Question: Plot the yield curve for each year between 2006 - 2020 and display these data on one graph. Yield Curve zero coupon 5-yr DATE 2006

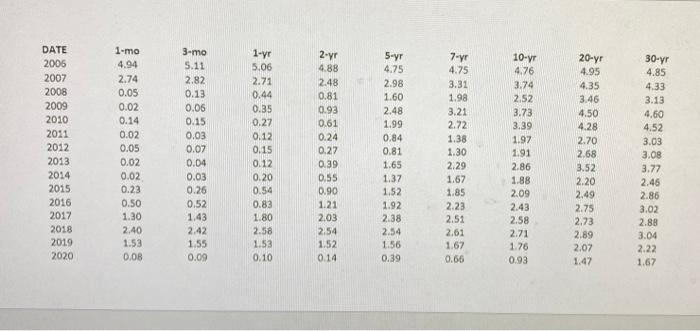

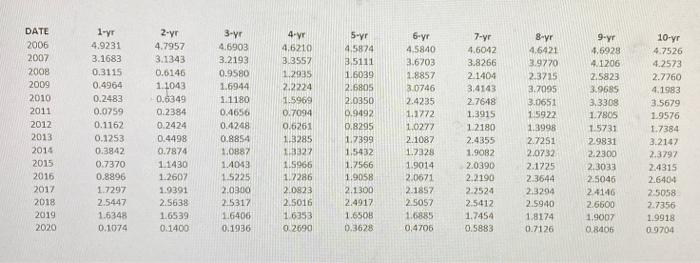

5-yr DATE 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 1-mo 4.94 2.74 0.05 0.02 0.14 0.02 0.05 0.02 0.02 0.23 0.50 1.30 2.40 1.53 0.08 3-mo 5.11 2.82 0.13 0.06 0.15 0.03 0.07 0.04 0.03 0.26 0.52 1.43 2.42 1.55 0.09 1-yr 5.06 2.71 0.44 0.35 0.22 0.12 0.15 0.12 0.20 0.54 0.83 1.80 2.58 1.53 0.10 2-yr 4.88 2.48 0.81 0.93 0.61 0.24 0.22 0.39 0.55 0.90 1.21 203 2.54 1.52 4.75 2.98 1.60 2.48 1.99 0.84 0.81 1.65 1.37 1.52 1.92 2.38 2 1.56 0.39 7-yr 4.75 3.31 1.98 3.21 2.72 1.38 1.30 2.29 1.67 1.85 2.23 2.51 2.61 1.67 0.66 10-yr 4.76 3.74 2.52 3.73 3.39 1.97 1.91 2.86 1.88 2.09 2.43 2.58 2.71 1.76 0.93 20-yr 4.95 4.35 3.46 4.50 4.28 2.70 2.68 3.52 2.20 2.49 2.75 2.73 2.89 2.07 1.47 30-yr 4.85 4.33 3.13 4.60 4.52 3.03 3.08 3.77 2.46 2.86 3.02 2.88 3.04 2.22 1.67 0.14 3-yr DATE 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 1-yr 4.9231 3.1683 0.3115 0.4964 0.2483 0.0759 0.1162 0.1253 0.3842 0.7370 0.8896 1.7297 2.5447 1.6348 0.1074 2-yr 4.7957 3.1343 0.6146 1.1043 0.6349 0.2384 0.2424 0.4498 0.7874 1.1430 1.2607 1.9391 2.5638 1.6539 0.1400 4,6903 3.2193 0.9580 1.6944 1.1180 0.4656 0.4248 0.8854 1.0887 1.4043 1.5225 2.0300 2.5317 1.6406 0.1936 4. 4,6210 3.3557 12935 2.2224 1.5969 0.7094 0.6261 1.3285 13327 1.5966 1.2286 2.0823 2.5016 16353 0.2690 5-yr 4.5874 3.5111 1.6039 2.5805 2.0350 0.9492 0.8295 1.7399 1.5432 1.7566 1.9058 2.1300 2.4917 1.6508 0.3628 6-yr 4.5840 3.6703 1.8857 3.0746 2.4235 1.1772 1,0277 2.1087 1.7328 1.9014 2.0671 2.1857 2.5057 1.6885 0,4706 7-yr 4,6042 3.8266 2.1404 3,4143 2.7648 1.3915 1 2180 2.4355 1.9082 2.0390 2.2190 2.2524 2:5412 1.7454 0.5883 8-yr 4.6421 3.9770 2.3715 3.7095 3.0651 15922 1.3998 2.7251 2.0732 2.1725 2.3644 2.3294 2.5940 1.8174 0.7126 9-yr 4.5928 41206 2.5823 3.9685 3.3308 1.7805 1.5731 29831 2.2300 2.3033 2.5046 24146 26500 1.9007 0.8406 10-yr 4.7526 4.2573 2.7760 4.1983 3.5679 1.9576 1.7384 3.2142 2.3797 2.4315 2.6404 25058 2.7356 1.9918 0.9704 5-yr DATE 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 1-mo 4.94 2.74 0.05 0.02 0.14 0.02 0.05 0.02 0.02 0.23 0.50 1.30 2.40 1.53 0.08 3-mo 5.11 2.82 0.13 0.06 0.15 0.03 0.07 0.04 0.03 0.26 0.52 1.43 2.42 1.55 0.09 1-yr 5.06 2.71 0.44 0.35 0.22 0.12 0.15 0.12 0.20 0.54 0.83 1.80 2.58 1.53 0.10 2-yr 4.88 2.48 0.81 0.93 0.61 0.24 0.22 0.39 0.55 0.90 1.21 203 2.54 1.52 4.75 2.98 1.60 2.48 1.99 0.84 0.81 1.65 1.37 1.52 1.92 2.38 2 1.56 0.39 7-yr 4.75 3.31 1.98 3.21 2.72 1.38 1.30 2.29 1.67 1.85 2.23 2.51 2.61 1.67 0.66 10-yr 4.76 3.74 2.52 3.73 3.39 1.97 1.91 2.86 1.88 2.09 2.43 2.58 2.71 1.76 0.93 20-yr 4.95 4.35 3.46 4.50 4.28 2.70 2.68 3.52 2.20 2.49 2.75 2.73 2.89 2.07 1.47 30-yr 4.85 4.33 3.13 4.60 4.52 3.03 3.08 3.77 2.46 2.86 3.02 2.88 3.04 2.22 1.67 0.14 3-yr DATE 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 1-yr 4.9231 3.1683 0.3115 0.4964 0.2483 0.0759 0.1162 0.1253 0.3842 0.7370 0.8896 1.7297 2.5447 1.6348 0.1074 2-yr 4.7957 3.1343 0.6146 1.1043 0.6349 0.2384 0.2424 0.4498 0.7874 1.1430 1.2607 1.9391 2.5638 1.6539 0.1400 4,6903 3.2193 0.9580 1.6944 1.1180 0.4656 0.4248 0.8854 1.0887 1.4043 1.5225 2.0300 2.5317 1.6406 0.1936 4. 4,6210 3.3557 12935 2.2224 1.5969 0.7094 0.6261 1.3285 13327 1.5966 1.2286 2.0823 2.5016 16353 0.2690 5-yr 4.5874 3.5111 1.6039 2.5805 2.0350 0.9492 0.8295 1.7399 1.5432 1.7566 1.9058 2.1300 2.4917 1.6508 0.3628 6-yr 4.5840 3.6703 1.8857 3.0746 2.4235 1.1772 1,0277 2.1087 1.7328 1.9014 2.0671 2.1857 2.5057 1.6885 0,4706 7-yr 4,6042 3.8266 2.1404 3,4143 2.7648 1.3915 1 2180 2.4355 1.9082 2.0390 2.2190 2.2524 2:5412 1.7454 0.5883 8-yr 4.6421 3.9770 2.3715 3.7095 3.0651 15922 1.3998 2.7251 2.0732 2.1725 2.3644 2.3294 2.5940 1.8174 0.7126 9-yr 4.5928 41206 2.5823 3.9685 3.3308 1.7805 1.5731 29831 2.2300 2.3033 2.5046 24146 26500 1.9007 0.8406 10-yr 4.7526 4.2573 2.7760 4.1983 3.5679 1.9576 1.7384 3.2142 2.3797 2.4315 2.6404 25058 2.7356 1.9918 0.9704

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts