Question: pls all this three Question 6 5 points Save Answer Adventureland corporation offers 6.4 percent coupon bonds with semiannual payments and a yield to maturity

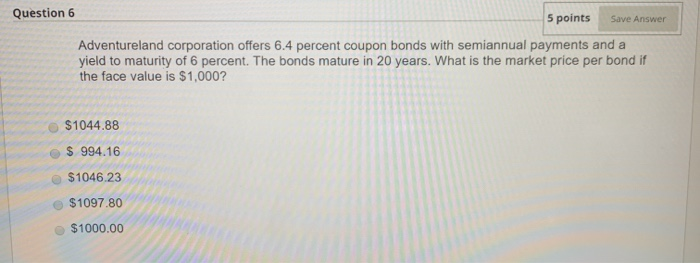

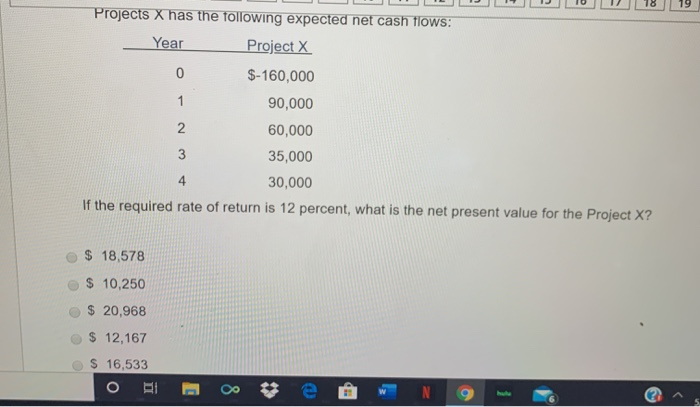

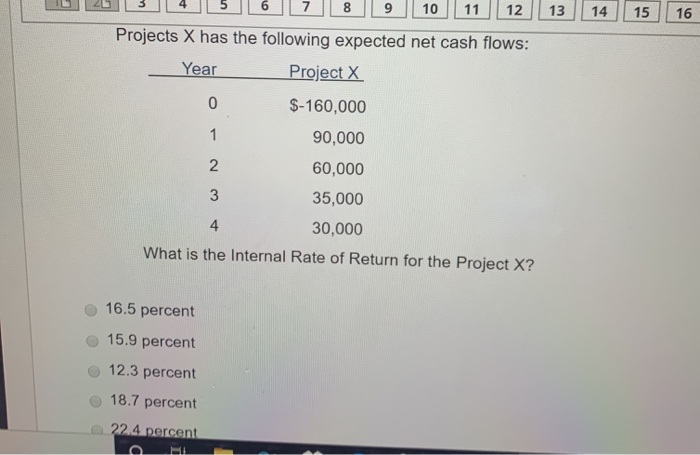

Question 6 5 points Save Answer Adventureland corporation offers 6.4 percent coupon bonds with semiannual payments and a yield to maturity of 6 percent. The bonds mature in 20 years. What is the market price per bond if the face value is $1,000? $1044.88 $ 994.16 $1046.23 $1097.80 $1000.00 Projects X has the following expected net cash flows: Year Project X $-160,000 90,000 60,000 35,000 30,000 If the required rate of return is 12 percent, what is the net present value for the Project X? $ 18,578 $ 10,250 $ 20,968 $ 12,167 $ 16,533 L U 13 14 15 16 3 4 5 6 7 8 9 10 11 12 Projects X has the following expected net cash flows: Year Project X $-160,000 90,000 60,000 35,000 30,000 What is the Internal Rate of Return for the Project X? 16.5 percent 15.9 percent 12.3 percent 18.7 percent 22.4 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts