Question: pls answer all thx Intro Glacier Inc. has no long-term debt. Its cost of equity is 22%, and its marginal tax rate is 0.34 .

pls answer all thx

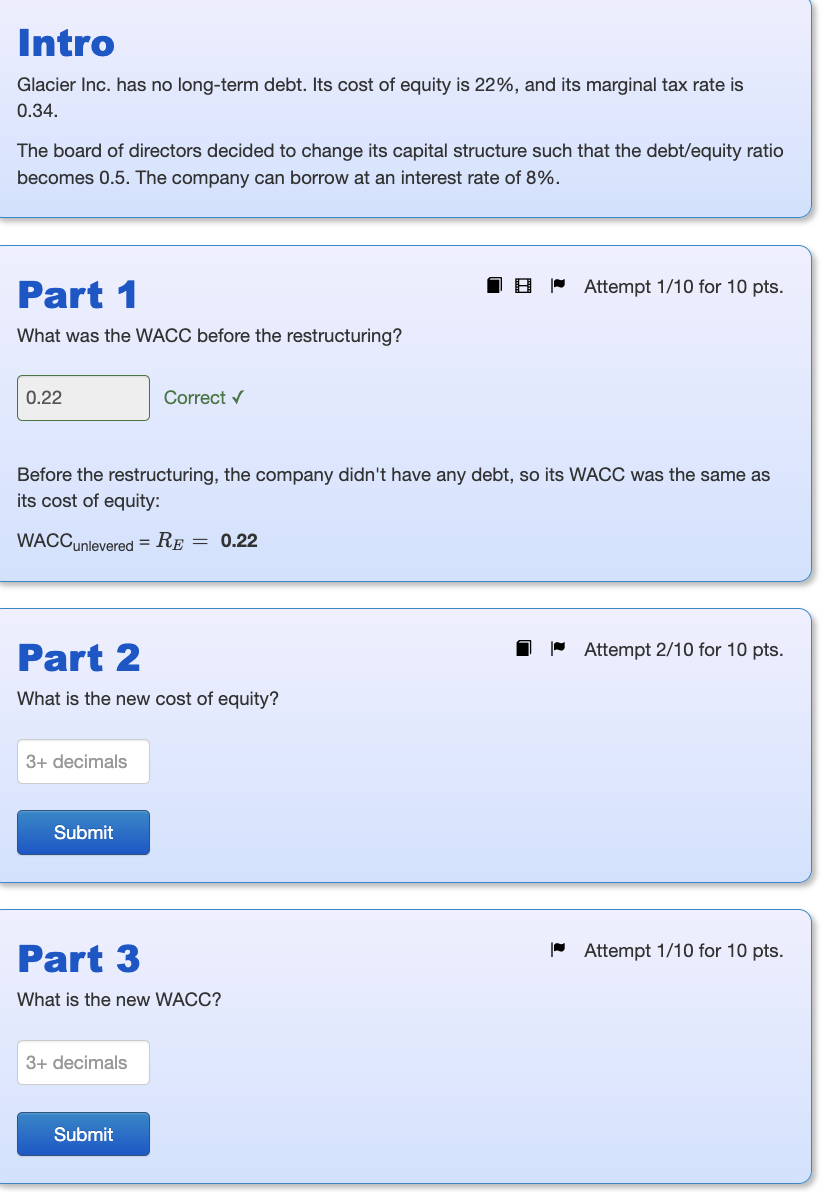

Intro Glacier Inc. has no long-term debt. Its cost of equity is 22%, and its marginal tax rate is 0.34 . The board of directors decided to change its capital structure such that the debt/equity ratio becomes 0.5 . The company can borrow at an interest rate of 8%. Part 1 Attempt 1/10 for 10 pts. What was the WACC before the restructuring? Correct Before the restructuring, the company didn't have any debt, so its WACC was the same as its cost of equity: WACCunlevered=RE=0.22 Part 2 Attempt 2/10 for 10 pts. What is the new cost of equity? Part 3 Attempt 1/10 for 10 pts. What is the new WACC

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock