Question: pleaseeeee help Consider a manufacturer that makes a certain product. Variable manufacturing overhead and fixed manufacturing overhead are allocated to each unit made based on

pleaseeeee help

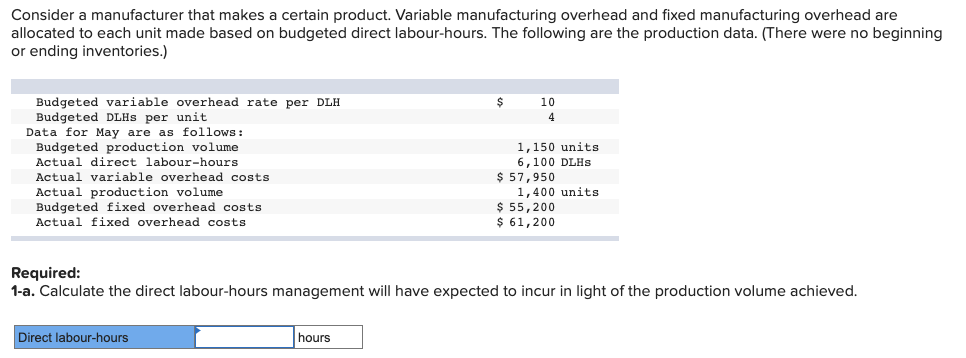

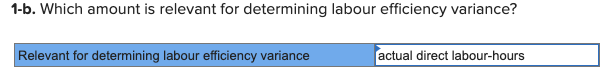

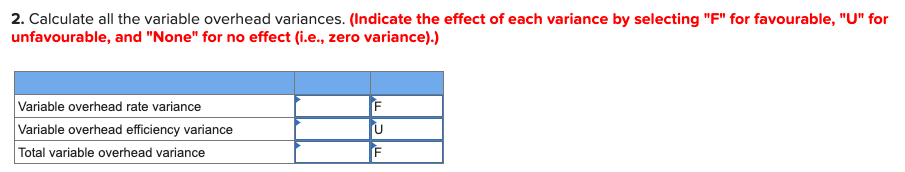

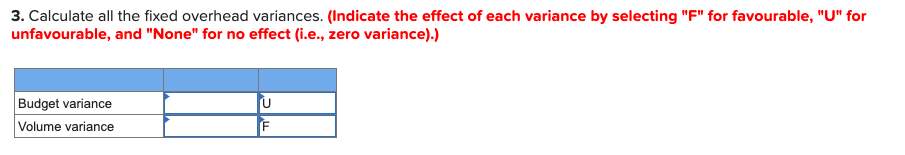

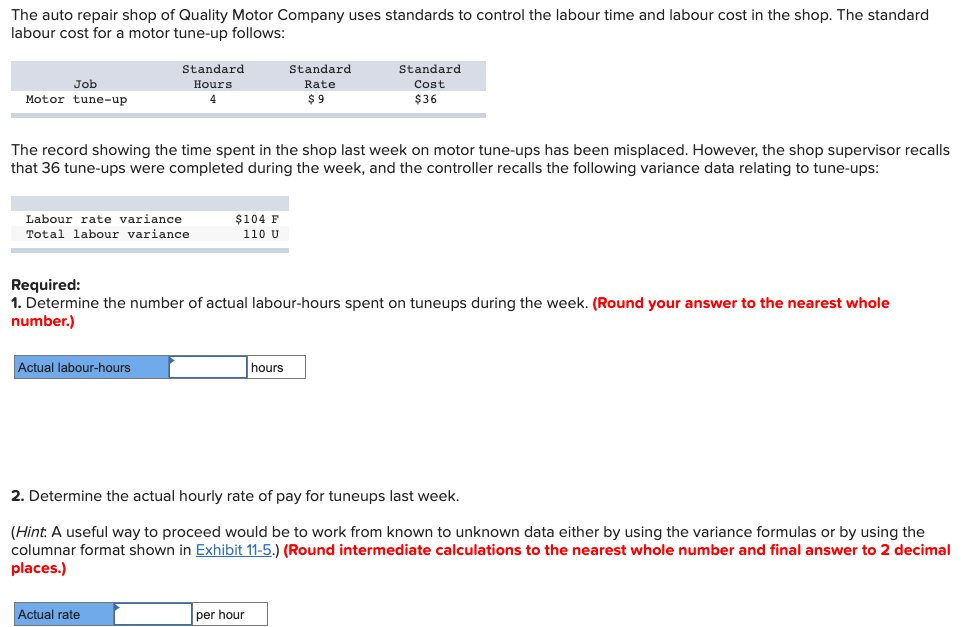

Consider a manufacturer that makes a certain product. Variable manufacturing overhead and fixed manufacturing overhead are allocated to each unit made based on budgeted direct labour-hours. The following are the production data. (There were no beginning or ending inventories.) Required: 1-a. Calculate the direct labour-hours management will have expected to incur in light of the production volume achieved. 1-b. Which amount is relevant for determining labour efficiency variance? 2. Calculate all the variable overhead variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) 3. Calculate all the fixed overhead variances. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) The auto repair shop of Quality Motor Company uses standards to control the labour time and labour cost in the shop. The standard labour cost for a motor tune-up follows: The record showing the time spent in the shop last week on motor tune-ups has been misplaced. However, the shop supervisor recalls that 36 tune-ups were completed during the week, and the controller recalls the following variance data relating to tune-ups: Required: 1. Determine the number of actual labour-hours spent on tuneups during the week. (Round your answer to the nearest whole number.) 2. Determine the actual hourly rate of pay for tuneups last week. (Hint: A useful way to proceed would be to work from known to unknown data either by using the variance formulas or by using the columnar format shown in Exhibit 11-5.) (Round intermediate calculations to the nearest whole number and final answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts