Question: Plp Please fill in the box's using Excel formatting. The correct answers to the blank boxes are shown off to the side in black. this

Plp

Plp

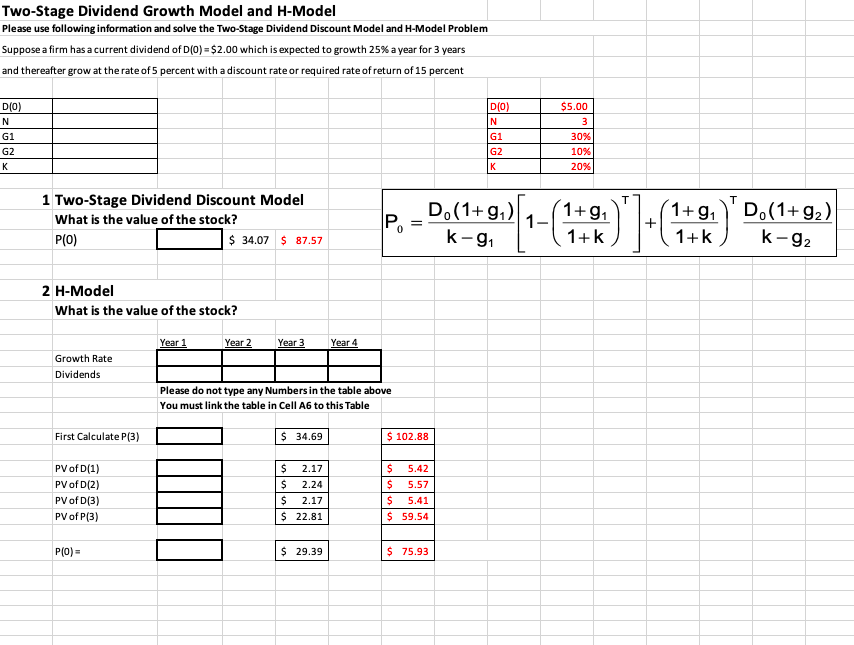

Please fill in the box's using Excel formatting. The correct answers to the blank boxes are shown off to the side in black. this is so you can check to ensure your answers are correct.

Two-Stage Dividend Growth Model and H-Model Please use following information and solve the Two-Stage Dividend Discount Model and H-Model Problem Suppose a firm has a current dividend of D(0) = $2.00 which is expected to growth 25% a year for 3 years and thereafter grow at the rate of 5 percent with a discount rate or required rate of return of 15 percent D(0) N G1 G2 DO) N G1 G2 K $5.00 3 30% 10% 20% 1 Two-Stage Dividend Discount Model What is the value of the stock? PIO) D. (1+9) 1-1 1+91 Po + 1+g, 'D.(1+92) 1+k $ 34.07 $ 87.57 K-9 1+k K-92 2 H-Model What is the value of the stock? Year 1 Year 2 Year 3 Year 4 Growth Rate Dividends Please do not type any Numbers in the table above You must link the table in Cell A6 to this Table First Calculate P(3) $ 34.69 $ 102.88 PV of D(1) PV of D(2) PV of D(3) PV of P(3) $ 2.17 $ 2.24 $ 2.17 $ 22.81 $ 5.42 $ 5.57 $ 5.41 $ 59.54 P(0) - $ 29.39 $ 75.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts