Question: Pls answer 1-8 journal entry. On June 30, 20X2, the end of the fiscal year, the Wadswarth Park District prepared the following trial) balance for

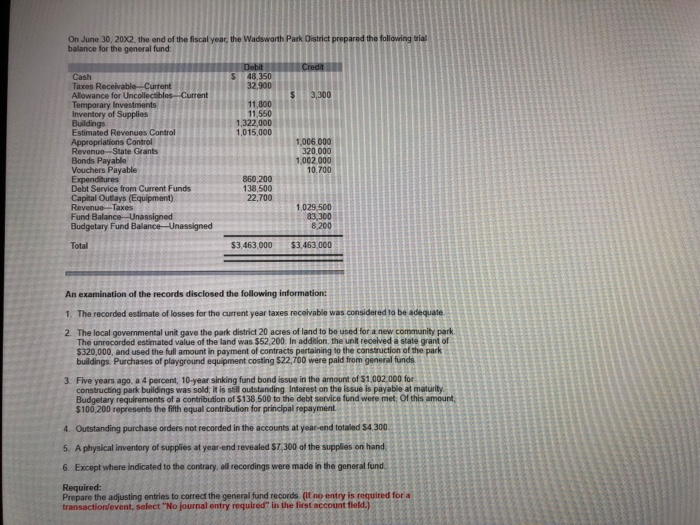

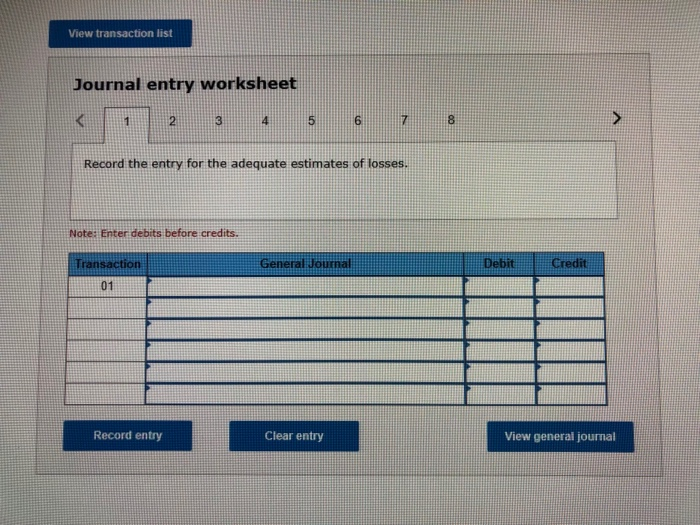

On June 30, 20X2, the end of the fiscal year, the Wadswarth Park District prepared the following trial) balance for the general fund Debit 48.350 32.900 Credit Cash Taxes Receivable-Current Allowance for Uncollectibles-Current Temporary Investments Inventory of Supplies Buildings Estimated Revenues Contral Appropriations Control Revenue-State Grants Bonds Payable Vouchers Payable Expenditures Debt Service from Current Funds Capital Outlays (Equipment) Revenue Taxes Fund Balance-Unassigned Budgetary Fund Balance-Unassigned S 3,300 11.800 11,550 1,322.000 1,015,000 1,006.000 320.000 1,002.000 10.700 860,200 138,500 22,700 1,029 500 83.300 8200 $3,463,000 Total $3.463.000 An examination of the records disclosed the following information: 1. The recorded estimate of losses for the current year taxes receivable was considered to be adequate 2 The local governmental unit gave the park district 20 acres of land to be used for a new community park The unrecorded estimated value of the land was $52,200. In addition, the unit received a state grant of $320,000, and used the full amount in payment of contracts pertaining to the canstruction of the park buildings. Purchases of playground equipment costing $22,700 were paid from general funds 3. Five years ago, a 4 percent, 10-year sinking fund bond issue in the amount of $1.002.000 for constructing park buildings was sold; it is still outstanding Interest on the issue is payable at maturity Budgetary requirements of a contribution of $138.500 to the debt service fund were met: Of this amount. $100.200 represents the fifth equal contribution for principal repayment 4. Outstanding purchase orders not recorded in the accounts at year-end totaled $4.300 5. A physical inventory of supplies at year-end revealed $7,300 of the supplies on hand 6. Except where indicated to the contrary, all recordings were made in the general fund Required: Prepare the adjusting entries to correct the general fund records (If no entry is required for a transaction/event, select "No journal entry required" ln the first account fleld.) View transaction list Journal entry worksheet 6 7 1 1 2 5 Record the entry for the adequate estimates of losses. Note: Enter debits before credits. Credit Debit Transaction General Journal 01 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts