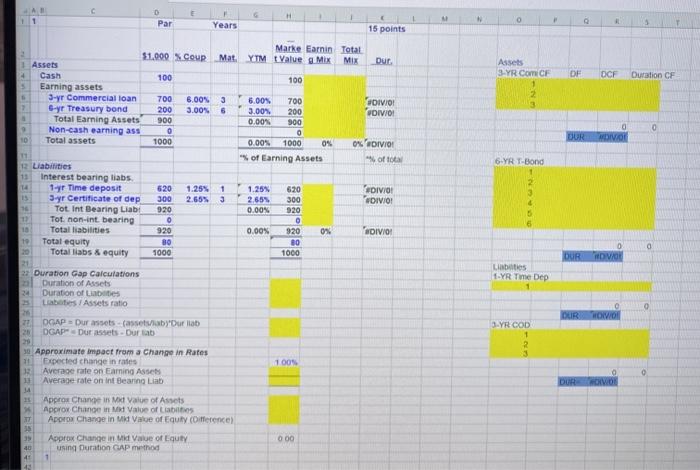

Question: pleqse include cell references E H 1 0 Par Years 15 points Marke Earnin Total Mat. YTM Value Mix MIX Dur Assets 3-YR ComiCF OF

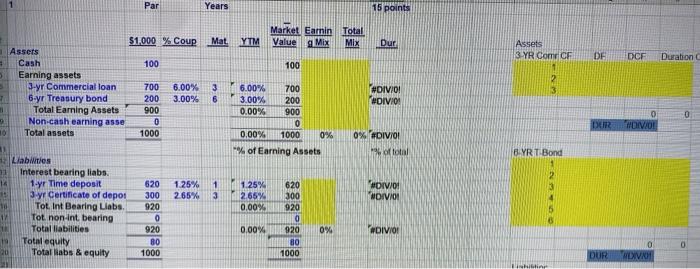

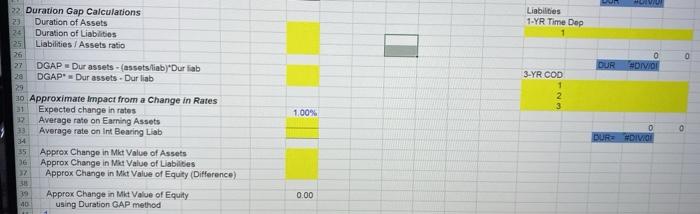

E H 1 0 Par Years 15 points Marke Earnin Total Mat. YTM Value Mix MIX Dur Assets 3-YR ComiCF OF DCF Duration CF 100 31,000 Coup 1 Assets Cash 100 Earning assets 3-yr Commercial loan 700 6.00 2 e-yr Treasury bond 200 3.00% Total Earning Assets 900 Non-cash earning ass 0 Total assets 1000 2 3 6 'OIVIO DIV/0! 6.00% 700 3.00% 200 0.00% 900 0 0.00% 1000 os of Earning Assets 0 VOL SD DOR 0% HOIVIO ofte 6-YR T-Bond 2 3 1.25% 2.659 0.00% DIVIDI DIVO 620 300 920 0 920 B0 1000 5 6 0.00% DIVIO 0 DUR RDVOE Lities 1-YR Time Dep 12 Liabilities Interest bearing liabs T4 1- Time deposit 520 1.25% 1 Syr Certificate of dep 300 2.655 3 14 Tot. Int Bearing Liab 920 Tot. non-int, bearing 0 Total liabilities 920 Total equity 80 Total labs & equity 1000 21 Duration Gap Calculations Duration of Assets Duration of Liabities Labtes / Assets ratio 20 OGAP - Durassets-assets/aby'Our liab 25 DGAD - Durassets - Durat 29 30 Approximate impact from a Change in Rates 71 Expected change in rates 13 Average rate on Earning Assets 13 Average rate on int Beanna Lab JA Approx Change in value of Assets Approx Change in Mid Value of Labios ADOT Change in Mt Value of Equity (Oifference) 35 39 Approx Change in Mid Value of Equity using Duration CAP method DUR WOWO DYR COD 1 2 3 100% DUR OWO 000 40 41 Par Years 15 points Market Earnin Total Value Mix Mix Mat YTM Dur Assets 3 YR Com CF OF DCF Duration 100 $1.000 % Coup Assets Cash 100 Earning assets 3-yr Commercial loan 700 6.00% 1 6-yr Treasury bond 200 3.00% Total Earning Assets 900 3 Non-cash earning asse 0 10 Total assets 1000 3 6 6.00% 700 3 #DIV/0! HOIVIO 3.00% 200 0.00% 900 0 0.00% 1000 0% % of Earning Assets DER POIVRON 0% GDIV/0! % of total BYRT.Bond 2 620 1.25% 2.65% 1 3 Liables 1 Interest bearing liabs. 14 1-Yr Time deposit 3 yr Certificate of depot 18 Tot. Int Bearing Llabs. Tot non-int bearing Total liabilities Total equity 20 Total labs & equity 1.25% 2,65% 0.00% #DIV/0! WOIVIO 300 920 0 920 BO 1000 620 300 920 0 920 BO 1000 0.00% 0% #DIVIO DUR MEXIVO ht MV Liabilities 1-YR Time Dep DUR 0 Vio 3-YR COD 1 2 3 32 Duration Gap Calculations 23 Duration of Assets 124 Duration of Liabilities 25 Liabilities / Assets ratio 26 27 DGAP - Dur assets - (assets/iab) Durlab 20 DGAP Dur assets. Dur liab 29 30 Approximate Impact from a Change in Rates 31 Expected change in rates 37 Average rate on Earning Assets 23 Average rate on Int Bearing Liab 34 35 Approx Change in Mkt Value of Assets 36 Approx Change in Mt Value of Liabilities Approx Change in Mikt Value of Equity (Difference) 318 Approx Change in Mit Value of Equity 10 using Duration GAP method 1.00% DUR DIVIO 39 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts