Question: plesse answer question III. answers 1, 2, 3 AND 4 PLEASE!!!! III. Consider the following option strategy of two put options. Long a put option

plesse answer question III. answers 1, 2, 3 AND 4 PLEASE!!!!

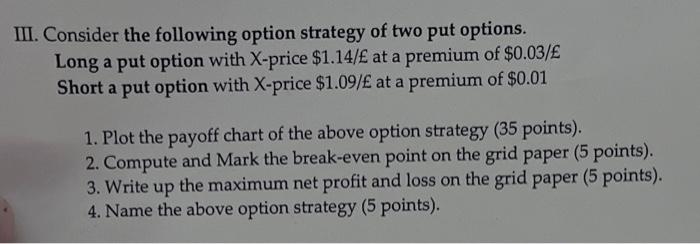

III. Consider the following option strategy of two put options. Long a put option with X-price $1.14/ at a premium of $0.03/ Short a put option with X-price $1.09/ at a premium of $0.01 1. Plot the payoff chart of the above option strategy ( 35 points). 2. Compute and Mark the break-even point on the grid paper ( 5 points). 3. Write up the maximum net profit and loss on the grid paper ( 5 points). 4. Name the above option strategy ( 5 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock