Question: Pleasw help! The flowchart is included. operations manager knows that total monthly demand exceeds the capacity available for production. Thus, she is interested in determining

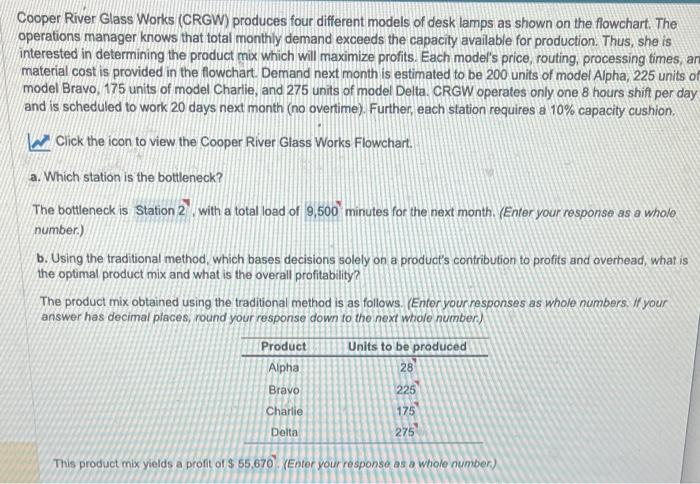

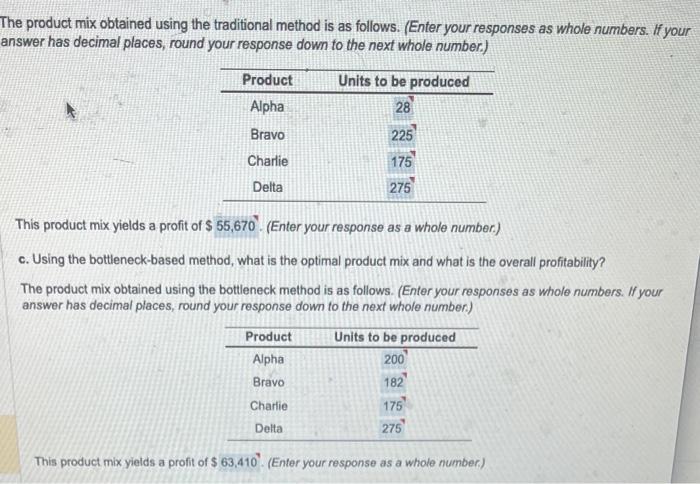

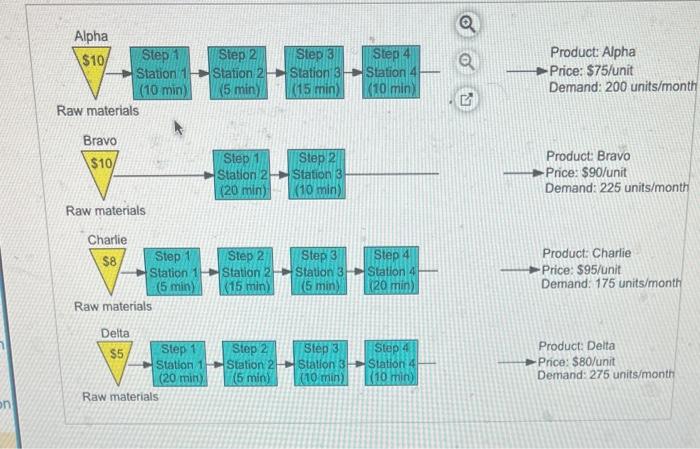

operations manager knows that total monthly demand exceeds the capacity available for production. Thus, she is interested in determining the product mix which will maximize profits. Each model's price, routing, processing times, ar material cost is provided in the fowchart. Demand next month is estimated to be 200 units of model Alpha, 225 units of model Bravo, 175 units of model Charlie, and 275 units of model Delta. CRGW operates only one 8 hours shift per day and is scheduled to work 20 days next month (no overtime). Further, each station requires a 10% capacity cushion. Click the icon to view the Cooper River Glass Works Flowchart. a. Which station is the bottleneck? The bottleneck is Station 2). with a total load of 9,500 minutes for the next month. (Enter your response as a wholo number.) b. Using the traditional method, which bases decisions solely on a product's contribution to profits and overhead, what is the optimal product mix and what is the overall profitability? The product mix obtained using the traditional method is as follows. (Enter your responses as whole numbers. /f your answer has decimal places, round your response down to the next whole number) This product mix yields a profit of $55,670. (Enter your response as a whole number) The product mix obtained using the traditional method is as follows. (Enter your responses as whole numbers. If your answer has decimal places, round your response down to the next whole number.) This product mix yields a profit of $55,670. (Enter your response as a whole number.) c. Using the bottleneck-based method, what is the optimal product mix and what is the overall profitability? The product mix obtained using the bottleneck method is as follows. (Enter your responses as whole numbers. If your answer has decimal places, round your response down to the next whole number.) This product mix yields a profit of $63,410. (Enter your response as a whole number). Alpha Product: Alpha Demand: 200 units/month Raw materials Bravo Product: Bravo Price: \$90/unit Demand: 225 units/month Raw materials Charlie Product: Charlie -Price: \$95/unit Demand: 175 units/month Raw materials Product: Delta Price: \$80/unit Demand: 276 units/month Raw materials operations manager knows that total monthly demand exceeds the capacity available for production. Thus, she is interested in determining the product mix which will maximize profits. Each model's price, routing, processing times, ar material cost is provided in the fowchart. Demand next month is estimated to be 200 units of model Alpha, 225 units of model Bravo, 175 units of model Charlie, and 275 units of model Delta. CRGW operates only one 8 hours shift per day and is scheduled to work 20 days next month (no overtime). Further, each station requires a 10% capacity cushion. Click the icon to view the Cooper River Glass Works Flowchart. a. Which station is the bottleneck? The bottleneck is Station 2). with a total load of 9,500 minutes for the next month. (Enter your response as a wholo number.) b. Using the traditional method, which bases decisions solely on a product's contribution to profits and overhead, what is the optimal product mix and what is the overall profitability? The product mix obtained using the traditional method is as follows. (Enter your responses as whole numbers. /f your answer has decimal places, round your response down to the next whole number) This product mix yields a profit of $55,670. (Enter your response as a whole number) The product mix obtained using the traditional method is as follows. (Enter your responses as whole numbers. If your answer has decimal places, round your response down to the next whole number.) This product mix yields a profit of $55,670. (Enter your response as a whole number.) c. Using the bottleneck-based method, what is the optimal product mix and what is the overall profitability? The product mix obtained using the bottleneck method is as follows. (Enter your responses as whole numbers. If your answer has decimal places, round your response down to the next whole number.) This product mix yields a profit of $63,410. (Enter your response as a whole number). Alpha Product: Alpha Demand: 200 units/month Raw materials Bravo Product: Bravo Price: \$90/unit Demand: 225 units/month Raw materials Charlie Product: Charlie -Price: \$95/unit Demand: 175 units/month Raw materials Product: Delta Price: \$80/unit Demand: 276 units/month Raw materials

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts