Question: pls answer all 3 question and correct answer format (decimal place) will give thumbs up Caspian Sea Drinks is considering buying the J-Mix 2000 .

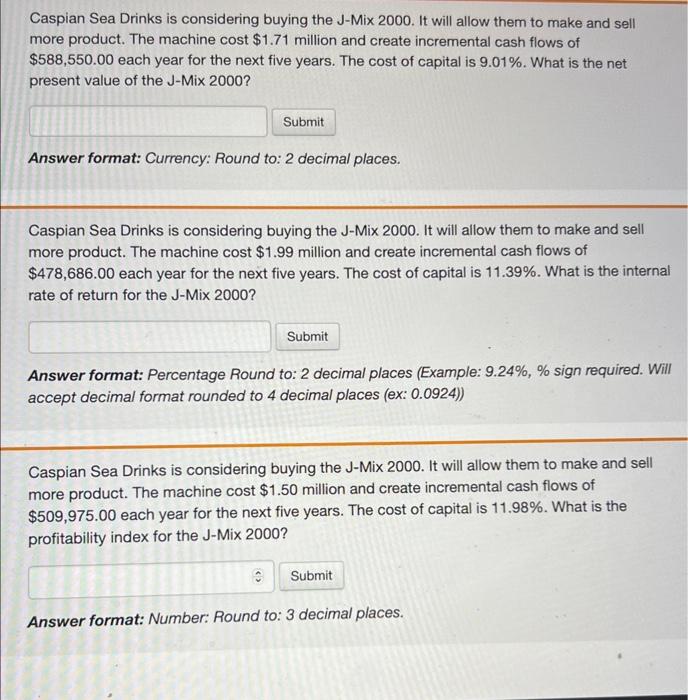

Caspian Sea Drinks is considering buying the J-Mix 2000 . It will allow them to make and sell more product. The machine cost $1.71 million and create incremental cash flows of $588,550.00 each year for the next five years. The cost of capital is 9.01%. What is the net present value of the J-Mix 2000? Answer format: Currency: Round to: 2 decimal places. Caspian Sea Drinks is considering buying the J-Mix 2000 . It will allow them to make and sell more product. The machine cost $1.99 million and create incremental cash flows of $478,686.00 each year for the next five years. The cost of capital is 11.39%. What is the internal rate of return for the J-Mix 2000 ? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Caspian Sea Drinks is considering buying the J-Mix 2000 . It will allow them to make and sell more product. The machine cost $1.50 million and create incremental cash flows of $509,975.00 each year for the next five years. The cost of capital is 11.98%. What is the profitability index for the J-Mix 2000 ? Answer format: Number: Round to: 3 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts