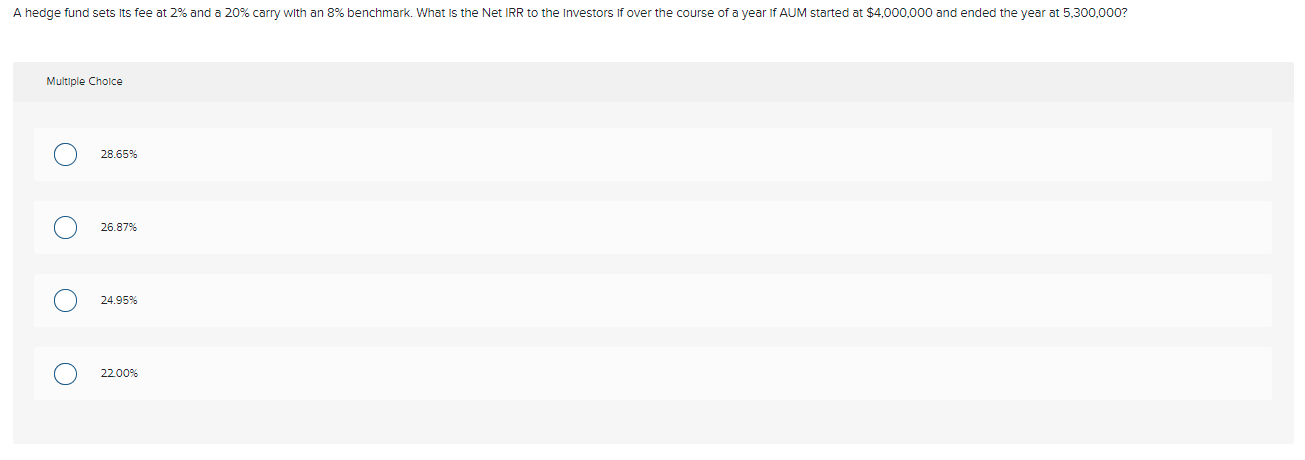

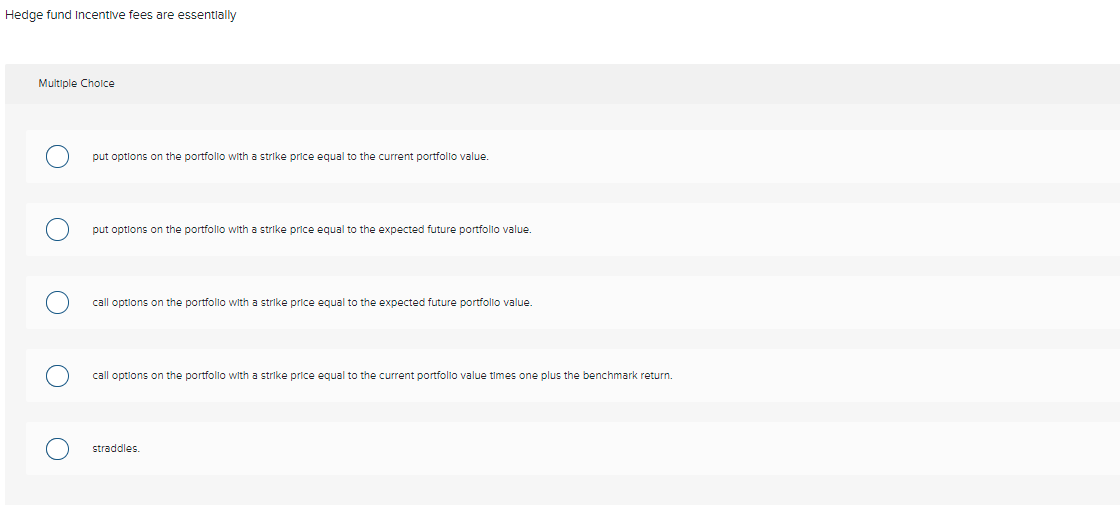

A hedge fund sets its fee at 2% and a 20% carry with an 8% benchmark. What is the Net IRR to the investors If over the course of a year if AUM started at $4,000,000 and ended the year at 5,300,000? Multiple Choice o 28.65% 26.87% O 24.95% O 22.00% Hedge fund Incentive fees are essentially Multiple Choice put options on the portfolio with a strike price equal to the current portfolio value. put options on the portfolio with a strike price equal to the expected future portfolio value. call options on the portfolio with a strike price equal to the expected future portfolio value. call options on the portfolio with a strike price equal to the current portfolio value times one plus the benchmark return. straddles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts