Question: pls answer in details (: reuploaded (: pls help b) Now assume that you have an opportunity to invest another 20m that yields with certainty

pls answer in details (:

reuploaded (: pls help

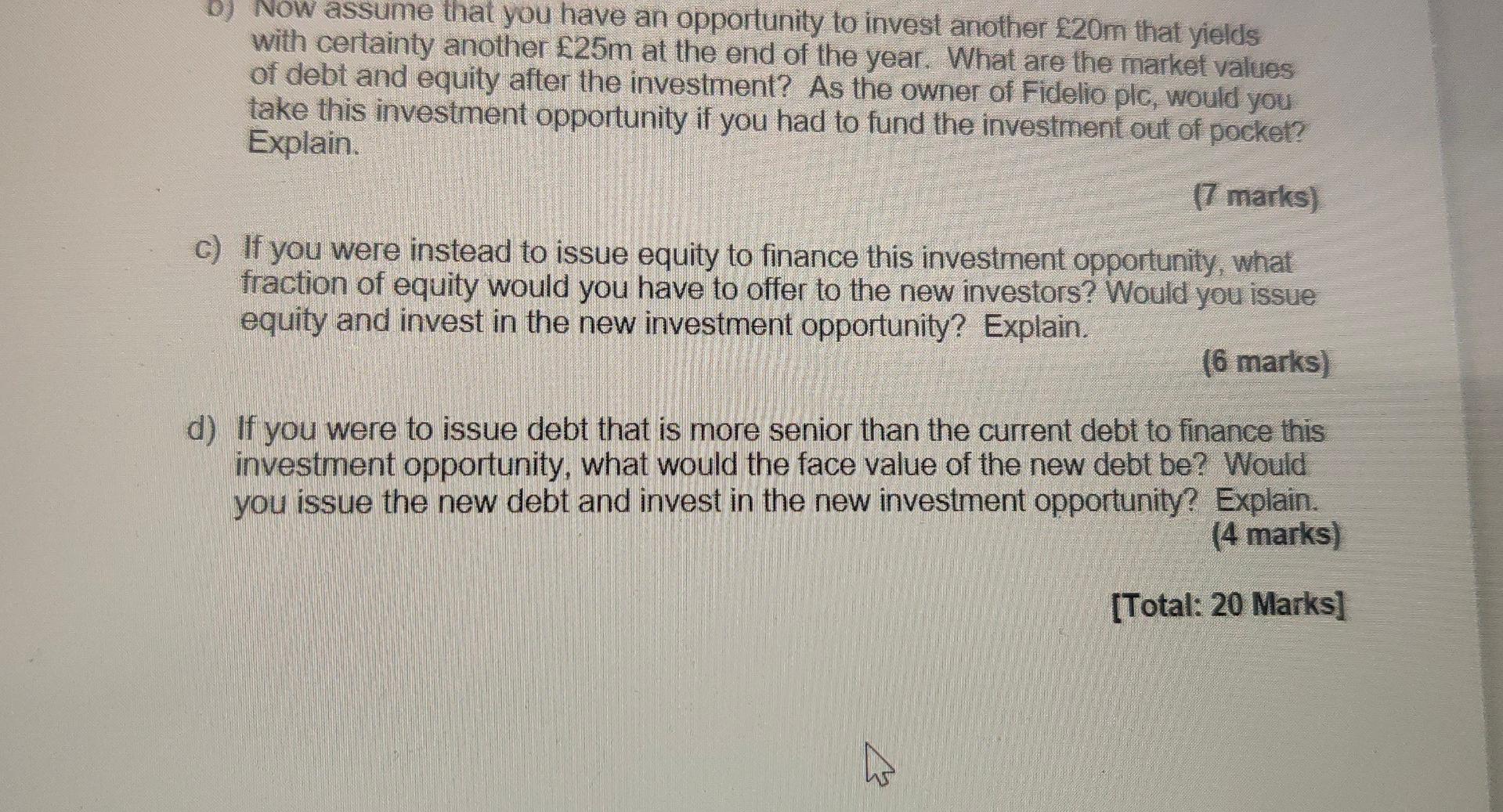

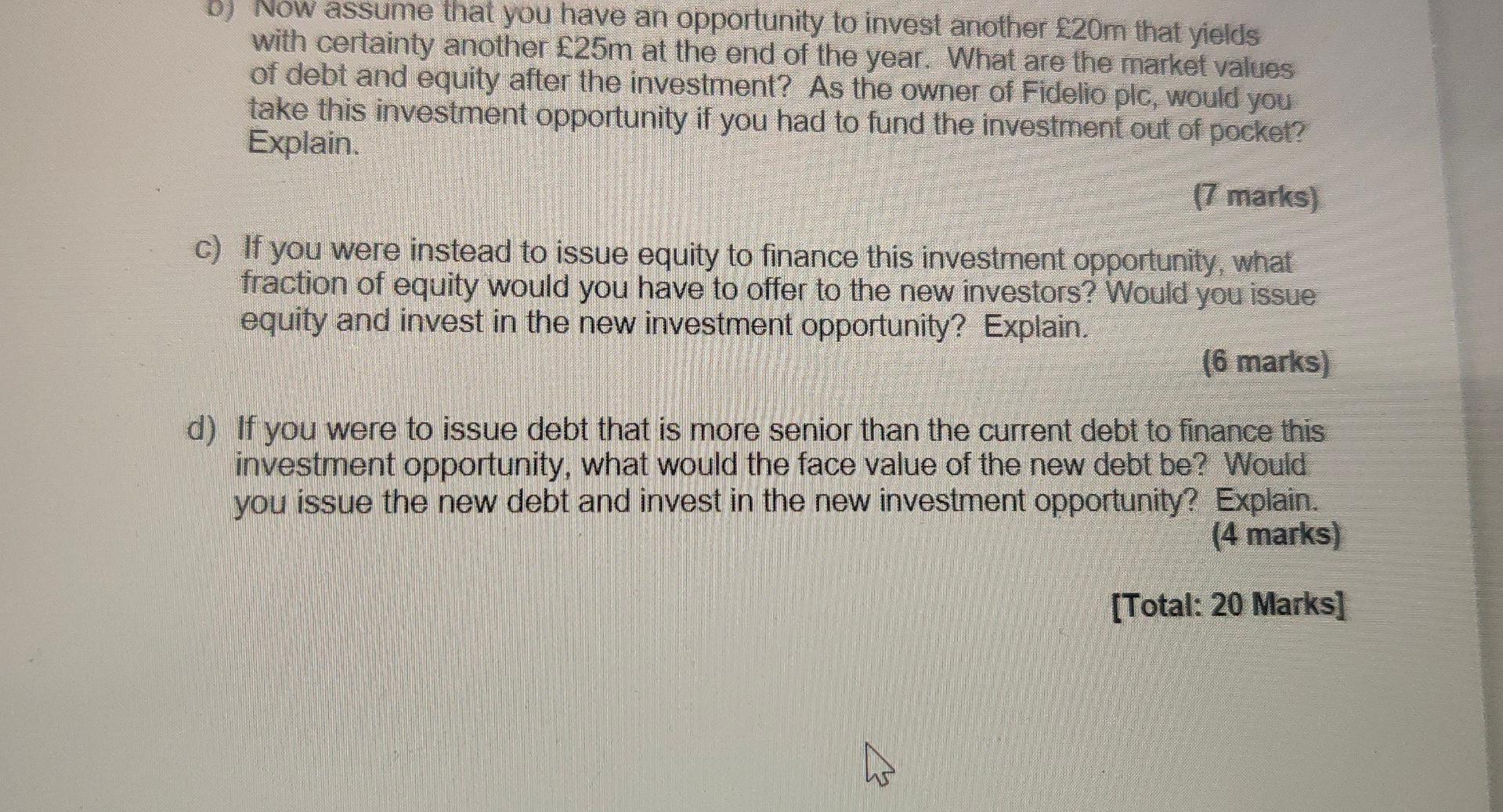

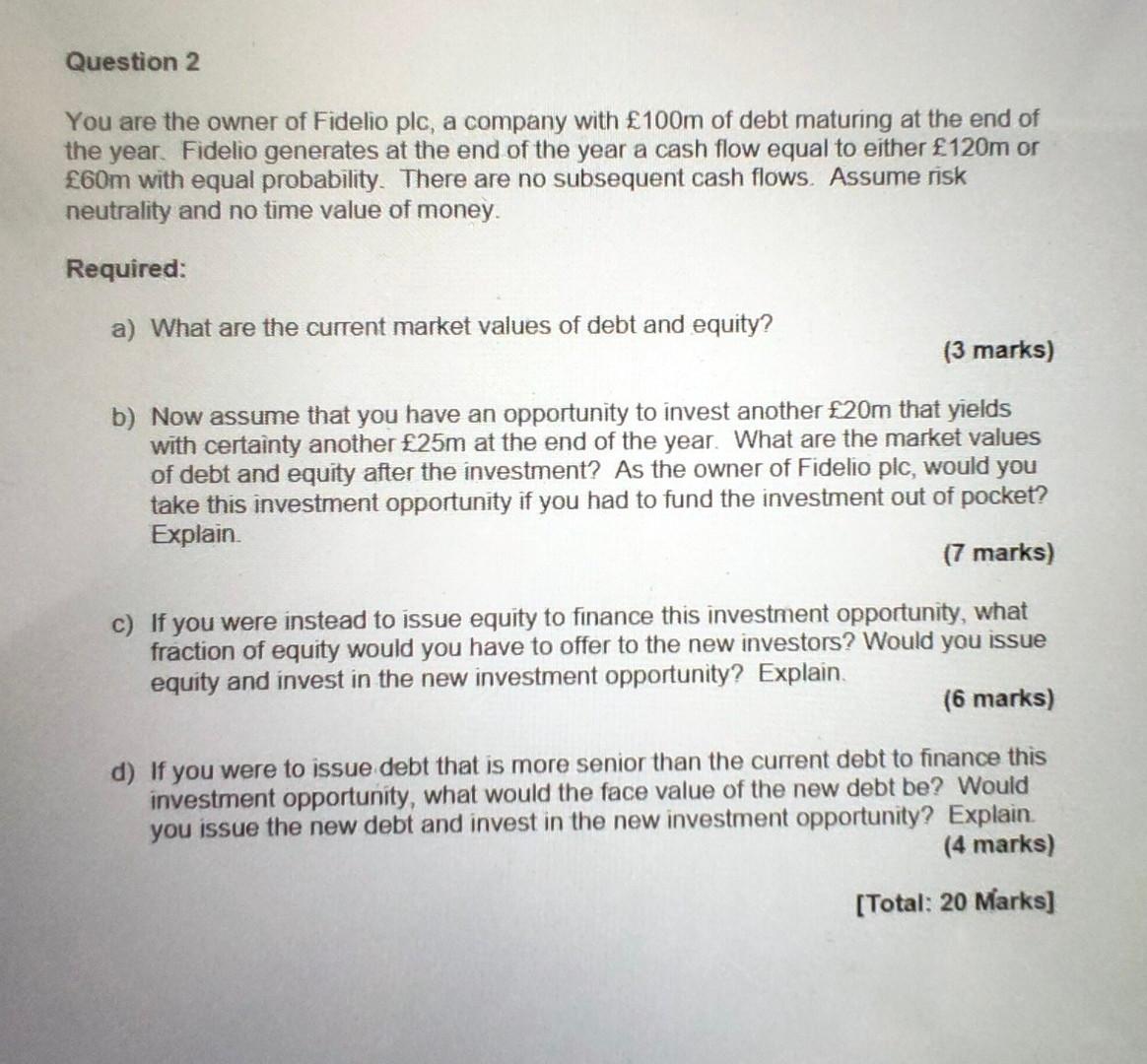

b) Now assume that you have an opportunity to invest another 20m that yields with certainty another 25m at the end of the year. What are the market values of debt and equity after the investment? As the owner of Fidelio plc, would you take this investment opportunity if you had to fund the investment out of pocket? Explain. (7 marks) c) If you were instead to issue equity to finance this investment opportunity, what fraction of equity would you have to offer to the new investors? Would you issue equity and invest in the new investment opportunity? Explain. (6 marks) d) If you were to issue debt that is more senior than the current debt to finance this investment opportunity, what would the face value of the new debt be? Would you issue the new debt and invest in the new investment opportunity? Explain. (4 marks) [Total: 20 Marks] ho b) Now assume that you have an opportunity to invest another 20m that yields with certainty another 25m at the end of the year. What are the market values of debt and equity after the investment? As the owner of Fidelio plc, would you take this investment opportunity if you had to fund the investment out of pocket? Explain. (7 marks) c) If you were instead to issue equity to finance this investment opportunity, what fraction of equity would you have to offer to the new investors? Would you issue equity and invest in the new investment opportunity? Explain. (6 marks) d) If you were to issue debt that is more senior than the current debt to finance this investment opportunity, what would the face value of the new debt be? Would you issue the new debt and invest in the new investment opportunity? Explain. (4 marks) [Total: 20 Marks] ho Question 2 You are the owner of Fidelio plc, a company with 100m of debt maturing at the end of the year. Fidelio generates at the end of the year a cash flow equal to either 120m or 60m with equal probability. There are no subsequent cash flows. Assume risk neutrality and no time value of money. Required: a) What are the current market values of debt and equity? (3 marks) b) Now assume that you have an opportunity to invest another 20m that yields with certainty another 25m at the end of the year. What are the market values of debt and equity after the investment? As the owner of Fidelio plc, would you take this investment opportunity if you had to fund the investment out of pocket? Explain (7 marks) c) If you were instead to issue equity to finance this investment opportunity, what fraction of equity would you have to offer to the new investors? Would you issue equity and invest in the new investment opportunity? Explain. (6 marks) d) If you were to issue debt that is more senior than the current debt to finance this investment opportunity, what would the face value of the new debt be? Would you issue the new debt and invest in the new investment opportunity? Explain. (4 marks) [Total: 20 Marks] b) Now assume that you have an opportunity to invest another 20m that yields with certainty another 25m at the end of the year. What are the market values of debt and equity after the investment? As the owner of Fidelio plc, would you take this investment opportunity if you had to fund the investment out of pocket? Explain. (7 marks) c) If you were instead to issue equity to finance this investment opportunity, what fraction of equity would you have to offer to the new investors? Would you issue equity and invest in the new investment opportunity? Explain. (6 marks) d) If you were to issue debt that is more senior than the current debt to finance this investment opportunity, what would the face value of the new debt be? Would you issue the new debt and invest in the new investment opportunity? Explain. (4 marks) [Total: 20 Marks] ho b) Now assume that you have an opportunity to invest another 20m that yields with certainty another 25m at the end of the year. What are the market values of debt and equity after the investment? As the owner of Fidelio plc, would you take this investment opportunity if you had to fund the investment out of pocket? Explain. (7 marks) c) If you were instead to issue equity to finance this investment opportunity, what fraction of equity would you have to offer to the new investors? Would you issue equity and invest in the new investment opportunity? Explain. (6 marks) d) If you were to issue debt that is more senior than the current debt to finance this investment opportunity, what would the face value of the new debt be? Would you issue the new debt and invest in the new investment opportunity? Explain. (4 marks) [Total: 20 Marks] ho Question 2 You are the owner of Fidelio plc, a company with 100m of debt maturing at the end of the year. Fidelio generates at the end of the year a cash flow equal to either 120m or 60m with equal probability. There are no subsequent cash flows. Assume risk neutrality and no time value of money. Required: a) What are the current market values of debt and equity? (3 marks) b) Now assume that you have an opportunity to invest another 20m that yields with certainty another 25m at the end of the year. What are the market values of debt and equity after the investment? As the owner of Fidelio plc, would you take this investment opportunity if you had to fund the investment out of pocket? Explain (7 marks) c) If you were instead to issue equity to finance this investment opportunity, what fraction of equity would you have to offer to the new investors? Would you issue equity and invest in the new investment opportunity? Explain. (6 marks) d) If you were to issue debt that is more senior than the current debt to finance this investment opportunity, what would the face value of the new debt be? Would you issue the new debt and invest in the new investment opportunity? Explain. (4 marks) [Total: 20 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts