Question: plesse explain in detail why we do this step and how we got $4.764 D, X (1 +9) D D 0 Example 1: P. R

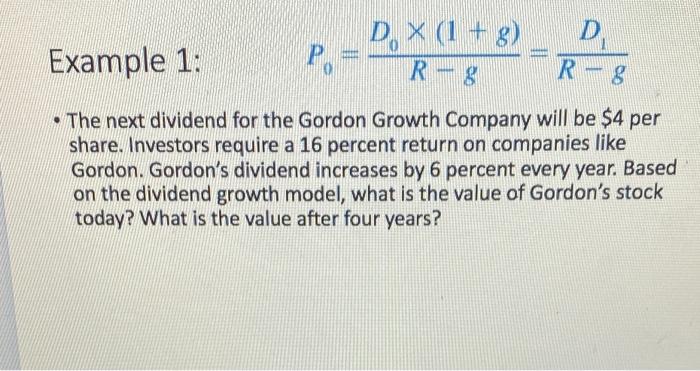

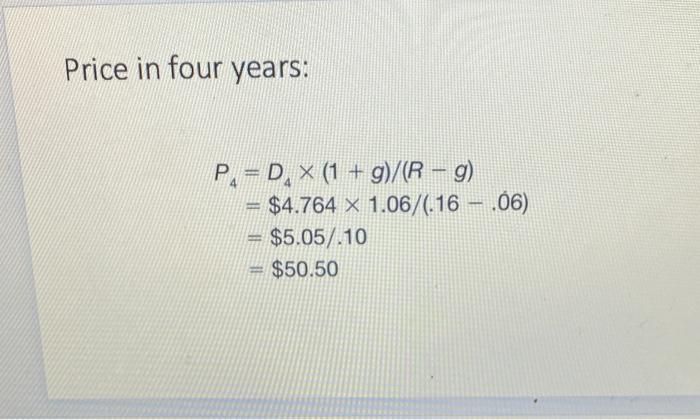

D, X (1 +9) D D 0 Example 1: P. R - 8 R- g The next dividend for the Gordon Growth Company will be $4 per share. Investors require a 16 percent return on companies like Gordon. Gordon's dividend increases by 6 percent every year. Based on the dividend growth model, what is the value of Gordon's stock today? What is the value after four years? Price in four years: P.=D, X (1 + g)/(R g) $4.764 x 1.06/(.16 - 06) = $5.05/.10 $50.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts