Question: plesse help me with figuring out the attached problem. thank you Rollins Corporation has a target capital structure 60% common equity. Assume the firm has

plesse help me with figuring out the attached problem.

plesse help me with figuring out the attached problem.

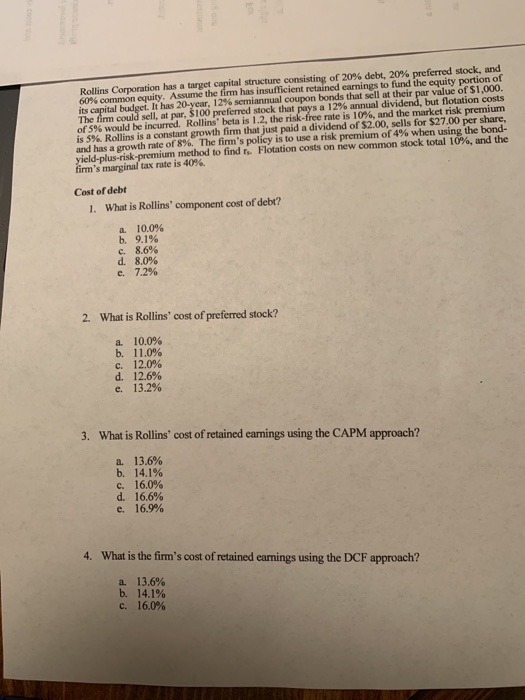

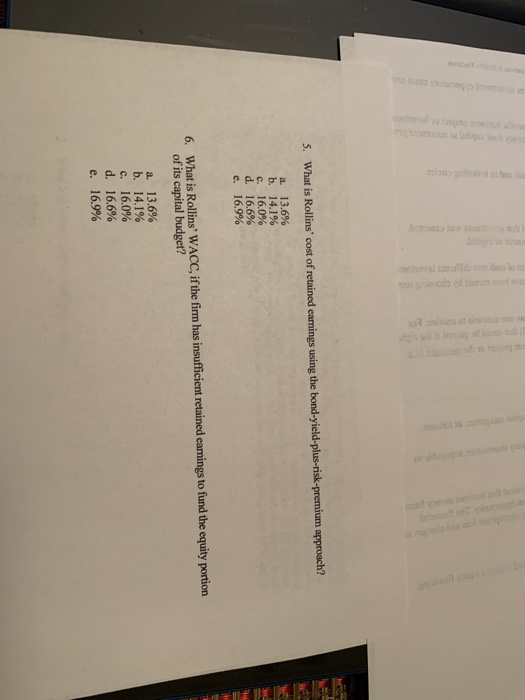

Rollins Corporation has a target capital structure 60% common equity. Assume the firm has insuff its capital budget. It has 20-year, 12% semiannual The firm could sell, at par, $100 preferred stock t of 5% would be incurred. Rollins' beta is 1.2, the is 5%. Rollins is a constant growth firm that just and has a growth rate of 8%. The firm's policy is ield-plus-risk-premium method to find ts. Flotat irm's marginal tax rate is 40%. Cost of debt 1. What is Rollins' component cost of debt? a. 10.0% b. 9.1% c. 8.6% d. 8.0% e. 7.2% 2. What is Rollins' cost of preferred stock? a. 10.0% b. 11.0% CA 12.0% rnitosti og p cocentu ons oor sta se ti bo and 107 et older on two tsionants 22 bol stort O Rollins Corporation has a target capital structure consisting of 20% debt, 20% preferred stock, and 60% common equity. Assume the firm has insufficient retained earnings to fund the equity portion of its capital budget. It has 20-year, 12% semiannual coupon bonds that sell at their par value of $1,000. The firm could sell, at par, $100 preferred stock that pays a 12% annual dividend, but flotation costs of 5% would be incurred. Rollins' beta is 1.2, the risk-free rate is 10%, and the market risk premium is 5%. Rollins is a constant growth firm that just paid a dividend of $2.00, sells for $27.00 per share, and has a growth rate of 8%. The firm's policy is to use a risk premium of 4% when using the bond- yield-plus-risk-premium method to find rs. Flotation costs on new common stock total 10%, and the firm's marginal tax rate is 40%. Cost of debt 1. What is Rollins' component cost of debt? a. 10.0% b. 9.1% c. 8.6% d. 8.0% e. 7.2% Rollins Corporation has a target capital structure consisting of 20% debt, 20% preferred stock, and 60% common equity. Assume the firm has insufficient retained earnings to fund the equity portion of its capital budget. It has 20-year, 12% semiannual coupon bonds that sell at their par value of $1,000. The firm could sell, at par, $100 preferred stock that pays a 12% annual dividend, but flotation costs of 5% would be incurred. Rollins' beta is 1.2, the risk-free rate is 10%, and the market risk premium is 5%. Rollins is a constant growth firm that just paid a dividend of $2.00, sells for $27.00 per share, and has a growth rate of 8%. The firm's policy is to use a risk premium of 4% when using the bond- yield-plus-risk-premium method to find. Flotation costs on new common stock total 10%, and the firm's marginal tax rate is 40%. Cost of debt 1. What is Rollins' component cost of debt? a b. c. d. e. 10.0% 9.1% 8.6% 8.0% 7.2% 2. What is Rollins' cost of preferred stock? a 10.0% b. 11.0% c. 12.0% d. 12.6% e. 13.2% 3. What is Rollins' cost of retained earnings using the CAPM approach? a. 13.6% b. 14.1% c. 16.0% d. 16.6% e. 16.9% 4. What is the firm's cost of retained earnings using the DCF approach? a b. c. 13.6% 14.1% 16.0% 5. What is Rollins' cost of retained earnings using the bond-yield-plus-risk-premium approach? a b. c. d. e. 13.6% 14.1% 16.0% 16.6% 16.9% LEKKE 6. What is Rollins' WACC, if the firm has insufficient retained earnings to fund the equity portion of its capital budget? a. 13.6% b. 14.1% c. 16.0% d. 16.6% e. 16.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts