Question: pls answer all the question thank you :) Question 1 a. Answer the following questions related to the cost of fund for AMC Resources Berhad.

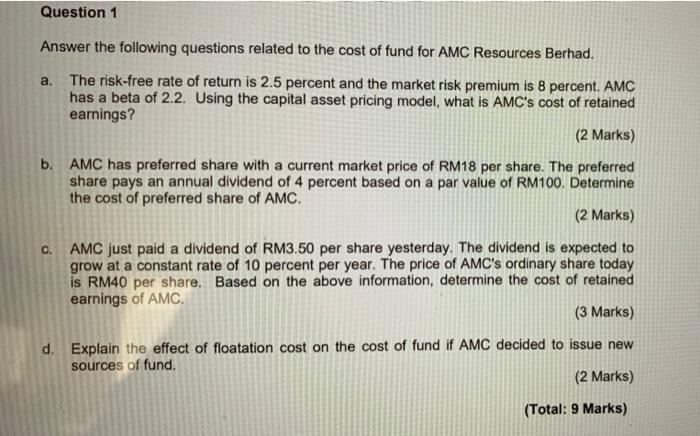

Question 1 a. Answer the following questions related to the cost of fund for AMC Resources Berhad. The risk-free rate of return is 2.5 percent and the market risk premium is 8 percent. AMC has a beta of 2.2. Using the capital asset pricing model, what is AMC's cost of retained earnings? (2 Marks) b. AMC has preferred share with a current market price of RM18 per share. The preferred share pays an annual dividend of 4 percent based on a par value of RM100. Determine the cost of preferred share of AMC. (2 Marks) c. AMC just paid a dividend of RM3.50 per share yesterday. The dividend is expected to grow at a constant rate of 10 percent per year. The price of AMC's ordinary share today is RM40 per share. Based on the above information, determine the cost of retained earnings of AMC (3 Marks) d. Explain the effect of floatation cost on the cost of fund if AMC decided to issue new sources of fund. (2 Marks) (Total: 9 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts