Question: plesse help with these three! thanks! Question 9 (1.6 points) The market value of a bond at the time it is issued sells for its

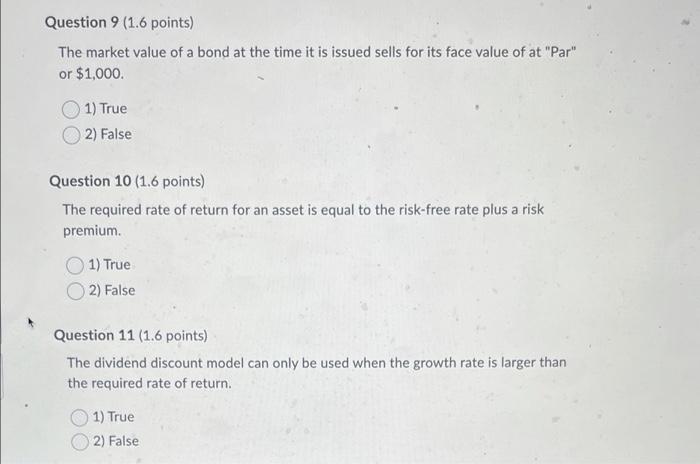

Question 9 (1.6 points) The market value of a bond at the time it is issued sells for its face value of at "Par" or $1,000 1) True 2) False Question 10 (1.6 points) The required rate of return for an asset is equal to the risk-free rate plus a risk premium 1) True 2) False Question 11 (1.6 points) The dividend discount model can only be used when the growth rate is larger than the required rate of return. 1) True 2) False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts