Question: plese plese try to answer the question because it will be due soon also provide the answer on excel which is I attached the image.

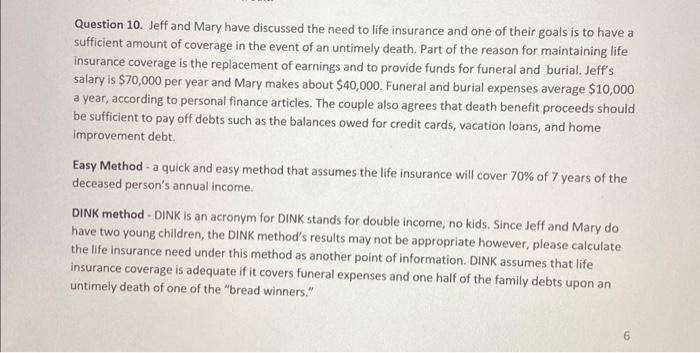

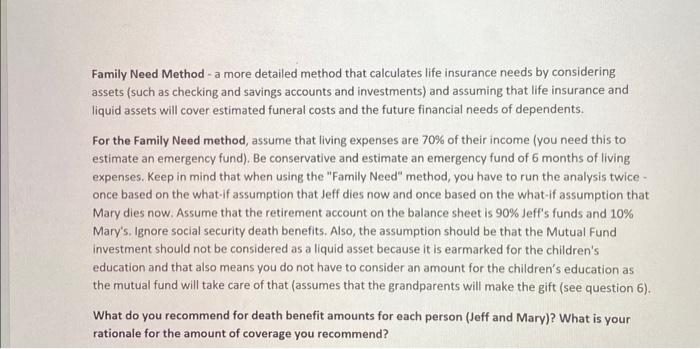

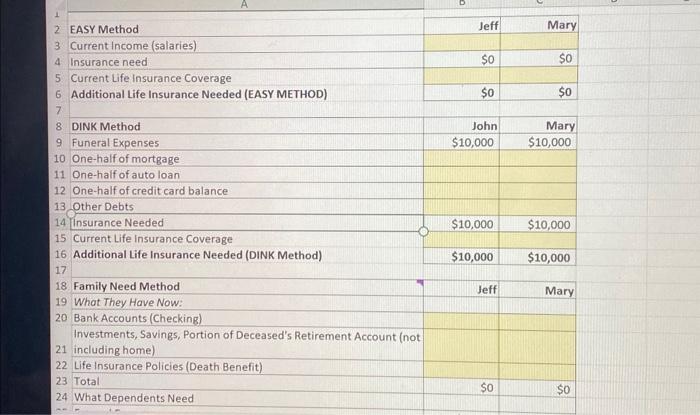

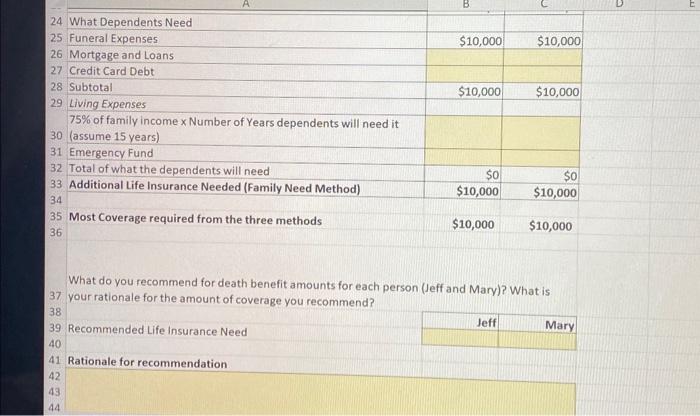

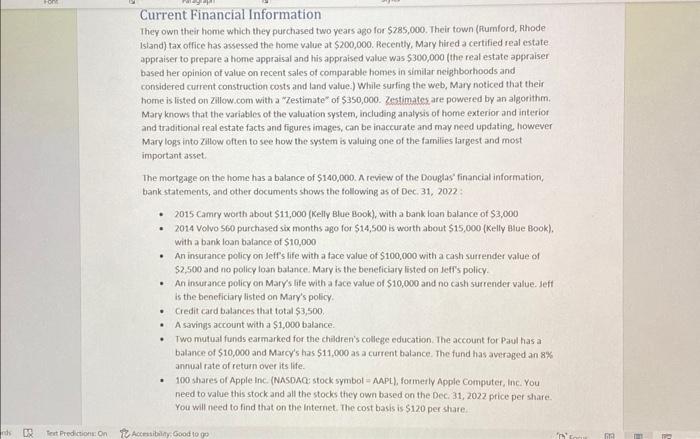

Question 10. Jeff and Mary have discussed the need to life insurance and one of their goals is to have a sufficient amount of coverage in the event of an untimely death. Part of the reason for maintaining life insurance coverage is the replacement of earnings and to provide funds for funeral and burial. Jeff's salary is $70,000 per year and Mary makes about $40,000. Funeral and burial expenses average $10,000 a year, according to personal finance articles. The couple also agrees that death benefit proceeds should be sufficient to pay off debts such as the balances owed for credit cards, vacation loans, and home improvement debt. Easy Method - a quick and easy method that assumes the life insurance will cover 70% of 7 years of the deceased person's annual income. DINK method - DINK is an acronym for DINK stands for double income, no kids. Since Jeff and Mary do have two young children, the DINK method's results may not be appropriate however, please calculate the life insurance need under this method as another point of information. DINK assumes that life insurance coverage is adequate if it covers funeral expenses and one half of the family debts upon an untimely death of one of the "bread winners." 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts