Question: plesse answer both questions and show the work for the answers. if you use excel please include formulas so I can follow. thank you 6.1

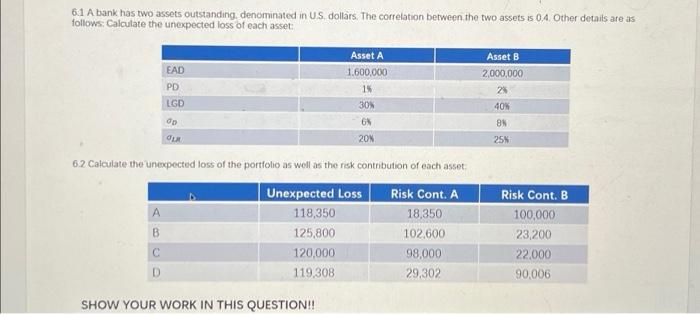

6.1A bank has two assets outstanding, denominated in U.S, dollars. The correlation between the two assets is 0.4, Other details are as follows: Calculate the unexpected loss of each asset: 6.2 Calculate the unexpected loss of the portiolio as well as the nisk contribution of each asset: SHOW YOUR WORK IN THIS QUESTIONI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts