Question: pleass answer if you sure other wise skip it 4. Based on the following information Calculate State of Economy Probability of State of Economy Rate

pleass answer if you sure other wise skip it

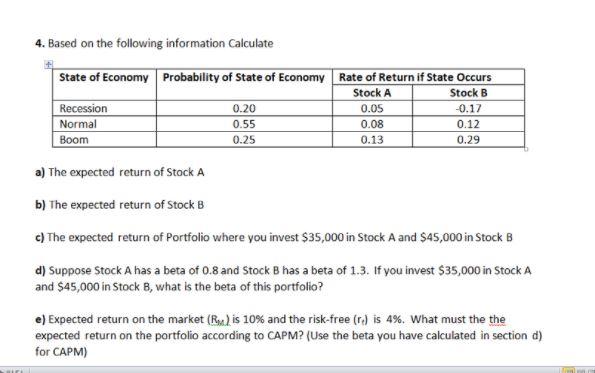

4. Based on the following information Calculate State of Economy Probability of State of Economy Rate of Return if State Occurs Stock A Stock B 0.20 0.05 -0.17 Recession Normal Boom 0.08 0.12 0.55 0.25 0.13 0.29 a) The expected return of Stock A b) The expected return of Stock B c) The expected return of Portfolio where you invest $35,000 in Stock A and $45,000 in Stock B d) Suppose Stock A has a beta of 0.8 and Stock B has a beta of 1.3. If you invest $35,000 in Stock A and $45,000 in Stock B, what is the beta of this portfolio? e) Expected return on the market (Rus) is 10% and the risk-free (r) is 4%. What must the the expected return on the portfolio according to CAPM? (Use the beta you have calculated in section d) for CAPM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts