Question: plese answer kn order manner. thank you ! Note: Even though the tax law has changed we are asking that you use all of the

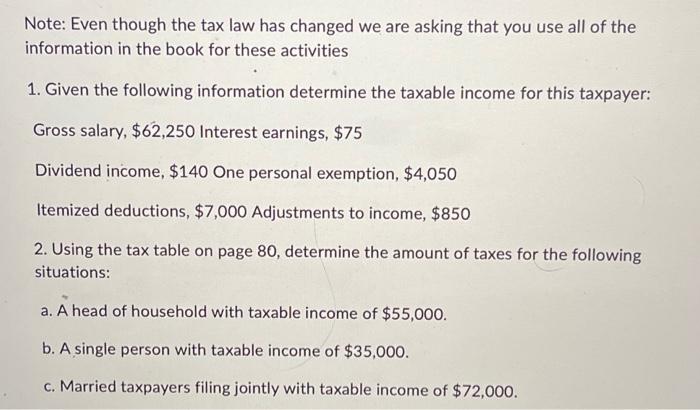

Note: Even though the tax law has changed we are asking that you use all of the information in the book for these activities 1. Given the following information determine the taxable income for this taxpayer: Gross salary, $62,250 Interest earnings, \$75 Dividend income, $140 One personal exemption, $4,050 Itemized deductions, $7,000 Adjustments to income, $850 2. Using the tax table on page 80 , determine the amount of taxes for the following situations: a. A head of household with taxable income of $55,000. b. A single person with taxable income of $35,000. c. Married taxpayers filing jointly with taxable income of $72,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts