Question: plese show your work you can use excel. Bob Evans is an analyst at a private equity firm. He want to buy the Healthy Food

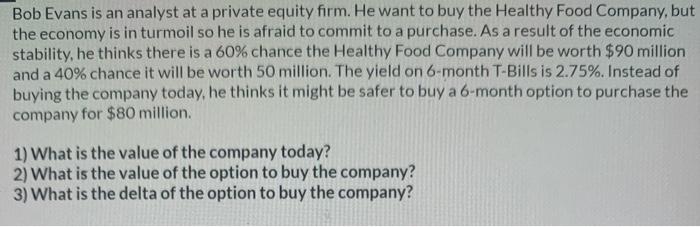

Bob Evans is an analyst at a private equity firm. He want to buy the Healthy Food Company, but the economy is in turmoil so he is afraid to commit to a purchase. As a result of the economic stability, he thinks there is a 60% chance the Healthy Food Company will be worth $90 million and a 40% chance it will be worth 50 million. The yield on 6-month T-Bills is 2.75%. Instead of buying the company today, he thinks it might be safer to buy a 6-month option to purchase the company for $80 million. 1) What is the value of the company today? 2) What is the value of the option to buy the company? 3) What is the delta of the option to buy the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts