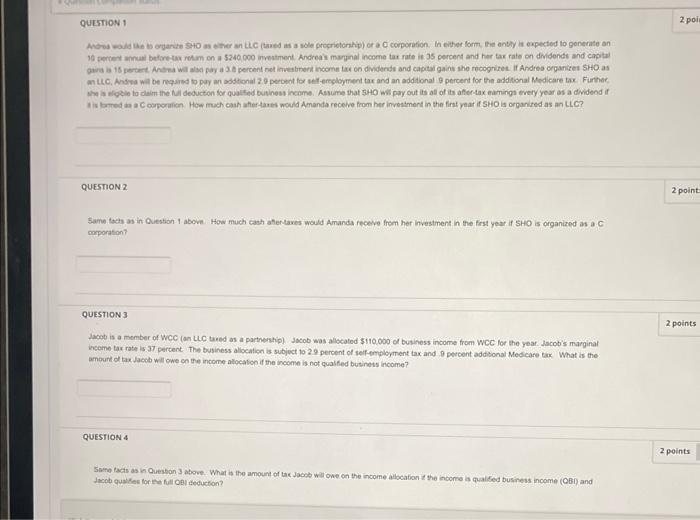

Question: pls answer #3 and 4 question 2 Same tacs as in Ouestion 1 above. How much cash atertaves would Amanda receve frem her investment in

question 2 Same tacs as in Ouestion 1 above. How much cash atertaves would Amanda receve frem her investment in the frat year if 5HO is organized as a C mporation? QUESTION 3 Jacot is a member of WCC (an UC tared as a parthertip). Jacob was allocated $110,000 of bushess income from WCC for the year. Jacob's marginat inceme tax rate is 31 percent. The business alccation is subject 102.9 percent of seffemplogment tax and 9 percent addisonal Medcare tax What is the anburt of tax Jaceb will owe on the income atocaton if the income is not qualfed businets income? QUESTION 4 Joob quaikes for fer fill osi teduction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts