Question: pleaseeee help A June sales forecast projects that 4,500 units are going to be sold at a price of $10.00 per unit. The desired ending

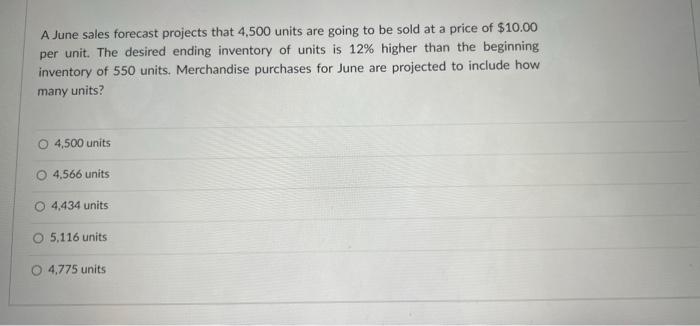

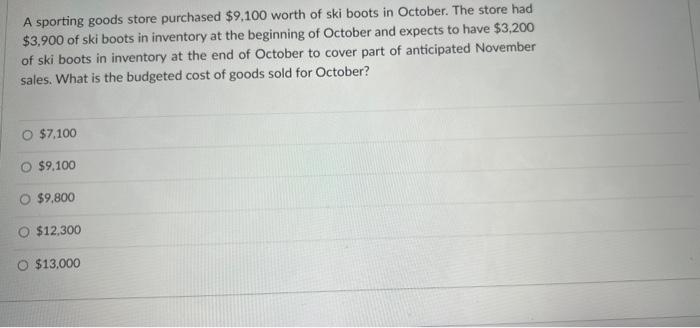

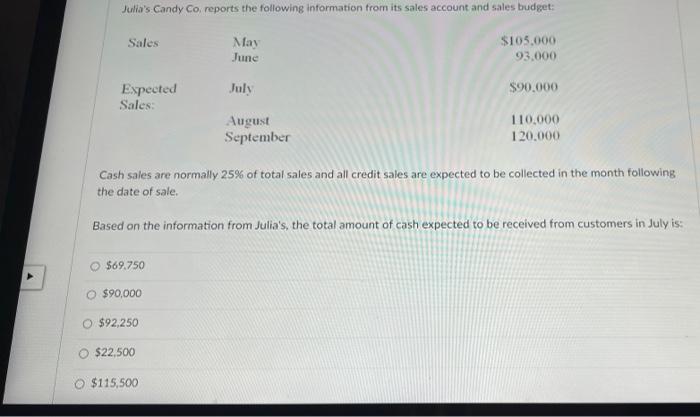

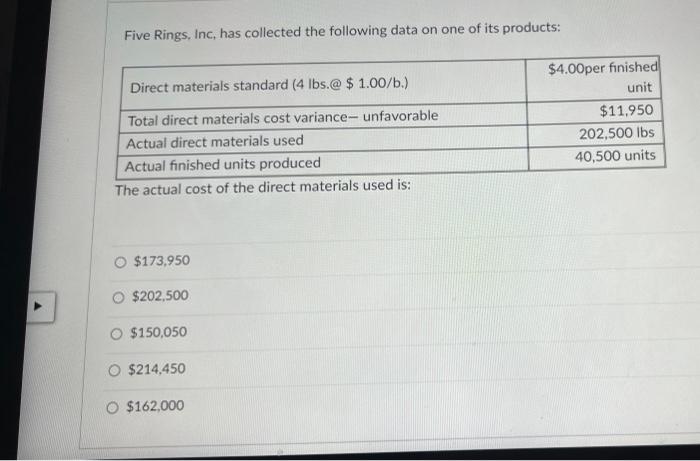

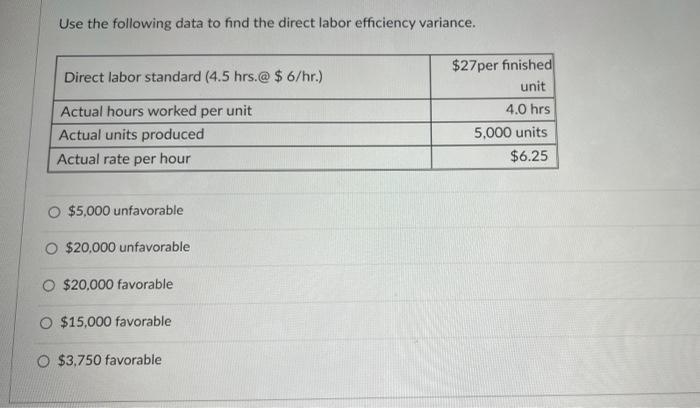

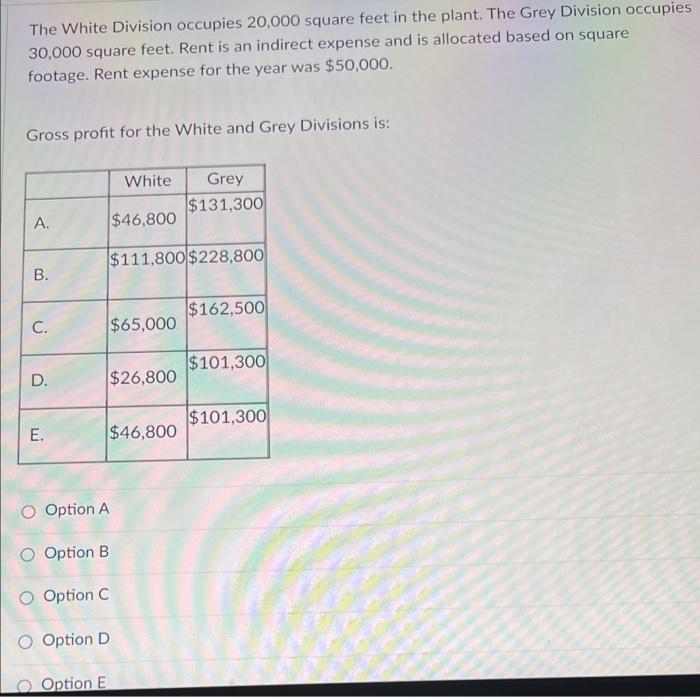

A June sales forecast projects that 4,500 units are going to be sold at a price of $10.00 per unit. The desired ending inventory of units is 12% higher than the beginning inventory of 550 units. Merchandise purchases for June are projected to include how many units? 4,500 units 4,566 units 4,434 units 5,116 units 4,775 units A sporting goods store purchased $9,100 worth of ski boots in October. The store had $3,900 of ski boots in inventory at the beginning of October and expects to have $3,200 of ski boots in inventory at the end of October to cover part of anticipated November sales. What is the budgeted cost of goods sold for October? O $7,100 O $9.100 O $9,800 O $12,300 O $13,000 Julia's Candy Co, reports the following information from its sales account and sales budget: $105.000 93,000 Sales Expected Sales: O $69.750 O $90,000 O $92,250 $22,500 May June Cash sales are normally 25% of total sales and all credit sales are expected to be collected in the month following the date of sale. Based on the information from Julia's, the total amount of cash expected to be received from customers in July is: $115,500 August September $90,000 110,000 120,000 Five Rings, Inc, has collected the following data on one of its products: Direct materials standard (4 lbs.@ $ 1.00/b.) Total direct materials cost variance- unfavorable Actual direct materials used Actual finished units produced The actual cost of the direct materials used is: $173,950 $202,500 $150,050 $214,450 O $162,000 $4.00per finished unit $11,950 202,500 lbs 40,500 units Use the following data to find the direct labor efficiency variance. Direct labor standard (4.5 hrs.@ $6/hr.) Actual hours worked per unit Actual units produced Actual rate per hour O $5,000 unfavorable O $20,000 unfavorable $20,000 favorable O $15,000 favorable O $3,750 favorable $27per finished unit 4.0 hrs 5,000 units $6.25 The White Division occupies 20,000 square feet in the plant. The Grey Division occupies 30,000 square feet. Rent is an indirect expense and is allocated based on square footage. Rent expense for the year was $50,000. Gross profit for the White and Grey Divisions is: A. B. C. D. E. O Option A O Option B O Option C Option D Option E White $46,800 $111,800 $228,800 $65,000 $26,800 Grey $131,300 $46,800 $162,500 $101,300 $101,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts