Question: Pleaseeeee answer its really important specially part 1 and 3 please Answer the following questions: 1. Calculate Pfizers Provision for Income Tax (Income Tax Expense)

Pleaseeeee answer its really important specially part 1 and 3 please

Answer the following questions:

1.

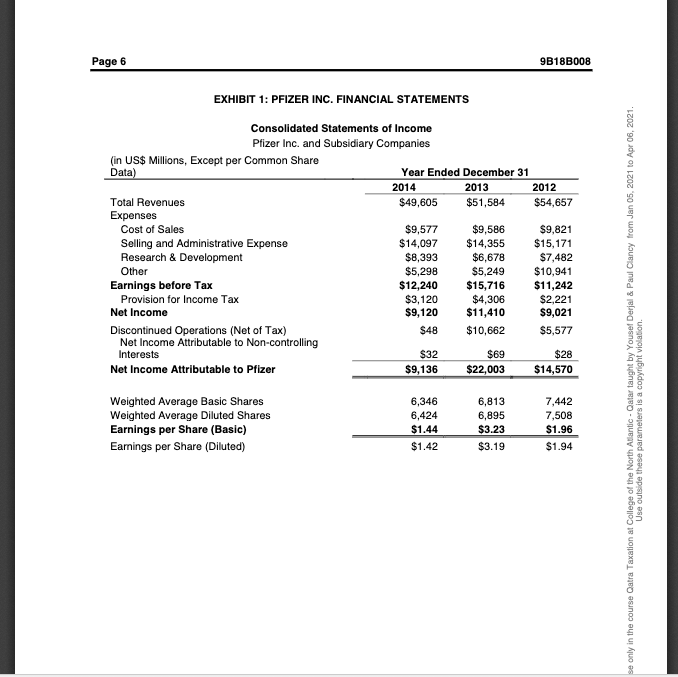

Calculate Pfizers Provision for Income Tax (Income Tax Expense) for each of its fiscal

years 2012, 2013, & 2014 assuming Pfizers tax residency had been moved to Ireland

the beginning of 2012. How much would the total income tax savings for these three

years have been?

2.

Briefly explain how tax inversions work.

3.

How is transfer pricing related to the offshore cash holdings of U.S. firms? What

happens if a U.S. firm repatriates offshore profits?

4.

Are tax inversions and/or transfer pricing unethical? Explain

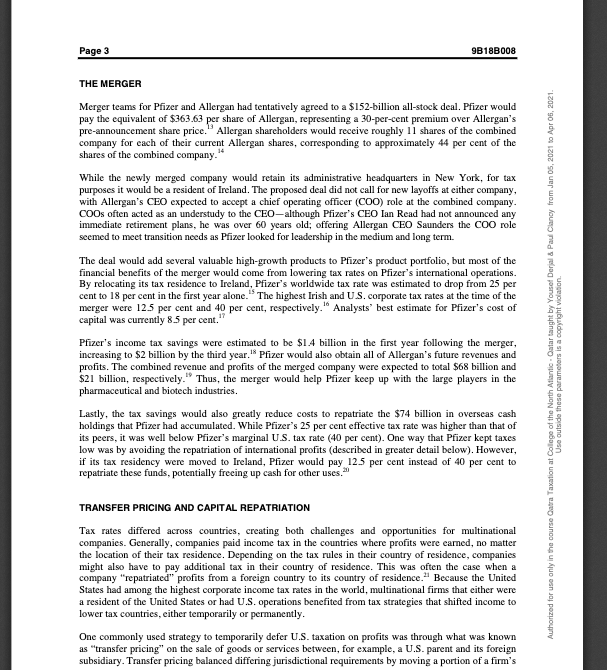

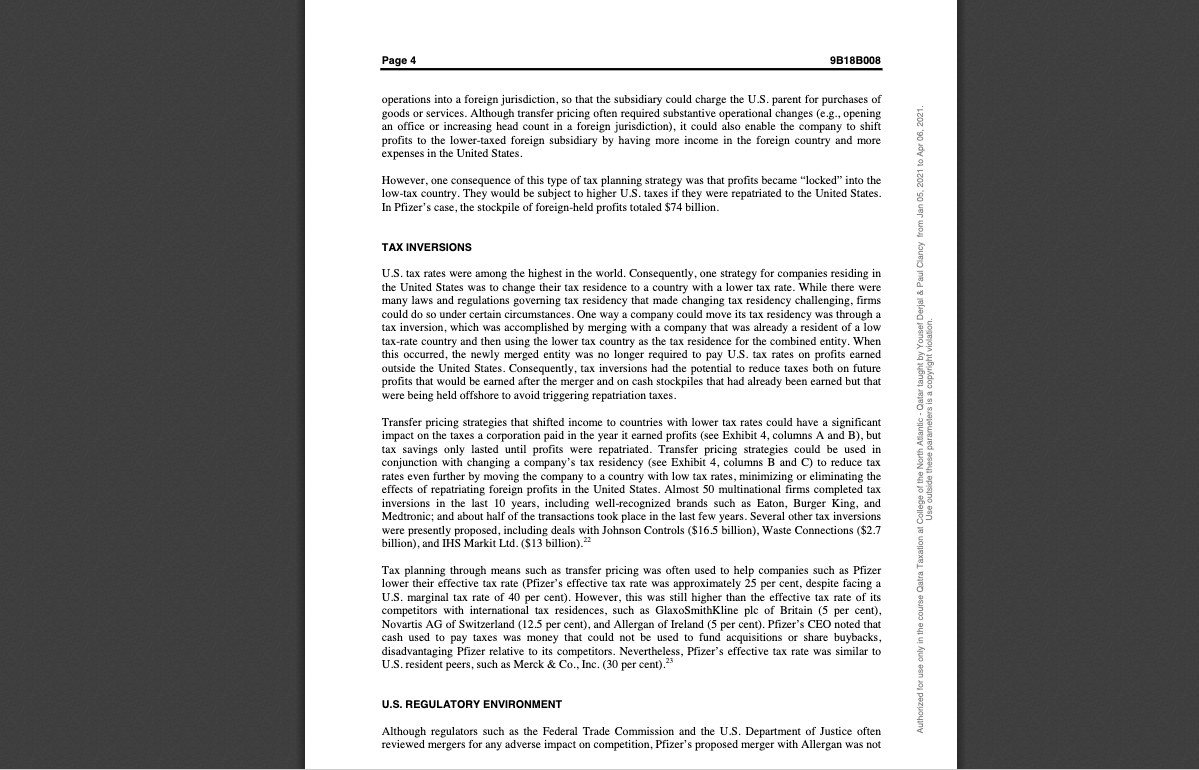

Page 3 9B18B008 THE MERGER Merger teams for Pfizer and Allergan had tentatively agreed to a $152-billion all-stock deal. Pfizer would pay the equivalent of $363.63 per share of Allergan, representing a 30-per-cent premium over Allergan's pre-announcement share price. Allergan shareholders would receive roughly 11 shares of the combined company for each of their current Allergan shares, corresponding to approximately 44 per cent of the shares of the combined company." While the newly merged company would retain its administrative headquarters in New York, for tax purposes it would be a resident of Ireland. The proposed deal did not call for new layoffs at either company, with Allergan's CEO expected to accept a chief operating officer (COO) role at the combined company. COOs often acted as an understudy to the CEO-although Pfizer's CEO Ian Read had not announced any immediate retirement plans, he was over 60 years old, offering Allergan CEO Saunders the COO role seemed to meet transition needs as Pfizer looked for leadership in the medium and long term. The deal would add several valuable high-growth products to Pfizer's product portfolio, but most of the financial benefits of the merger would come from lowering tax rates on Pfizer's international operations. By relocating its tax residence to Ireland, Pfizer's worldwide tax rate was estimated to drop from 25 per cent to 18 per cent in the first year alone. The highest Irish and US. corporate tax rates at the time of the merger were 125 per cent and 40 per cent, respectively." Analysts' best estimate for Pfizer's cost of capital was currently 8.5 per cent." Pfizer's income tax savings were estimated to be $1.4 billion in the first year following the merger, increasing to $2 billion by the third year.' Pfizer would also obtain all of Allergan's future revenues and profits. The combined revenue and profits of the merged company were expected to total $68 billion and $21 billion, respectively. Thus, the merger would help Pfizer keep up with the large players in the pharmaceutical and biotech industries. Lastly, the tax savings would also greatly reduce costs to repatriate the $74 billion in overseas cash holdings that Pfizer had accumulated. While Pfizer's 25 per cent effective tax rate was higher than that of its peers, it was well below Pfizer's marginal U.S. tax rate (40 per cent). One way that Pfizer kept taxes low was by avoiding the repatriation of international profits (described in greater detail below). However, if its tax residency were moved to Ireland, Pfizer would pay 125 per cent instead of 40 per cent to repatriate these funds, potentially freeing up cash for other uses." Authorized for use only in the course atra Taxation at College of the North Atlantic Oatar taught by Yousef Derjal & Paul Clancy from Jan 05, 2021 to Apr 06, 2021 Use outside these parameters is a copyright violation TRANSFER PRICING AND CAPITAL REPATRIATION Tax rates differed across countries, creating both challenges and opportunities for multinational companies. Generally, companies paid income tax in the countries where profits were earned, no matter the location of their tax residence. Depending on the tax rules in their country of residence, companies might also have to pay additional tax in their country of residence. This was often the case when a company "repatriated" profits from a foreign country to its country of residence." Because the United States had among the highest corporate income tax rates in the world, multinational firms that either were a resident of the United States or had U.S. operations benefited from tax strategies that shifted income to lower tax countries, either temporarily or permanently. One commonly used strategy to temporarily defer U.S. taxation on profits was through what was known as "transfer pricing" on the sale of goods or services between, for example, a U.S.parent and its foreign subsidiary. Transfer pricing balanced differing jurisdictional requirements by moving a portion of a firm's Page 3 9B18B008 THE MERGER Merger teams for Pfizer and Allergan had tentatively agreed to a $152-billion all-stock deal. Pfizer would pay the equivalent of $363.63 per share of Allergan, representing a 30-per-cent premium over Allergan's pre-announcement share price. Allergan shareholders would receive roughly 11 shares of the combined company for each of their current Allergan shares, corresponding to approximately 44 per cent of the shares of the combined company." While the newly merged company would retain its administrative headquarters in New York, for tax purposes it would be a resident of Ireland. The proposed deal did not call for new layoffs at either company, with Allergan's CEO expected to accept a chief operating officer (COO) role at the combined company. COOs often acted as an understudy to the CEO-although Pfizer's CEO Ian Read had not announced any immediate retirement plans, he was over 60 years old, offering Allergan CEO Saunders the COO role seemed to meet transition needs as Pfizer looked for leadership in the medium and long term. The deal would add several valuable high-growth products to Pfizer's product portfolio, but most of the financial benefits of the merger would come from lowering tax rates on Pfizer's international operations. By relocating its tax residence to Ireland, Pfizer's worldwide tax rate was estimated to drop from 25 per cent to 18 per cent in the first year alone. The highest Irish and US. corporate tax rates at the time of the merger were 125 per cent and 40 per cent, respectively." Analysts' best estimate for Pfizer's cost of capital was currently 8.5 per cent." Pfizer's income tax savings were estimated to be $1.4 billion in the first year following the merger, increasing to $2 billion by the third year.' Pfizer would also obtain all of Allergan's future revenues and profits. The combined revenue and profits of the merged company were expected to total $68 billion and $21 billion, respectively. Thus, the merger would help Pfizer keep up with the large players in the pharmaceutical and biotech industries. Lastly, the tax savings would also greatly reduce costs to repatriate the $74 billion in overseas cash holdings that Pfizer had accumulated. While Pfizer's 25 per cent effective tax rate was higher than that of its peers, it was well below Pfizer's marginal U.S. tax rate (40 per cent). One way that Pfizer kept taxes low was by avoiding the repatriation of international profits (described in greater detail below). However, if its tax residency were moved to Ireland, Pfizer would pay 125 per cent instead of 40 per cent to repatriate these funds, potentially freeing up cash for other uses." Authorized for use only in the course atra Taxation at College of the North Atlantic Oatar taught by Yousef Derjal & Paul Clancy from Jan 05, 2021 to Apr 06, 2021 Use outside these parameters is a copyright violation TRANSFER PRICING AND CAPITAL REPATRIATION Tax rates differed across countries, creating both challenges and opportunities for multinational companies. Generally, companies paid income tax in the countries where profits were earned, no matter the location of their tax residence. Depending on the tax rules in their country of residence, companies might also have to pay additional tax in their country of residence. This was often the case when a company "repatriated" profits from a foreign country to its country of residence." Because the United States had among the highest corporate income tax rates in the world, multinational firms that either were a resident of the United States or had U.S. operations benefited from tax strategies that shifted income to lower tax countries, either temporarily or permanently. One commonly used strategy to temporarily defer U.S. taxation on profits was through what was known as "transfer pricing" on the sale of goods or services between, for example, a U.S.parent and its foreign subsidiary. Transfer pricing balanced differing jurisdictional requirements by moving a portion of a firm's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts