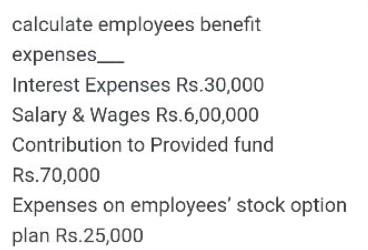

Question: plese provide answer only no need to show the calculation calculate employees benefit expenses_ Interest Expenses Rs.30,000 Salary & Wages Rs.6,00,000 Contribution to provided fund

plese provide answer only no need to show the calculation

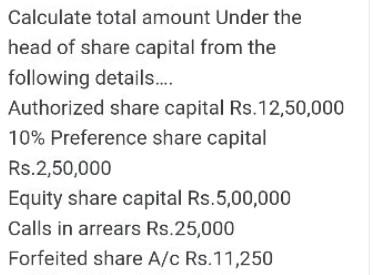

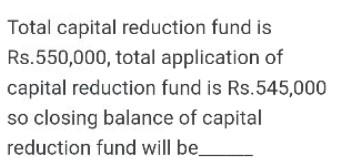

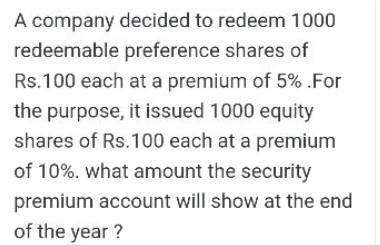

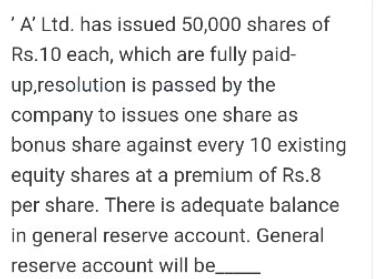

calculate employees benefit expenses_ Interest Expenses Rs.30,000 Salary & Wages Rs.6,00,000 Contribution to provided fund Rs.70,000 Expenses on employees' stock option plan Rs. 25,000 Calculate total amount Under the head of share capital from the following details.... Authorized share capital Rs.12,50,000 10% Preference share capital Rs. 2,50,000 Equity share capital Rs.5,00,000 Calls in arrears Rs.25,000 Forfeited share A/c Rs.11,250 Total capital reduction fund is Rs.550,000, total application of capital reduction fund is Rs.545,000 so closing balance of capital reduction fund will be A company decided to redeem 1000 redeemable preference shares of Rs.100 each at a premium of 5%.For the purpose, it issued 1000 equity shares of Rs.100 each at a premium of 10%. what amount the security premium account will show at the end of the year? 'A' Ltd. has issued 50,000 shares of Rs.10 each, which are fully paid- up,resolution is passed by the company to issues one share as bonus share against every 10 existing equity shares at a premium of Rs.8 per share. There is adequate balance in general reserve account. General reserve account will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts