Question: pls answer both correctly. i will like and thumbs up On January 2, 2021, Sheffield Corp.issued at par $2090000 of 6% convertible bonds. Each $1000

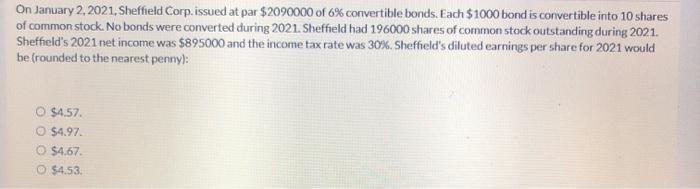

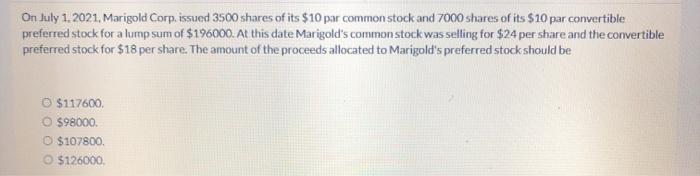

On January 2, 2021, Sheffield Corp.issued at par $2090000 of 6% convertible bonds. Each $1000 bond is convertible into 10 shares of common stock. No bonds were converted during 2021. Sheffield had 196000 shares of common stock outstanding during 2021. Sheffield's 2021 net income was $895000 and the income tax rate was 30%. Sheffield's diluted earnings per share for 2021 would be (rounded to the nearest penny): O $4.57 $4.97 O $4.67 $4.53 On July 1, 2021, Marigold Corp, issued 3500 shares of its $10 par common stock and 7000 shares of its $10 par convertible preferred stock for a lump sum of $196000. At this date Marigold's common stock was selling for $24 per share and the convertible preferred stock for $18 per share. The amount of the proceeds allocated to Marigold's preferred stock should be $117600 $98000 O $107800 $126000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts