Question: Pls answer I will upvote asap A client is looking to buy a European put option on a stock to as they say hedge a

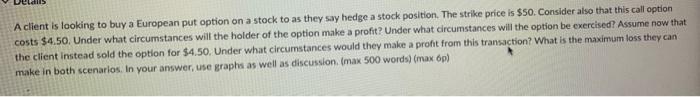

A client is looking to buy a European put option on a stock to as they say hedge a stock position. The strike price is $50. Consider also that this call option costs $4.50. Under what circumstances will the holder of the option make a profit? Under what circumstances will the option be exercised? Assume now that the client instead sold the option for $4.50. Under what circumstances would they make a profit from this transaction? What is the maximum loss they can make in both scenarios. In your answer, use graphs as well as discussion, (max 500 words) (max 0p)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts