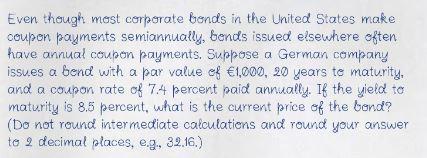

Question: pleass answer if you sure other wise skip it Even though mast corporate bonds in the United States make coupon payments semiannually, bends issued elsewhere

pleass answer if you sure other wise skip it

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock