Question: plez help me by steps Section 2 - Valuation Frank and his brother, George, are thinking of starting their own coepuny. The company will be

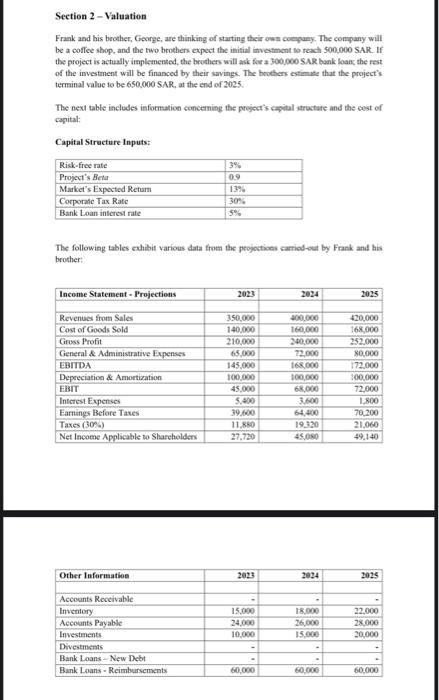

Section 2 - Valuation Frank and his brother, George, are thinking of starting their own coepuny. The company will be a coffee shop, and the two brothers expect the initial imvestment so reach 500,000 SAR. If the project is actually implemented, the brothers will ask for a 300000 SAR bonk loas the rest of the investment will be financed by their savings. The hoothers estimate that the project's terminal value to be 650,000 SAR, at the end of 2025 . The next table includes information concerning the preject's eapital stracture and the cost of capital: Capital Structure Inputs: The following tables exhibit various data from the peojoctices carriod-out by Frank and his brother: Using the Excel template provided to you (see the LMS platform), you need to: 2.1. Estimate the project's Cash-Flows applying the Free Cash-Flow to the Firm Method (FCFF). 2.2. Estimate the Weighted Average Cost of Capital (WACC). 2.3. Compute the project's Expected NPV according to the FCFF method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts