Question: Plese post it true and properly Current Attempt in Progress Windsor Oil Company is considering investing in a new oil well. It is expected that

Plese post it true and properly

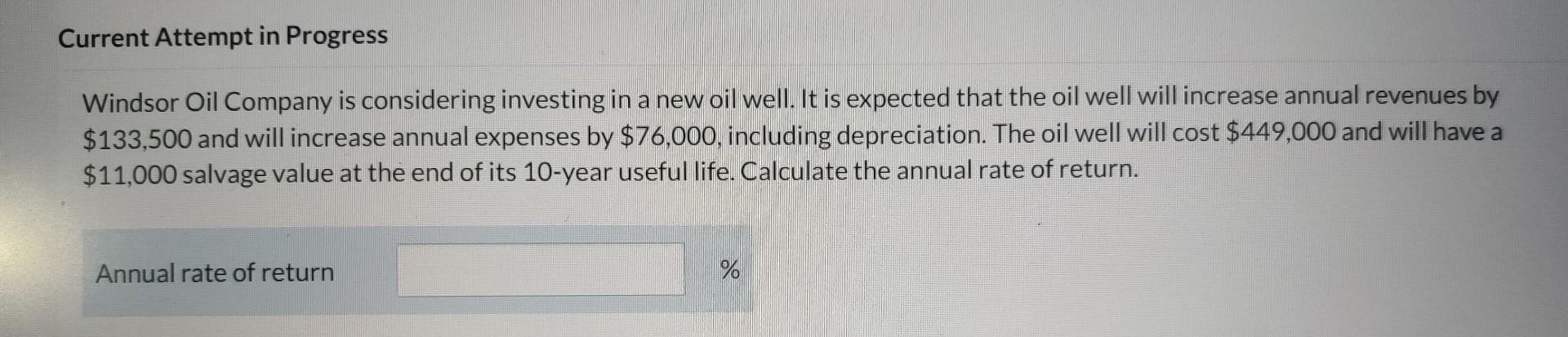

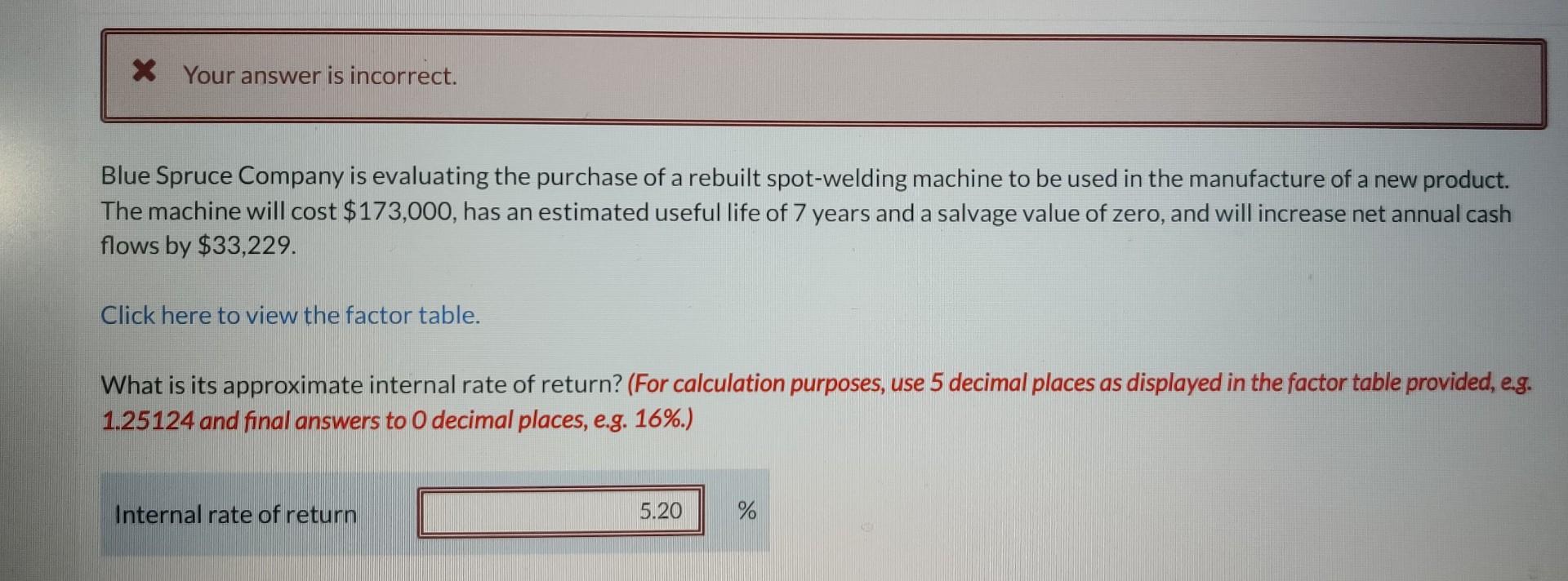

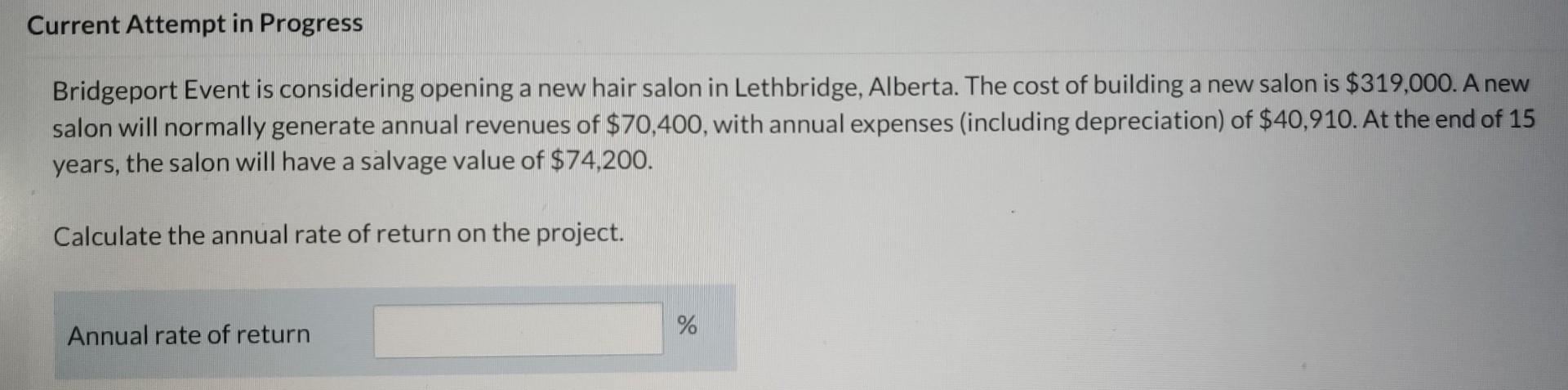

Current Attempt in Progress Windsor Oil Company is considering investing in a new oil well. It is expected that the oil well will increase annual revenues by $133,500 and will increase annual expenses by $76,000, including depreciation. The oil well will cost $449,000 and will have a $11,000 salvage value at the end of its 10 -year useful life. Calculate the annual rate of return. Annual rate of return % Blue Spruce Company is evaluating the purchase of a rebuilt spot-welding machine to be used in the manufacture of a new product. The machine will cost $173,000, has an estimated useful life of 7 years and a salvage value of zero, and will increase net annual cash flows by $33,229. Click here to view the factor table. What is its approximate internal rate of return? (For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25124 and final answers to 0 decimal places, e.g. 16%.) Bridgeport Event is considering opening a new hair salon in Lethbridge, Alberta. The cost of building a new salon is $319,000. A new salon will normally generate annual revenues of $70,400, with annual expenses (including depreciation) of $40,910. At the end 15 years, the salon will have a salvage value of $74,200. Calculate the annual rate of return on the project. Annual rate of return %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts