Question: pls answer and explain it thank u 1. Create a program that will allow the user to enter employee name and gross pay amount that

pls answer and explain it thank u 1. Create a program that will allow the user to enter employee name and gross pay amount that will calculate and display the monthly paycheck of an employee. The net pay is calculated after taking the following deductions:

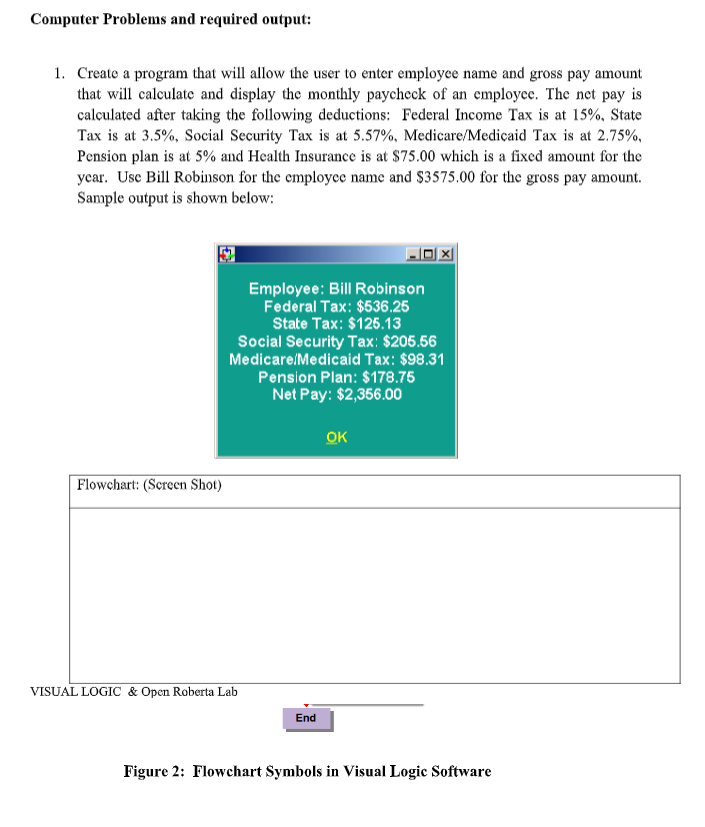

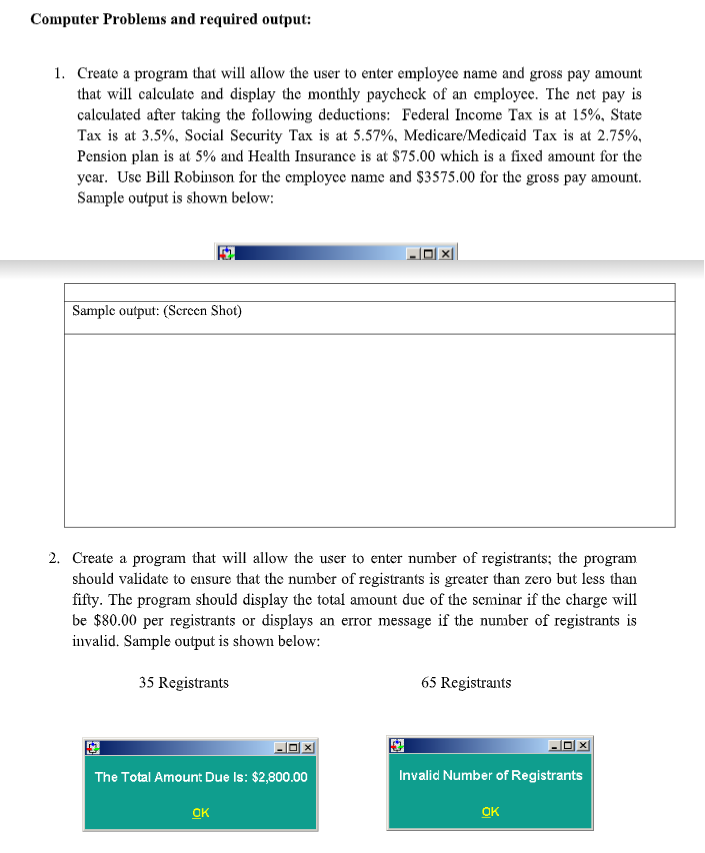

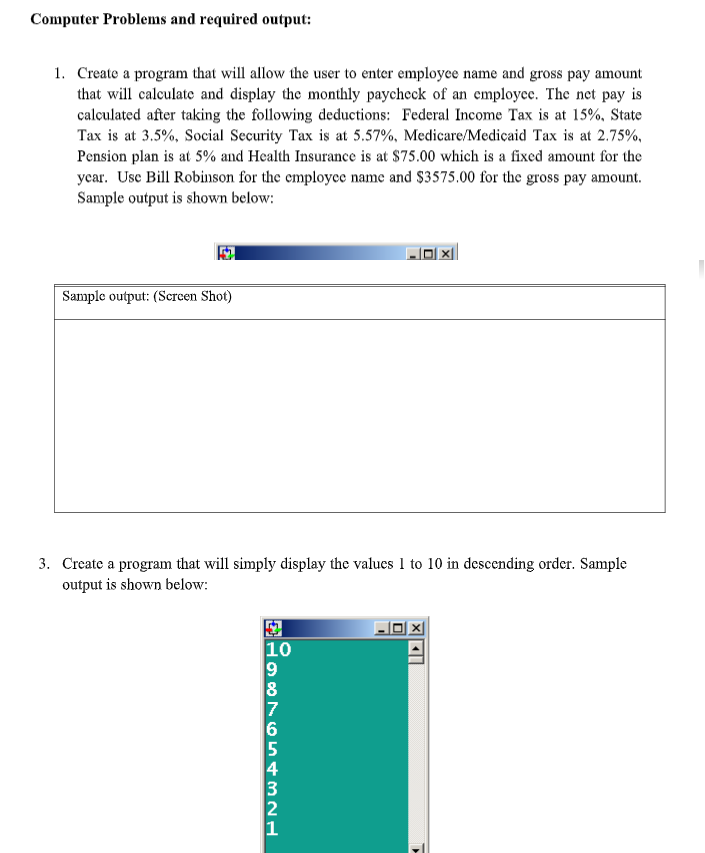

Computer Problems and required output: 1. Create a program that will allow the user to enter employee name and gross pay amount that will calculate and display the monthly paycheck of an employee. The net pay is calculated after taking the following deductions: Federal Income Tax is at 15%, State Tax is at 3.5%, Social Security Tax is at 5.57%, Medicare/Medicaid Tax is at 2.75%, Pension plan is at 5% and Health Insurance is at $75.00 which is a fixed amount for the year. Use Bill Robinson for the employec name and $3575.00 for the gross pay amount. Sample output is shown below: Employee: Bill Robinson Federal Tax: $536.25 State Tax: $126.13 Social Security Tax: $205.56 Medicare/Medicaid Tax: $98.31 Pension Plan: $178.75 Net Pay: $2,356.00 OK Flowchart: (Screen Shot) VISUAL LOGIC & Open Roberta Lab End Figure 2: Flowchart Symbols in Visual Logic Software Computer Problems and required output: 1. Create a program that will allow the user to enter employee name and gross pay amount that will calculate and display the monthly paycheck of an employee. The net pay is calculated after taking the following deductions: Federal Income Tax is at 15%, State Tax is at 3.5%, Social Security Tax is at 5.57%, Medicare/Medicaid Tax is at 2.75%, Pension plan is at 5% and Health Insurance is at $75.00 which is a fixed amount for the year. Use Bill Robinson for the employec name and $3575.00 for the gross pay amount. Sample output is shown below: Sample output: (Screen Shot) 2. Create a program that will allow the user to enter number of registrants; the program should validate to ensure that the number of registrants is greater than zero but less than fifty. The program should display the total amount due of the seminar if the charge will be $80.00 per registrants or displays an error message if the number of registrants is invalid. Sample output is shown below: 35 Registrants 65 Registrants The Total Amount Due is: $2,800.00 Invalid Number of Registrants OK OK Computer Problems and required output: 1. Create a program that will allow the user to enter employee name and gross pay amount that will calculate and display the monthly paycheck of an employee. The net pay is calculated after taking the following deductions: Federal Income Tax is at 15%, State Tax is at 3.5%, Social Security Tax is at 5.57%, Medicare/Medicaid Tax is at 2.75%, Pension plan is at 5% and Health Insurance is at $75.00 which is a fixed amount for the year. Use Bill Robinson for the employec name and $3575.00 for the gross pay amount. Sample output is shown below: Sample output: (Screen Shot) 3. Create a program that will simply display the values 1 to 10 in descending order. Sample output is shown below: 10 9 8 7 6 5 4 3 2 1 Sample output: (Screen Shot)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts